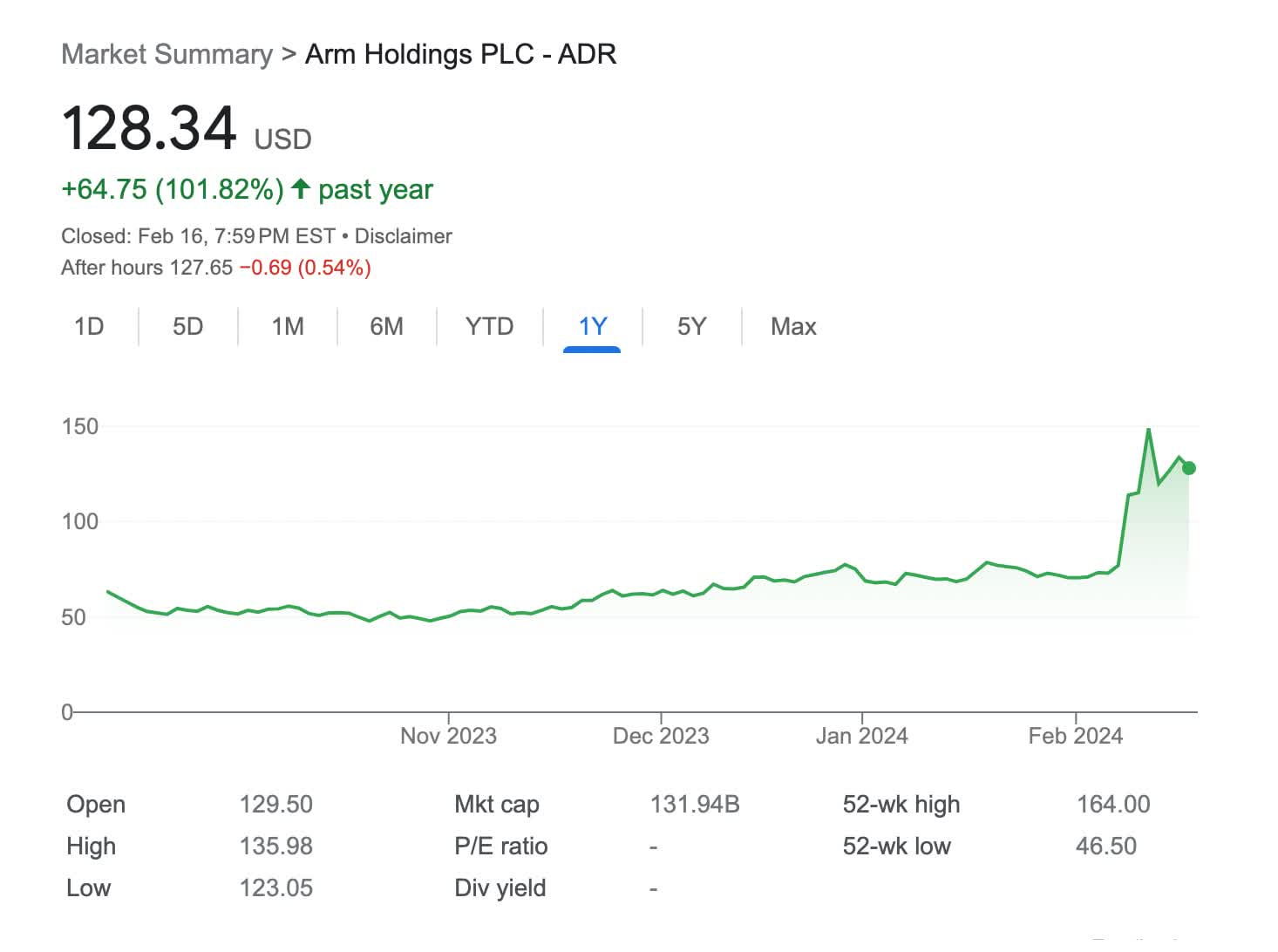

Recap: Arm reported its second set of earnings as a (once again) public company earlier this month. The numbers were particularly strong, well above consensus for both the current and guided quarters. Arm stock rallied strongly on the results up ~30% for the week and they are up over 60% in the last month. These numbers were important as they go a long way to establishing the company's credibility with the Street in a way their prior results did not. Solid execution and some strong tailwinds are helping.

With that said, we saw things we both liked and disliked in their numbers. Here are our highlights of those:

Positive: Growing Value Capture.

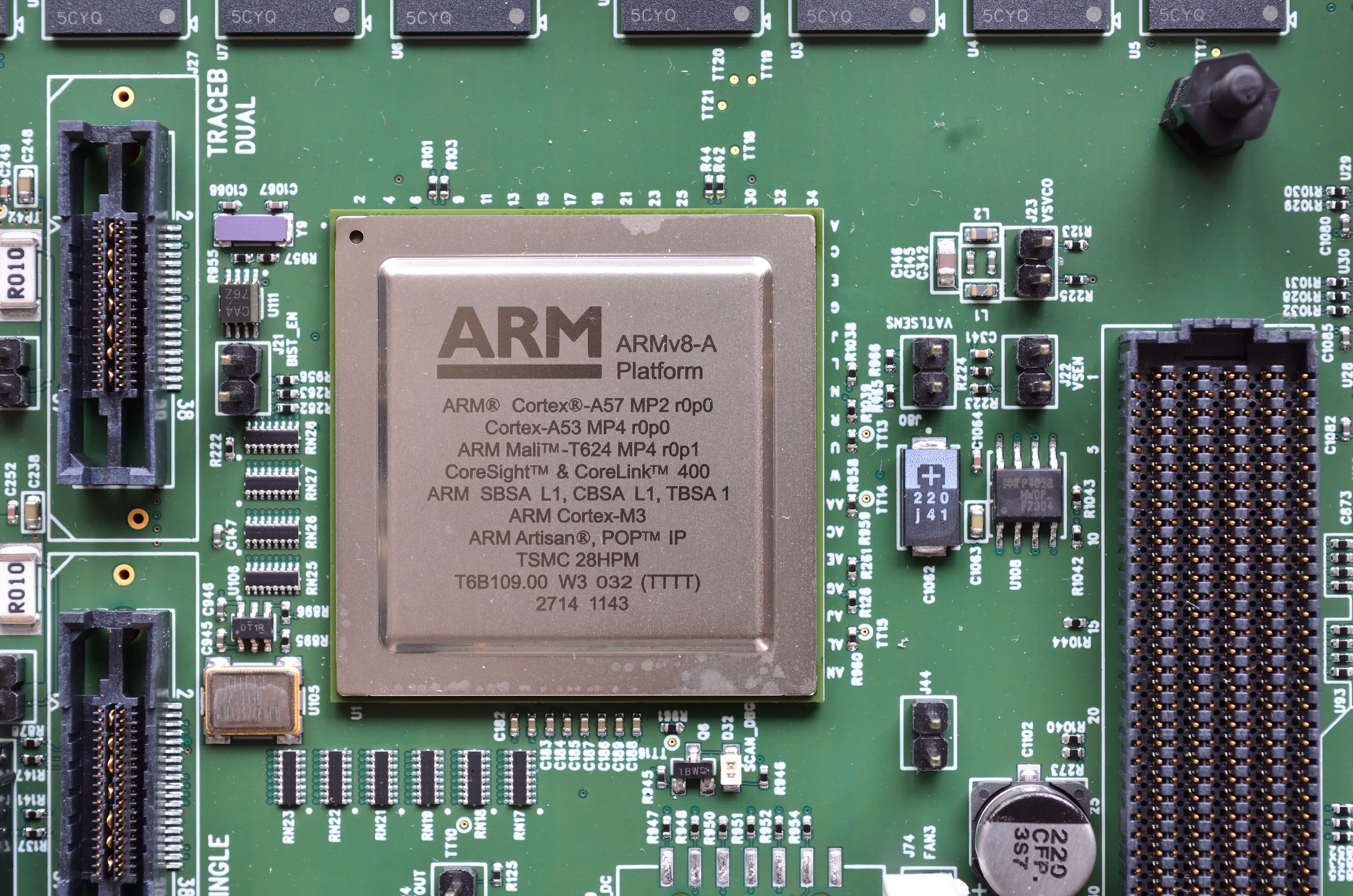

One of our chief concerns with the company since IPO has been the low value they capture per licensed chip shipped – roughly $0.11 per chip at the IPO. That figure continued to inch higher in the latest results, but critically they pointed out that their royalty rate doubles with the latest version of their IP (v9). This does not mean that all of their royalty rates are going to double any time soon, but it does point very much in the right direction. Critically, they noted this rate increase applies to architectural licenses as well.

Negative: The Model is Complex.

Judging from the number of questions management fielded on the call about this rate increase no one really knows how to model Arm. The company has a lot of moving parts in its revenue mix, and they have limits to their ability to communicate some very important parts of their model. We think that at some point the company would be well served by providing some clearer guide posts on how to build these models or they risk the Street always playing catch up with a wide swing of expectations each quarter.

Positive: Premium Plan Conversion.

The company said three companies converted from their AFA plan to the ATA model. We will not get into the details of those here, but these can best be thought of in software terms with customers on low priced subscription plans converting to Premium subscription plans.

This is a good trend, and management expressed a high degree of confidence that they expect to see it continue. They have spent a few years putting these programs in place and seem to have thought them through. This matters particularly because these programs are well suited for smaller, earlier-stage companies.

The old Arm struggled to attract new customers in large part because of the high upfront costs of Arm licenses. Programs like AFA and ATA could go a long way to redressing those past wrongs.

Negative: China remains a black box.

Arm China is a constant source of speculation. In the latest quarter it looks like a large portion of growth came from China, which does not exactly square with other data coming from China right now. It is still unclear to us how much of Arm's revenues from China's handset companies gets booked through Arm China as a related party transaction and how much is direct.

Investors are confused, too. There is no easy solution to this problem, digging too hard into Arm China's numbers is unlikely to make anyone happy with the answers, but hopefully over time it all settles down.

Positive: Growing Complexity of Compute.

Management repeatedly mentioned this factor, noting that this leads to more chips and more Arm cores shipping in the marketplace. Some of this is tied to AI, but we think the story is broader than that. It is going to be tempting to see much of Arm's growth as riding the AI wave, but this does not fully capture the situation.

The AI story is largely about GPUs, which are not particularly heavy with Arm cores. But those GPUs still need some CPU attach, and AI accelerators can sometimes be good Arm targets.

Negative: Diversification.

Arm remains heavily dependent on smartphones, and we suspect the return to inventory stocking by handset makers is playing a big role in their guidance. When asked about segmentation of their results the company declined to update the model provided during the IPO. We hope to see some diversification here when they do update their figures later in the year.

---

Overall, the company did a good job in the quarter. They still have some kinks to work out with their communication to the Street, but this was a good second step as a public company. And, that leaves open the question of valuation...

Arm is now worth $130+ billion and trades at 2025 P/E of 100x. These are lofty numbers. And while earnings were solid, the jump in the stock was considerably higher than the numbers alone justify. After their last earnings, the company attracted a fair amount of skepticism resulting in a sizable short interest ahead of last week's results. So the jump in the stock is in no small part attributable to an ugly short squeeze.

Roughly 25% of Arm's stock floats, the rest is held by parent Softbank. We have to imagine that a secondary offering for more of Softbank's shares is already in the works. The question is, can Arm ever grow into this valuation? This question sits at the root of all those sell-side questions about the v8 to v9 transition. If Arm can really double its value capture then its current valuation starts to look a bit more reasonable, but even if they double earnings next year it would still trade at ~50x.

The company does remain a critical part of the semis industry's foundation and for the moment appears to be executing well.