Why it matters: The global semiconductor industry was worth $439 billion in 2020, and is on track to grow even bigger this year. However, that growth potential is being eroded by a shortage of $1 chips that are essential for every display panel that needs to be manufactured.

A global shortage of chips has wreaked havoc on the supply chains of the tech and auto industries. This has caused many companies to scale back production at a time when demand is soaring for their products. This is the result of a combination of factors, and the current situation will probably not change until the end of next year.

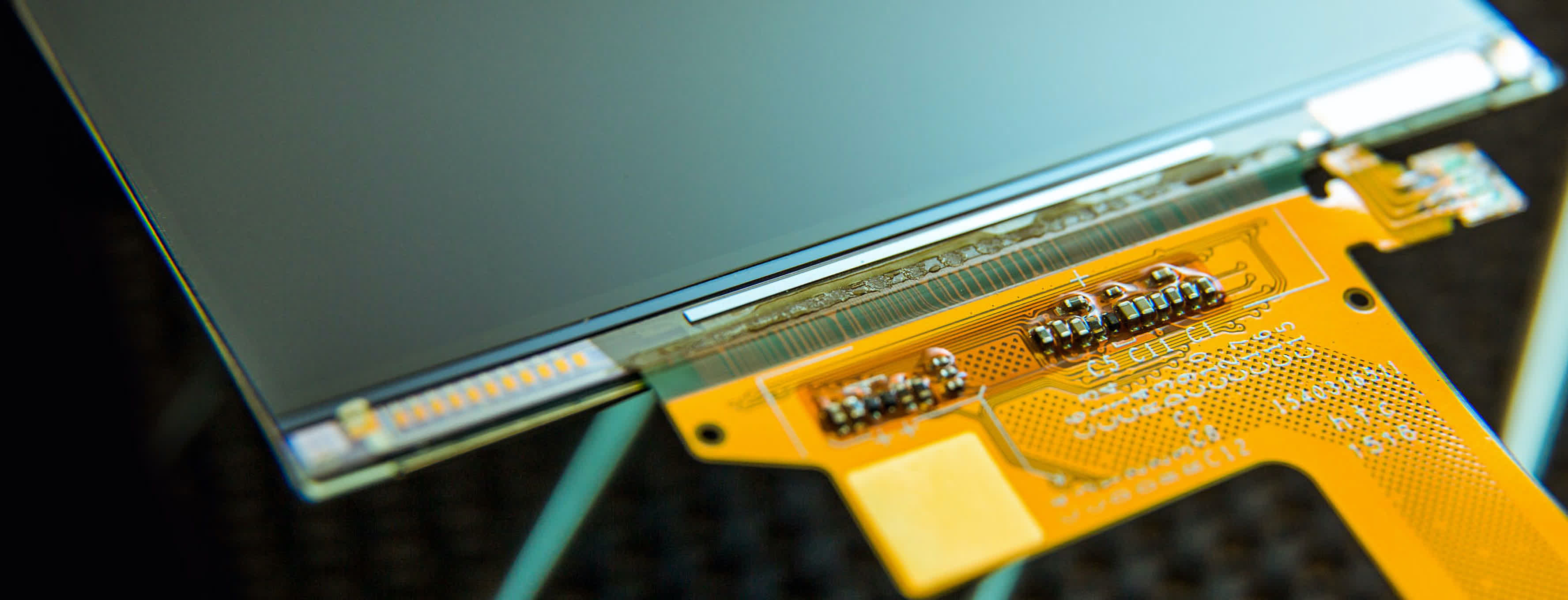

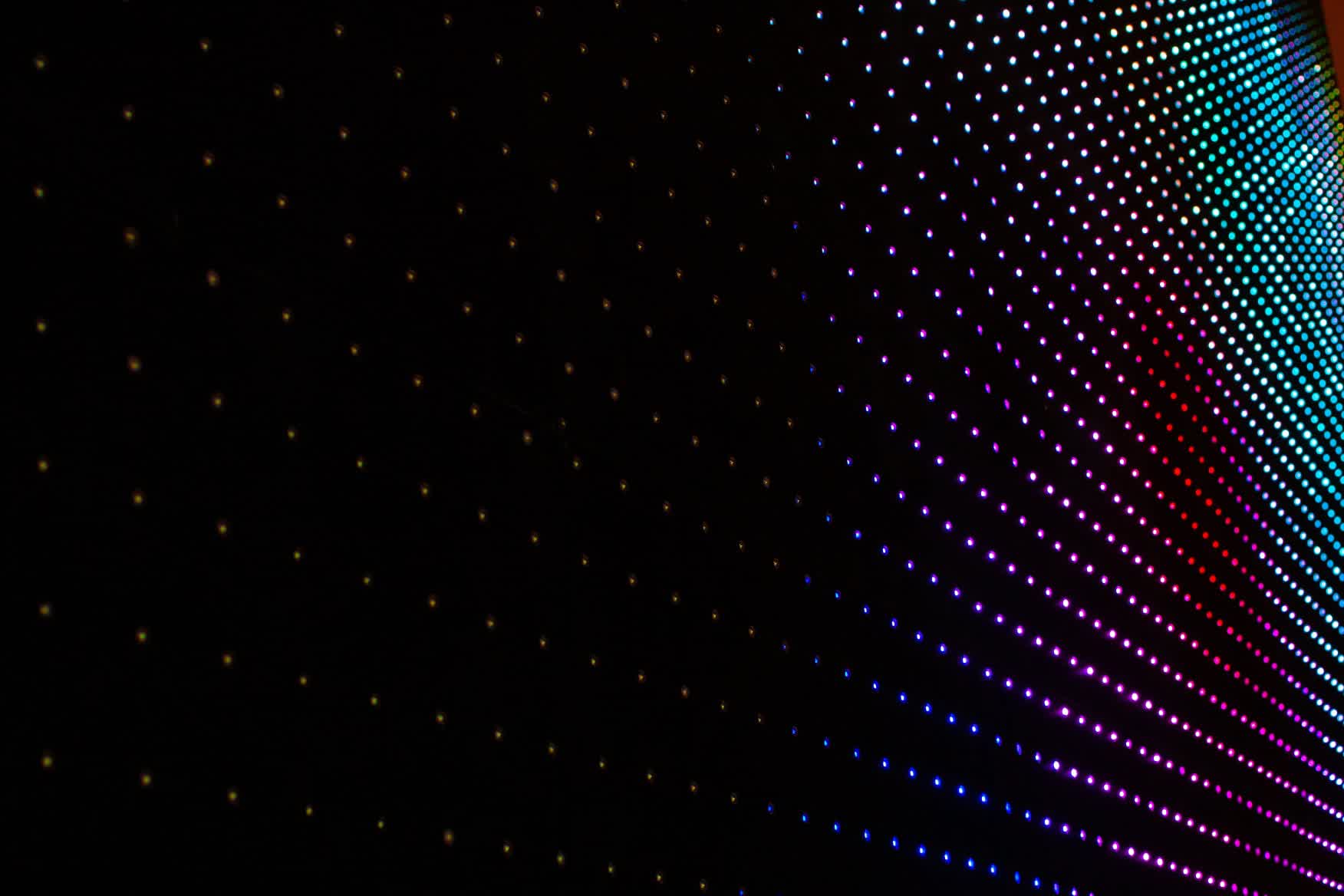

According to a Bloomberg report, there is now a serious shortage of display driver chips that is creating headaches for manufacturers of LCD and OLED panels. This in turn will affect all manner of consumer devices, from the lowly smartwatch to smartphones, tablets, laptops, computer monitors, TVs, smart appliances, and infotainment systems. Every new car or plane comes with one or more display panels, which only adds to the demand.

Interestingly, these are not the most expensive chips you can manufacture, such as the CPUs, GPUs, or the SoCs that go inside gaming consoles or mobile devices, which are complex and can cost between $100 to $1,000 or more for a single unit. Display driver chips, on the other hand, are relatively simple part that translate signals from your device into actual images on your screen, and cost around $1.

That's not to say that display driver ICs are not important, but companies don't need to use their most advanced process nodes to manufacture them. For instance, it's not uncommon for these chips to be made using 16 nm, 28 nm, 40 nm, or 95 nm process nodes. Some foundries such as SMIC even make 160 nm and 300 nm display driver chips for use in applications where power consumption is not a major concern.

Nevertheless, the shortage of these driver chips will likely cause further delays and price hikes for products that are currently in high demand, and the manufacturers of these chips don't see a solution in sight.

The shortfall is already visible in the doubling of prices for large LCD panels over the last year. Himax Technologies CEO Jordan WU told Bloomberg "I have never seen anything like this in the past 20 years since our company's founding."

Must read: Anatomy of a Monitor

Himax, alongside MagnaChip, Samsung, Novatek, FocalTech Systems, Synaptics, Raydium, MediaTek, and Silicon Works are among the key players in the display driver IC market, which was worth $7.1 billion in 2019 and is expected to reach $9.1 billion by 2023.

Wu explained that making more display driver ICs isn't possible as these are all fabless companies depending on foundries like TSMC, which have relatively limited production capacity for older process nodes that are typically used for fabrication.

Furthermore, building additional capacity and more advanced process nodes is too expensive and risky to make economic sense, which is why most of these companies are perfectly happy with mature process nodes where equipment has already depreciated and allows them to supply display driver ICs at a lower cost. As it is, demand for everything with a screen has only increased over the last year, so electronics aren't going to get any cheaper until we buy fewer of them.