The big picture: In case you weren't paying attention, Apple is now a bank. I jest, but only a little. It started with the Apple Card, and now the tech giant wants to hold your money, too. Of course, it is completely optional, but it does have some advantages if you are already an Apple cardholder.

As of May 2021, there were 6.4 million Apple Card users. Backed by Goldman Sachs, the overall service is popular for its convenient features, including Apple Pay and wallet app integration, real-time balances, on-device account management, cash back, and secure card/CVV numbers.

Apple Card has been successful enough that Cupertino now wants to hold your savings. On Thursday, the company announced it would soon offer "high-yield" savings to Apple Cardholders.

"Apple announced a new Savings account for Apple Card that will allow users to save their Daily Cash and grow their rewards in a high-yield Savings account from Goldman Sachs," Cupertino said.

Here's how it works. Apple Card is already set up to give users three percent back on Apple purchases (in-store or digital) and two percent for transactions with participating vendors like Walgreens, ExxonMobil, T-Mobile, and others. All other charges get a one-percent return.

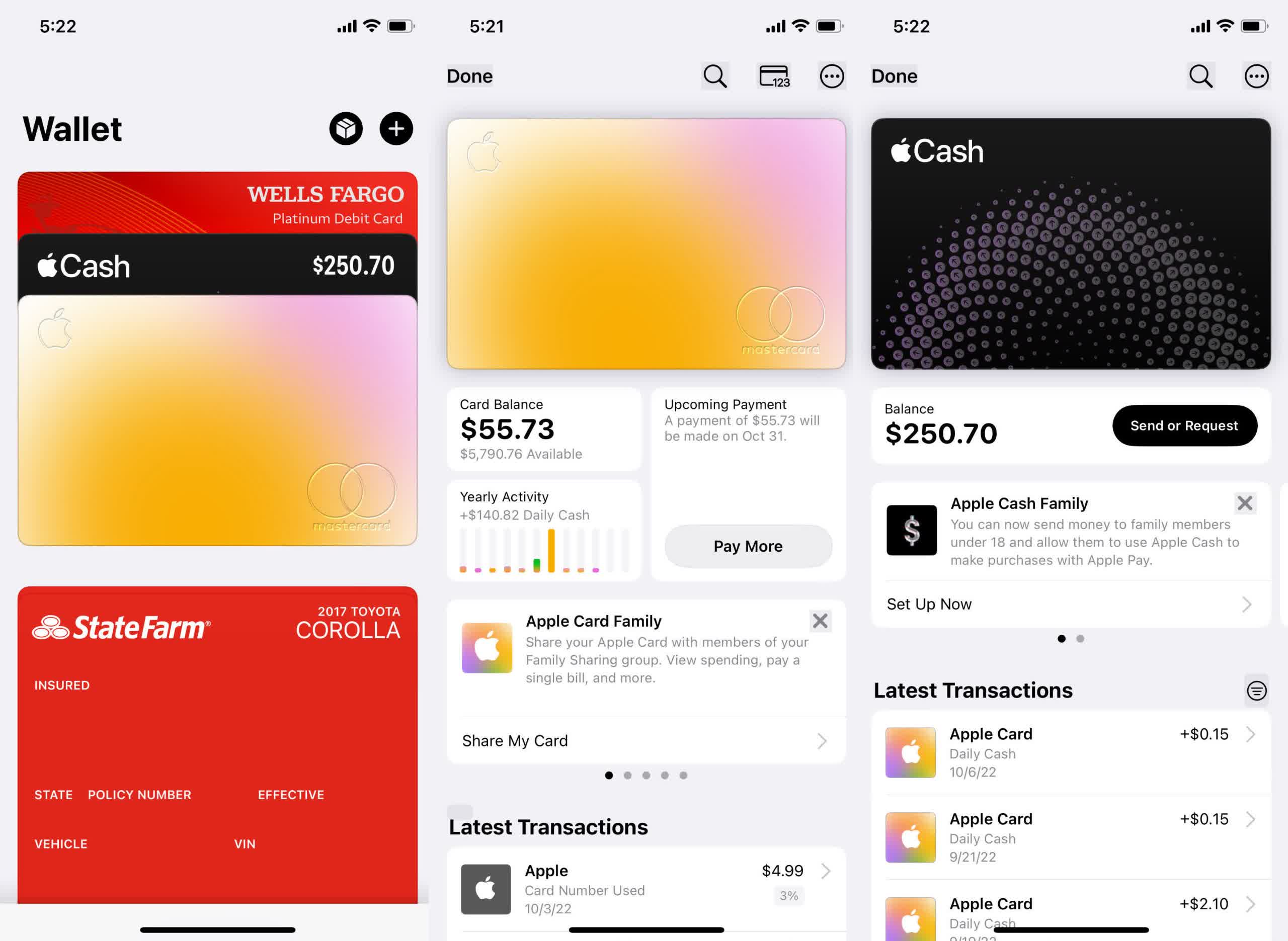

Currently, this money is stored on a separate virtual card in iPhone owners' wallets called "Apple Cash." It acts like a pre-paid debit card drawing against the Apple Cash balance. Customers can also transfer funds to their regular bank account. In other words, the money sits there until they do something with it.

Apple is proposing to put that money into a high-yield Goldman Sachs savings so that it can earn even more. Once users set up an account, Daily Cash will automatically start depositing into the savings instead of Apple Cash. However, customers can still opt to have the money go into the virtual card if they like.

"Users can change their Daily Cash destination at any time," the press release said.

Apple didn't define "high yield," but anything is better than nothing, which is what most banks give patrons on savings accounts. The feature might be another enticing perk for Apple Card customers if it's truly high-yield, especially considering the few banks that still offer interest-baring accounts usually provide significantly less than one percent.

Like all cards stored in the Wallet app, the savings account will have a management screen with similar options like viewing rewards and other activities. Users can also transfer funds to and from their attached checking accounts (used for making Apple Card payments), making it like a regular cash deposit account, just without the brick-and-mortar bank.

Increasing the growth potential of Daily Cash is a nice little incentive to set aside a little "free money," especially for those that rarely touch it anyway. It could come in handy for sudden expenditures or occasional splurging. If it truly is high-yield, it might even be a better option than users' current savings accounts. Regardless, it's hard to imagine current cardholders saying "no thanks" to extra money, regardless of the yield.

https://www.techspot.com/news/96312-apple-card-users-can-soon-sign-up-high.html