Why it matters: Prices for rare earth metals have surged over the past twelve months. This development will likely impact the prices of electronics for end-users in the coming months. Meanwhile, the US and China have been pointing fingers at each other, with no diplomatic solution in sight.

Over the past year, we've seen a string of news about supply shortages for everything from capacitors, $1 display driver chips to the advanced silicon found in phones, tablets, PC components, and car infotainment and driver assistance systems. Even if the tech industry were somehow able to crank more of these components, they'd still have to deal with a shortage of shipping containers.

Nikkei Asia reports, the crisis is far from over. Manufacturers of electronic components are now facing a new challenge as prices for rare-earth metals have surged over the past year and are expected to rise even further in the coming months.

The primary reason for the price hike is the smoldering trade war between China and the US, which never seems to end. Now that's affecting shipments of some of the crucial ingredients needed to make all manner of electronic products.

The lithium used in batteries, nuclear energy, and spacecraft equipment has seen the most significant price increase---150 percent compared to September 2020. The second-largest increase was observed for holmium, which has more than doubled over the past twelve months.

Holmium is used to make magnets and special alloys for sensors and actuators. Neodymium and praseodymium are also used to make strong magnets found in speakers, motors, wind turbines, and more. These two metals have also seen an increase in price of over 73 percent year-over-year.

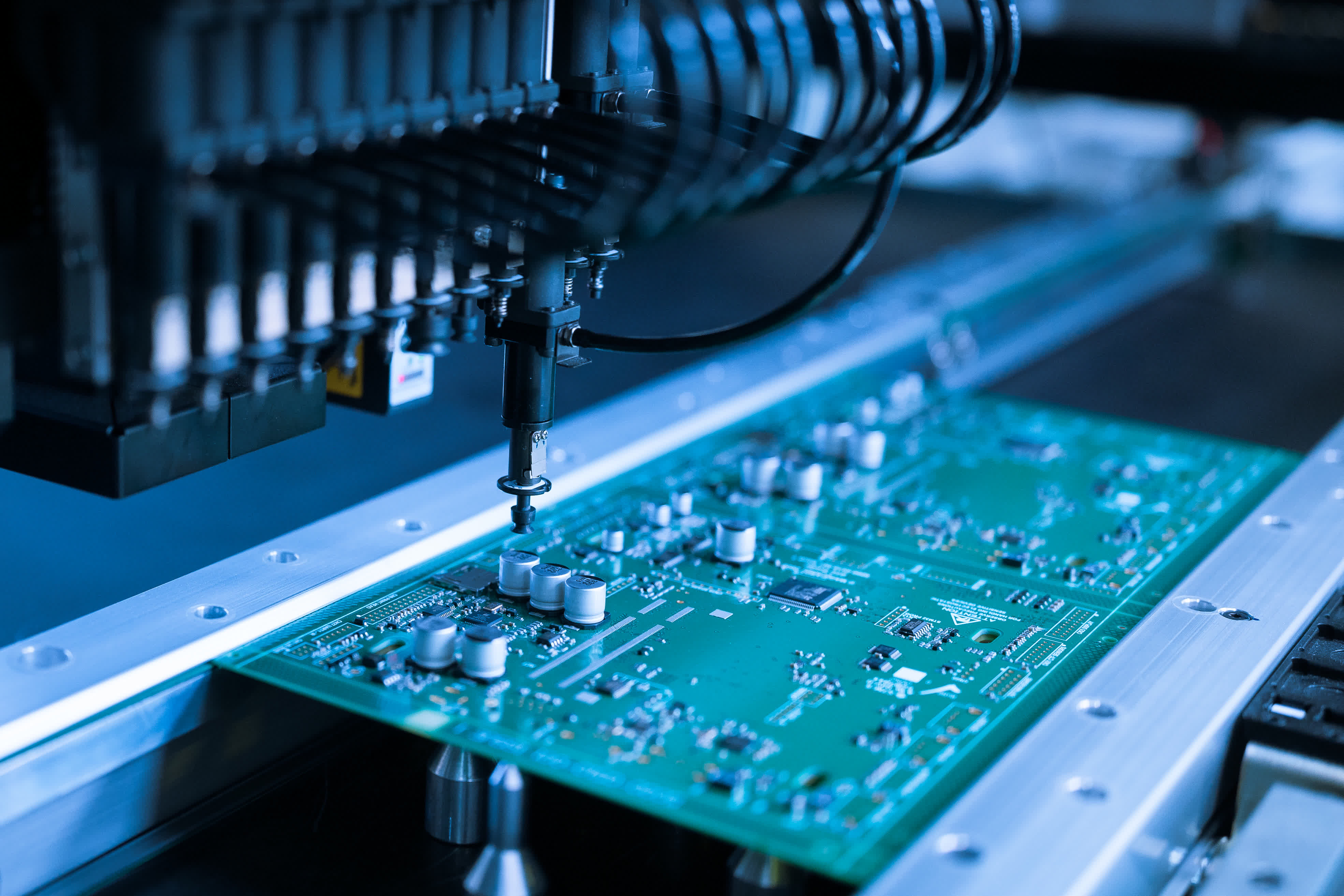

Prices of copper, tin, aluminum, cobalt, copper, and terbium oxide have also seen increased costs from anywhere between 37 to 82 percent. Manufacturers use these in chip packaging, mounting, and connecting electronic components on printed circuit boards, mechanical parts, metal casings, and more.

For most people, the behind-the-scenes process of sourcing these materials and transforming them into electronic devices, electric cars, and other products has been invisible and uninteresting. Now that it threatens to increase the prices we'll pay for various electronic goods, the ugly complexities of the global supply chain are bubbling to the surface.

It certainly doesn't help that governments have decided to electrify everything and set aggressive green goals at a time when the electronics and automotive industries can barely keep up. Demand for everything is at an all-time high, and experts have conflicting views on when supply will catch up with it.

| Year | US production (metric tons) | China production (metric tons) | Rest of the World (metric tons) | US share of global output | China share of global output |

|---|---|---|---|---|---|

| 1985 | 13,428 | 8,500 | 17,157 | 34% | 21% |

| 1990 | 22,713 | 16,480 | 20,917 | 38% | 27% |

| 1995 | 22,200 | 48,000 | 9,700 | 28% | 60% |

| 2000 | 5,000 | 73,000 | 5,500 | 6% | 87% |

| 2005 | 0 | 119,000 | 3,000 | 0% | 98% |

| 2010 | 0 | 120,000 | 11,000 | 0% | 92% |

| 2015 | 5,900 | 105,000 | 19,100 | 5% | 81% |

| 2020 | 38,000 | 140,000 | 62,000 | 16% | 58% |

Some believe that China is the culprit, as the country controls 55 percent of global production capacity and no less than 85 percent of the refining output for rare earth metals. In June, the Biden administration decried tighter export controls imposed by the Beijing government, calling them a "capricious enforcement of Chinese customs."

One of the proposed solutions to this problem is to build more US rare earth capacity and reduce the reliance on China for critical raw materials. Perhaps ironically, Chinese rare earth mining giant Shenghe Resources owns a minority stake in MP Minerals. This US company operates the recently re-opened Mountain Pass mine in California---the supposed buffer against fluctuating prices for rare earth materials coming out of China.

Image credit: Reuters

In trying to build more rare earth capacity, the US government has offered millions in grants for mining companies to expand their operations. However, most of the concentrates obtained through mining in the US---some 50,000 tonnes per year---still have to be sent to China for final processing.

Meanwhile, several Chinese suppliers that have contracts with Apple, Amazon, Dell, Facebook, Logitech, and Sennheiser have seen their gross margins shrink below the industry average of 20 percent. So far, they've been able to absorb the shock, but soon enough, they'll have to pass the costs to their customers, which will translate into higher prices for everything with electronics and batteries in it.

As of writing, there is only one consumer-facing company that adjusted its prices. During an earnings call, Sonos said it would raise prices between $10 to $100 depending on the product starting this month. Whether or not this will turn into a trend, only time will tell.

Masthead credit: Peggy Greb

https://www.techspot.com/news/91251-rare-earth-metal-prices-explode-may-lead-increased.html