Why it matters: Market intelligence company TrendForce has just released its latest predictions about the DRAM memory market. During the first quarter of 2024, the company says, buyers should expect to spend more for every existing category of DRAM-based products.

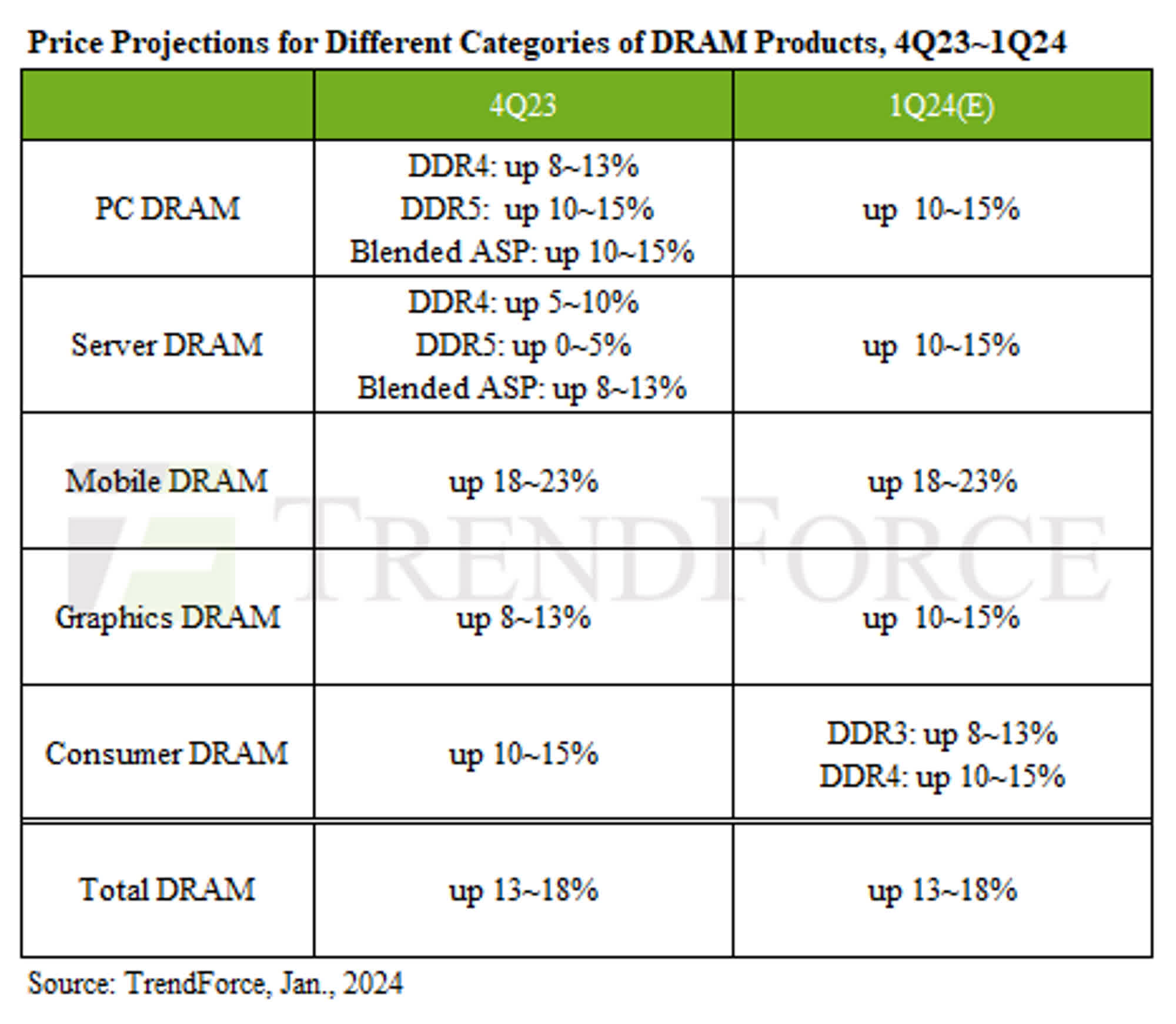

The semiconductor industry should experience a new wave of growth in the coming year as memory manufacturers gradually increase DRAM prices by cutting or controlling production. During the first quarter of 2024, TrendForce says, DRAM contract prices are estimated to increase by around 13-18 percent.

International Data Corporation recently pointed out that memory chip manufacturers have implemented significant production controls to inflate prices since November 2023. TrendForce now predicts an unclear demand outlook for 2024, so manufacturers still believe that "sustained" cuts in production are the solution to maintaining the supply-demand balance in the memory industry.

TrendForce provides 1Q24 price projections for different categories of DRAM products, which include PC, server, mobile, graphics, and consumer memory. Currently, the PC DRAM business deals with unfilled DDR5 orders as customers continue buying DDR4 modules to avoid the upcoming (expected) price surge.

The PC industry is gradually adopting the "newer" DDR5 standard, but prices have yet to hit the target set by manufacturers. TrendForce predicts a 10- to 15-percent increase for PC DRAM. Coincidentally, analysts expect the same for Server DRAM. Meanwhile, DDR5 modules made up 40 percent of the entire server inventory in the fourth quarter of 2023, and production is ramping up so that manufacturers can increase their profit margins.

In the mobile DRAM business, prices are at historic lows, and buyers are building up their "cost-effective" inventories. TrendForce notes that the smartphone market has some "lingering uncertainties." Therefore, production is not ramping up, and DRAM prices will increase by 18-23 percent in the next three months.

Demand remains robust in the graphics memory business, with GDDR6 16Gb chips leading the way. Contract prices will increase 10 to 15 percent in 1Q24, and TrendForce is closely monitoring the still somewhat "niche" market.

Analysts expect consumer DRAM prices to increase by 8 to 13 percent for DDR3 chips and 10 to 15 percent for DDR4. They also expect DDR4 prices to continue to outpace DDR3, as Taiwanese manufacturers are sitting on surplus DDR3.