A fake website set up by a bunch of scammers, designed to imitate the look of legitimate news outlet Bloomberg, has led to a seven percent increase in Twitter's stock value after the fake website published an article relating to the social network.

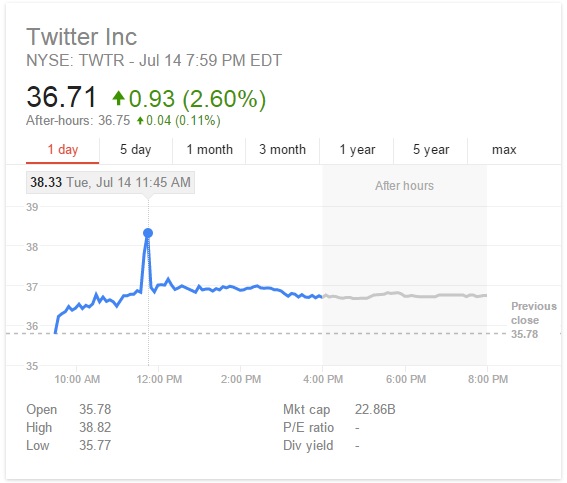

The article published on fake domain Bloomberg.market (seen above), which has since been taken down, claimed that Twitter would be acquired for $31 billion, possibly by Google. As news quickly spread to traders fooled by the website's attempts at imitating the real Bloomberg, Twitter's NYSE stock spiked at 11.45am before returning to previous trends around half an hour later.

The owner of the fake website hasn't been identified, as they used WhoisGuard to mask their real name when registering the domain in Panama. It is likely the article was published as part of a 'pump and dump' stock fraud scheme, where the scammers would have held Twitter stock before selling it after their fake news pushed the stock price up.

While the website's design was a good reproduction of Bloomberg, numerous grammatical errors and a misspelling of former Twitter CEO Dick Costolo's name as "Costello" hinted that this wasn't a real Bloomberg article. After the pumping and dumping of Twitter stock had occurred, Bloomberg spoesperson Ty Trippet confirmed that Bloomberg.market was not a domain owned by the real Bloomberg.

Twitter stock ended up rising by 2.6% during yesterday's trading, largely unaffected (except for one large spike) by the release of the fake news.

https://www.techspot.com/news/61370-fake-bloomberg-website-sends-twitter-stock-soaring.html