In brief: Predatory loan apps, which use sensitive information taken from users' phones to extort them when they can't pay their high-interest loans, were banned by Google last year. But that hasn't stopped tens of thousands of people across the world from downloading them via the Play Store.

Google banned personal loans with an Annual Percentage Rate (APR) of 36 percent or higher back in October 2019. Predatory loan apps that collect personal data from devices to blackmail borrowers were explicitly banned last year.

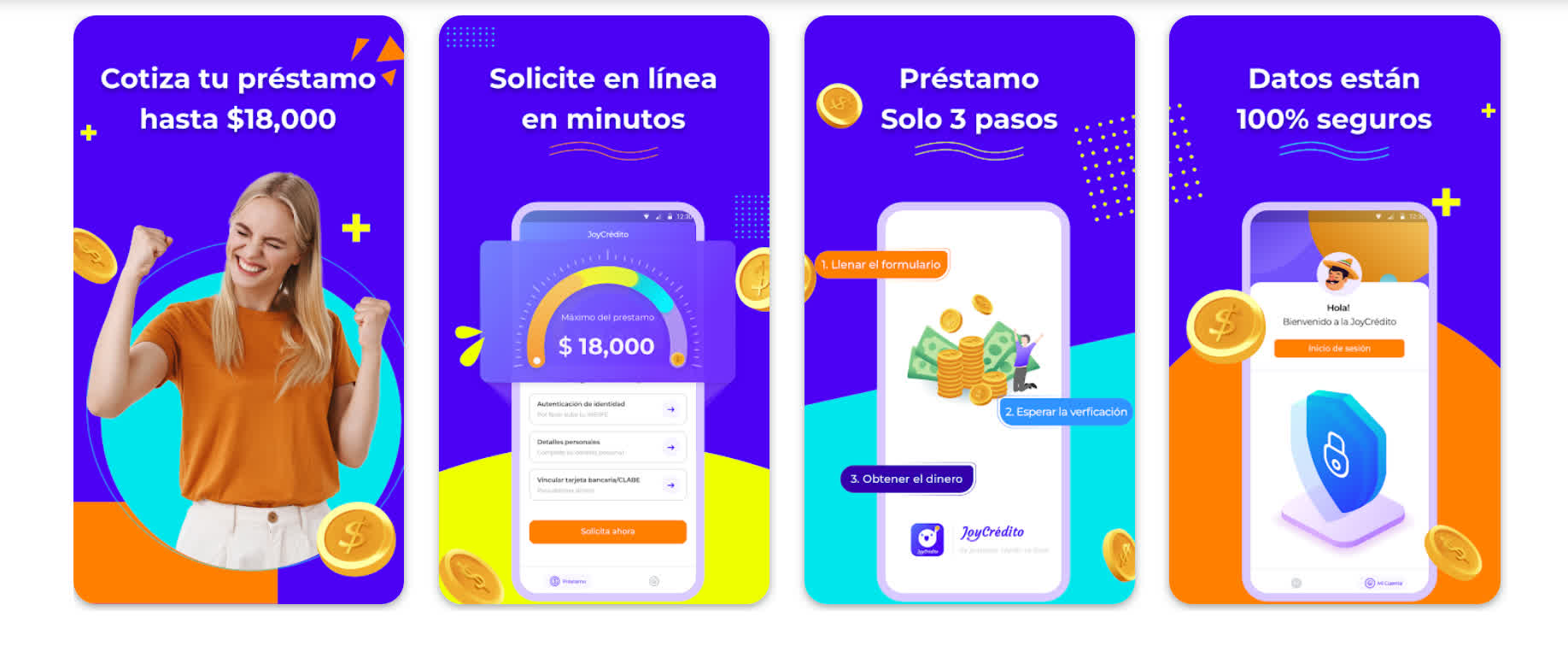

Enforcing Google's policy is proving difficult, especially in Latin American countries and locations such as India. Rest of World highlights the story of Ana Mariela Macías González, a 31-year-old state employee from Puebla, Mexico. She downloaded several predatory apps from the Play Store, including one called JoyCrédito. It led to her debt increasing from 1,000 pesos ($60) to almost 60,000 ($3,500) in less than six months.

González started receiving tens of intimidating calls and texts every day from debt collectors sent by the predatory apps. Some included altered photos of her and implications she was a prostitute. Her entire contacts list also received the messages.

Consumer watchdog group Mexico City's Citizen Council for Safety and Justice says there have been 135 reports filed to local authorities regarding JoyCrédito's fraud and extortion tactics; yet the app is still available to download from the Play Store.

Rest of World looked at 15 apps on the Play Store that violates Google's terms and conditions. Twelve of them explicitly ask for access to either the camera roll or contacts in the Google Play store's terms of service. Two others specified full access only in external documents, and one other gave no data access information. There are also cases where the apps collect SMS and SMS log data.

The publication writes that even before the loans are due, many of these apps threaten users by promising to send deepfaked pornographic or incriminating images to family and friends if the repayments are not maintained.

There are also stories of users being extorted just for downloading the apps and not completing the loan application forms. González says her full name, phone number, bank account, and official ID were shared between predatory loan apps, some of which deposited loan money in her bank without her ever applying to the companies.

Google says it is investigating the matter and collaborating with Mexican authorities in the ongoing investigations. But the incidents have led to questions about whether Google is even reviewing apps' terms and services.