The decline of the PC has been discussed ad nauseam. Just last week, we learned that PC shipments dropped by nearly 12 percent during the second quarter. Predictably, the trend is putting the world's largest PC vendors in a very tough predicament.

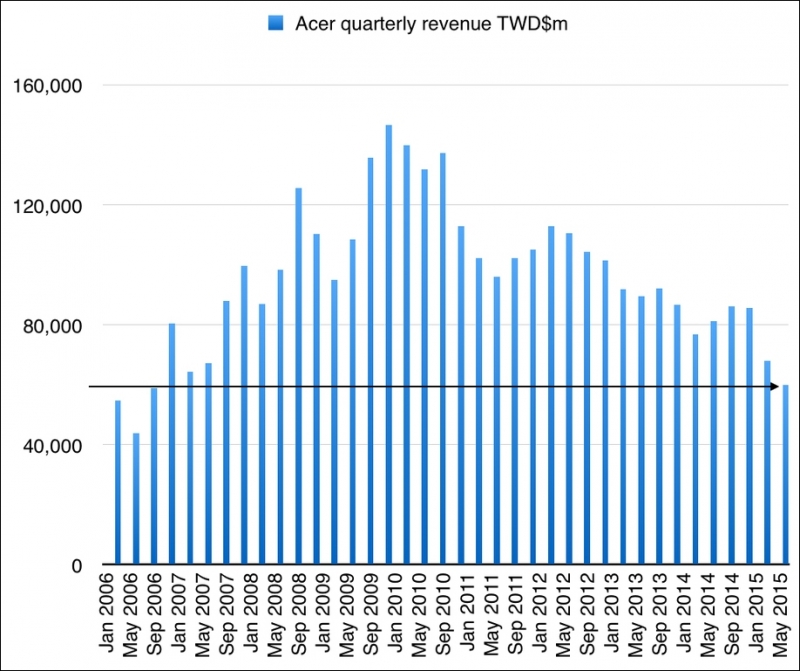

Acer, the fifth largest computer vendor in the world, has revealed that revenues for the second quarter plummeted more than 30 percent. The admission was independent of a full earnings report but the message was loud and clear: Q2 was the smallest quarter for Acer since 2006.

The company is reportedly hoping that strong sales of 2-in-1s, Chromebooks and gaming notebooks will help it turn the corner in the second half of the year. The looming release of Windows 10 should also help not just Acer but the entire industry.

The PC industry has faced an uphill battle for close to a decade now. The rise in popularity of tablets and smartphones means consumers are updating their home PCs less frequently. Worse yet, some have phased out traditional computers entirely in favor of mobile devices.

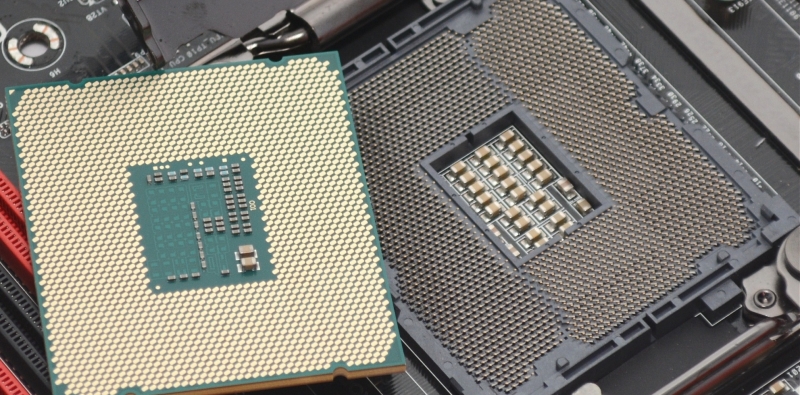

During the PC's heyday, it wasn't uncommon for consumers to replace their computer every couple of years or so. Fierce competition between AMD and Intel during the late '90s and into the early '00s turned out processors with meaningful performance enhancements that gave users a reason to upgrade.

Once AMD waved the white flag, however, it allowed Intel to take its foot off the throttle a bit. With no real competition to speak of, Intel was no longer required to push the performance envelope as it once had.

As a result, consumers are able to get far more life out of a processor (and in turn, a computer) than they once were. Solid state drives and perhaps graphics cards excluded, today's hardware isn't all that faster than what was available 3-4 years ago.

The lower turnover rate is just one of a number of reasons why the PC industry is where it is today. Desktops and notebooks still have their place and will be around for quite a while longer but its golden days are clearly in the rearview mirror at this point.

Lead image courtesy Krizstian Bocsi, Bloomberg