In context: A short squeeze is when a group or class of investors buy up shares of a company they see as undervalued because other investors are betting it will fail. This activity is legal as long as the purchasers do not rally a stock by misrepresentation. In that case, it is called a pump-and-dump scheme and is illegal.

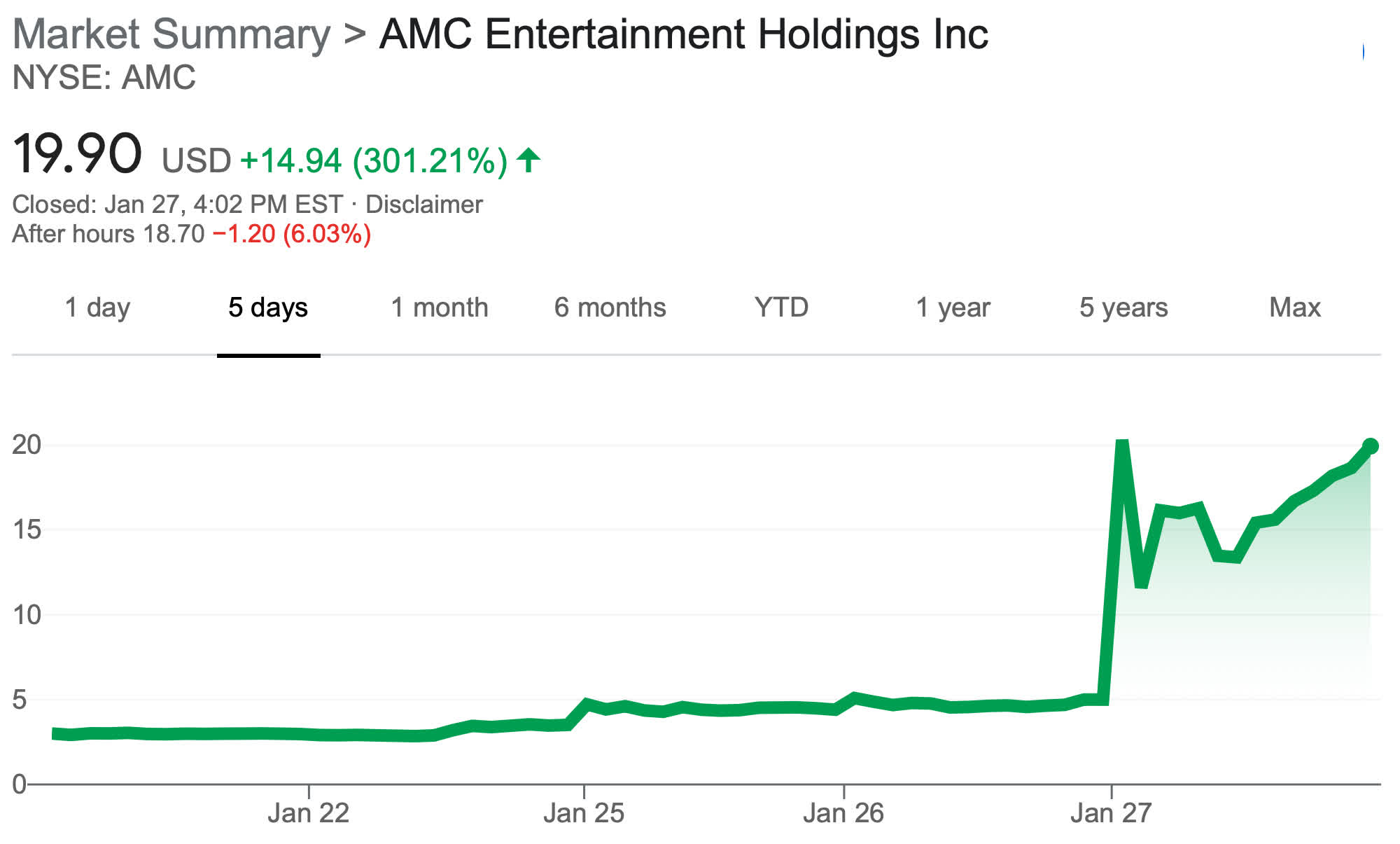

Day traders belonging to a Reddit group continue to squeeze short-sellers on Wall Street by vacuuming up even more stocks that are expected to fail, including AMC. The struggling theater chain closed at $5 per share on Tuesday. As of this writing, the stock is trading at $19.90—a nearly 300-percent gain in under 24 hours.

GameStop has been struggling for a while and is likely to go bankrupt before long. In fact, many investors are short selling shares in a bet that it will fail. However, it is this exact situation that has made it a prime target for a short squeeze.

We reported earlier this week, members of the subreddit r/wallstreetbets have been actively buying up shares in GameStop and encouraging others to do the same. As these day traders pick up the stock on the cheap, it drives the price up. This uptick starts a chain reaction as short-sellers are forced to cover their shorts at a loss.

As more short bets bow out, the price soars even higher, creating a domino effect. Before the squeeze, GameStop was trading steadily at around $18 per share. Yesterday it closed at $147.98, and as of publication, the stock is valued at $347.51.

Business Insider notes that the group now appears to be going after similar "prime" targets like AMC, Nokia (up 45 percent), BlackBerry (up 41 percent), and Bed Bath & Beyond (up 31 percent). Whether these companies see the same huge spike that GameStop has experienced remains to be seen. It mainly depends on how many investors pick up the stock for a quick win and how many shorts on the company's stock are out there.

Before you entertain the notion of jumping into this crazy Wall Street game, be warned: It's not a get-rich-quick scheme. A squeeze is very volatile. These falsely inflated values will crash eventually, and there will be losers when that happens. Unless you get in early and get out at the right time during a squeeze, it is easy to lose your money. So don't bet what you can't afford to lose.

There is also the possibility that the SEC will get involved at some point. So far, it does not appear that the Reddit investors have done anything illegal, but it is easy to see how a squeeze could turn into a pump-and-dump, so be careful.

https://www.techspot.com/news/88439-reddit-gamestop-traders-now-driving-up-stock-amc.html