In brief: TSMC just had its best month ever in terms of sales, and it looks like 2022 might also be its best year yet. Strong demand for GPUs, CPUs, consoles, and phones has been a boon for foundries like TSMC, who is using it to fuel capacity expansions in Taiwan, Japan and the US.

Taiwan Semiconductor Manufacturing Company (TSMC) released its preliminary report on its Q1 2022 earnings this week. The world’s largest semiconductor foundry said it recorded sales of NT$146.9 billion (around $5.2 billion) in February.

This is the company’s highest recorded revenue figure for the month of February, and while it’s down 15 percent month-on-month when compared to January, it represents a 38 percent increase when compared to the same period last year. The difference from January is mostly due to downtime related to the week-long Lunar New Year holiday.

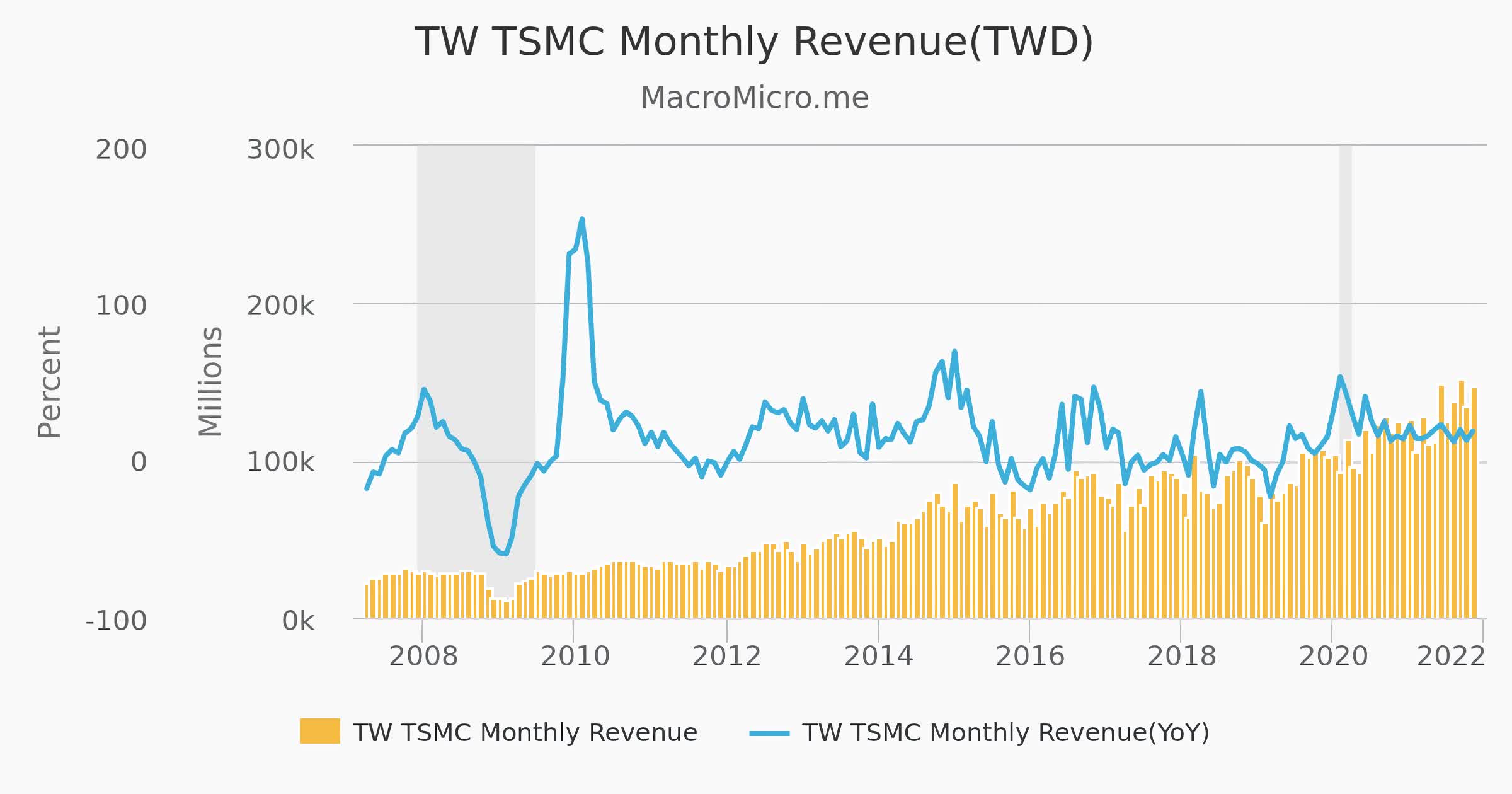

Image source: MacroMicro

TSMC says it recorded combined sales of NT$319.1 billion for the first two months of 2022, which is a 36.8 percent year-over-year increase. The company expects an uptick in sales for this month, so it has adjusted its revenue forecast to reflect a target of $16.6 billion to $17.2 billion for the first quarter.

The company has enjoyed a strong financial performance over the past two years amid unrelenting demand for chips made on its advanced process nodes. Earlier this year, TSMC promised it would spend anywhere from $40 billion to $44 billion on upgrading its manufacturing capacity in 2022.

Apple remains TSMC’s largest customer, with an estimated 26 percent of its revenue coming from the Cupertino giant. Apple’s recently announced M1 Ultra chipset is the result of a deeper collaboration with TSMC, involving the latter’s 4nm process node as well as its advanced 2.5D chip-on-wafer-on-substrate with silicon interposer (CoWoS-S) technology.

The foundry has many reasons to be optimistic about the future, as Nvidia is said to have spent $10 billion for a large chunk of its 5nm capacity. Its 3nm process node also looks promising, with Qualcomm planning to tap into it for future Snapdragon 8-series chips.

This year, TSMC has decided to increase wafer prices for its 7nm and 5nm process nodes, and if history is any indication Apple will likely enjoy the smallest price hike. Other companies will see anywhere from 10 to 20 percent higher prices starting in Q3 2022.

Fortunately, this is also when Nvidia and AMD’s AIB partners expect to see a 10 percent increase in graphics card shipments, so it’s possible the wafer price hike won’t have a pronounced effect on retail prices for GPUs. Either way, TSMC is optimistic about its outlook and expects its 2022 sales to grow by 25 to 29 percent when compared to last year.

https://www.techspot.com/news/93740-tsmc-had-record-month-february-track-record-year.html