In brief: This week, Samsung introduced a new solution for payment card security. It combines a fingerprint sensor, a security chip, and other elements to streamline card authentication while also adding another layer of protection.

Samsung's fingerprint sensor, called S3B512C, adds a new layer of security when combined with a security chip and secure processor. It’s mainly meant for payment cards, but Samsung says it can also work for other kinds of authentication like employee IDs or membership cards. The authentication tech should allow users to use their cards without entering their PIN.

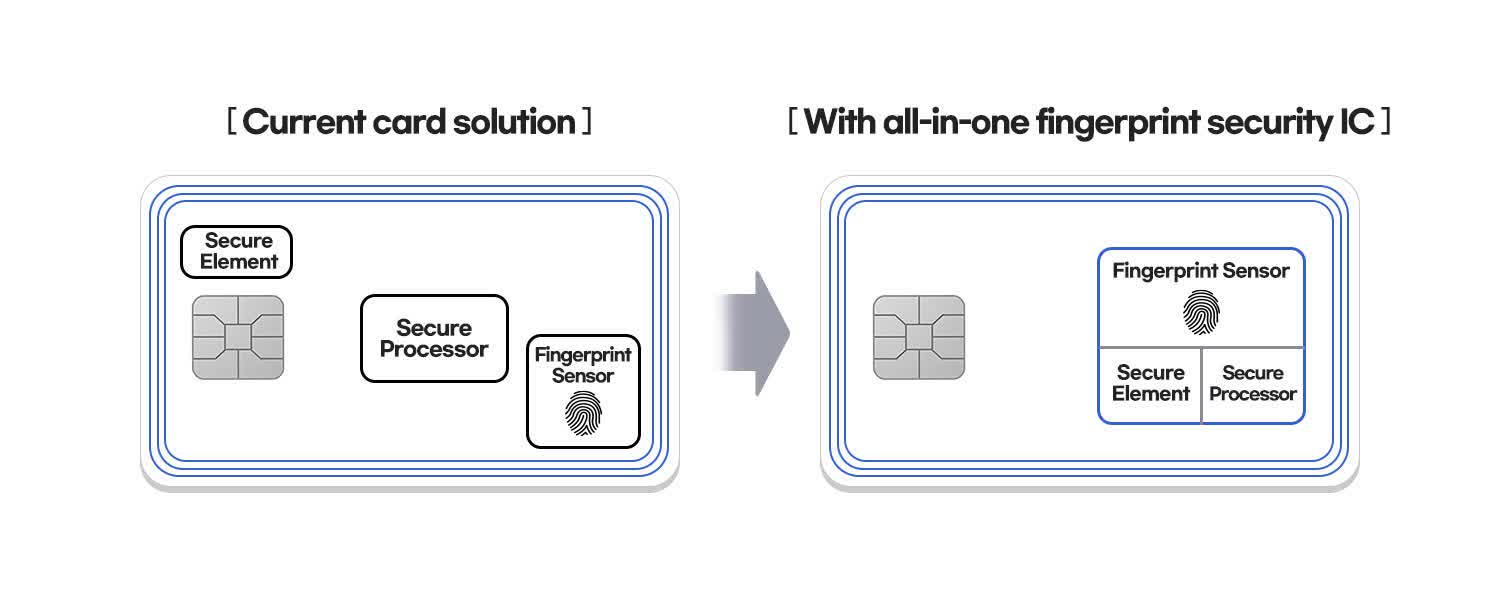

Samsung calls this the world’s first security chip that reads fingerprint information. It uses the Secure Element to store and authenticate encrypted biometric data then analyzes it with its Secure Processor. It has also been certified for EMVCo and Common Criteria Evaluation Assurance Level 6+. The tech works with Mastercard’s latest Biometric Evaluation Plan Summary for payment cards.

Last August, Mastercard said it would start phasing out old magnetic strip authentication in favor of more secure chips beginning in 2024, though it won't entirely remove the strip until 2033. Still, there have been reports of hackers simply brute-force guessing payment card numbers and then selling them on the dark web. That is one area that fingerprint authentication cannot address.

https://www.techspot.com/news/93129-samsung-combines-security-ic-biometrics-new-payment-card.html