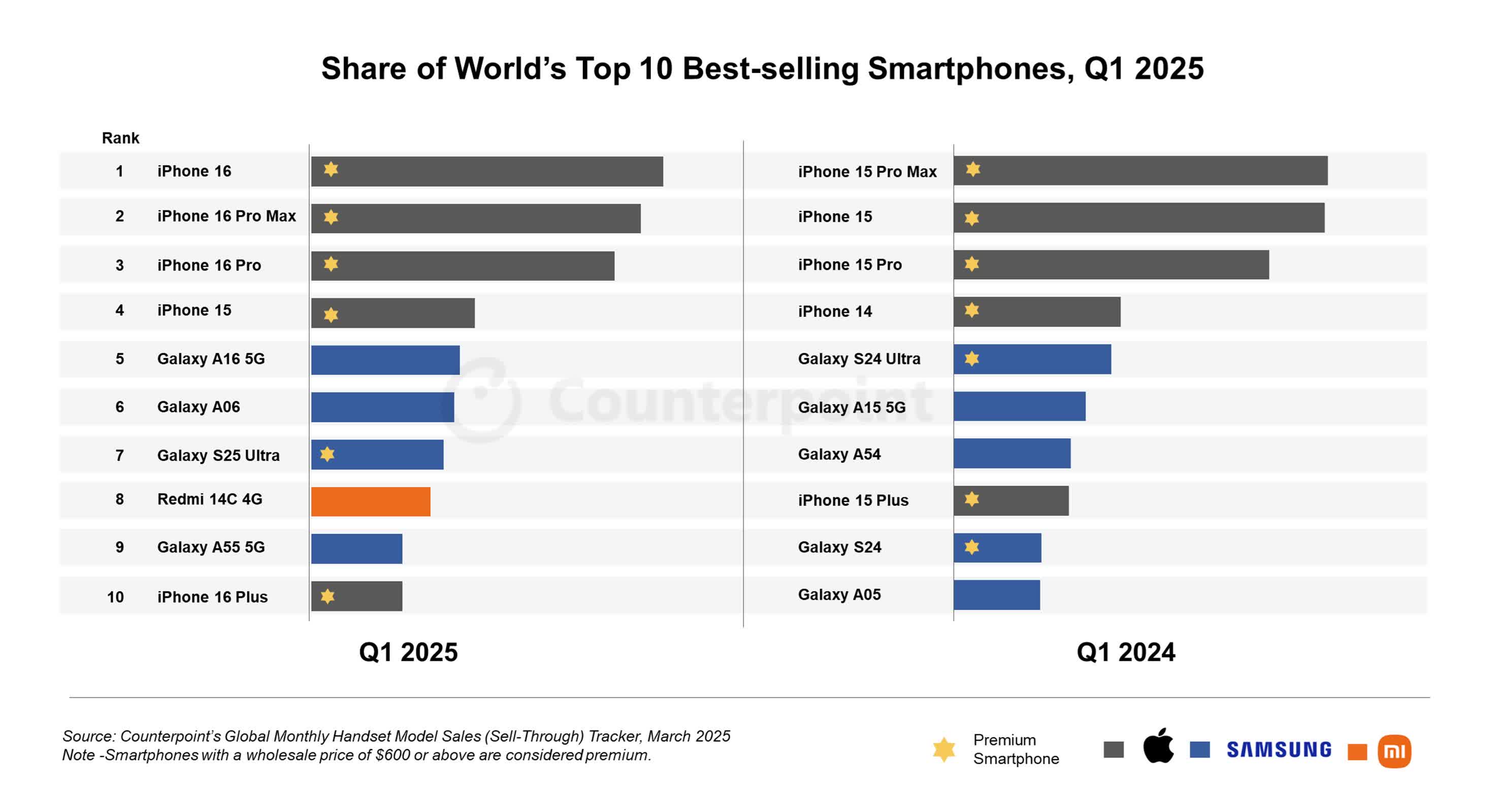

In brief: Apple's iPhone 16 has claimed the title of the world's top-selling smartphone in the first quarter of 2025, marking the first time in two years that the base model of Apple's flagship series has led global sales. This resurgence was reported by Counterpoint Research's latest smartphone sales tracker.

The report highlighted Apple's continued dominance in the premium smartphone segment, with five of its models making the top ten for the fifth consecutive year in a first quarter.

The iPhone 16's strong performance was especially notable in Japan, the Middle East, and Africa. In Japan, improved economic conditions and updated carrier subsidy rules played to Apple's advantage, driving the highest growth in base variant sales in years. The device's appeal in these regions was further boosted by Apple's consistent pricing strategy and the strength of its ecosystem.

Trailing the base model, the iPhone 16 Pro Max and iPhone 16 Pro secured the second and third spots globally. However, Apple's premium models encountered headwinds in China, where government incentives favored smartphones priced below 6,000 yuan (about $833). This, coupled with fierce competition from local brands like Huawei, limited the Pro series' momentum in the Chinese market. Despite these challenges, the Pro variants continued to account for nearly half of all iPhone sales for the third consecutive quarter.

The first quarter also marked the debut of the iPhone 16e, which quickly secured the sixth spot on the global bestseller list in its first full month of availability. Although the 16e carries a higher price tag than the SE 2022, it is expected to outpace its predecessor thanks to notable technological upgrades and a broader feature set, further strengthening Apple's position in the mid-range segment.

Samsung, Apple's closest rival, saw its flagship Galaxy S25 Ultra drop to seventh place, down from the fifth position held by the S24 Ultra a year earlier. This decline was attributed mainly to a shorter sales window for the S25 Ultra during the quarter.

Nevertheless, the S25 series maintained solid performance, contributing a quarter of Samsung's total smartphone sales in its active month. The series also showcased Samsung's push towards more advanced AI integration.

Samsung's Galaxy A16 5G climbed to fifth place, up one spot from its predecessor, the A15 5G, in Q1 2024. The A16 5G experienced a 17 percent year-over-year growth rate, driven by its expanded availability in North America, which accounted for a third of its global sales. The model also gained traction in Asia-Pacific, Latin America, the Middle East, and Africa, solidifying its presence in the budget 5G segment.

A broader market trend in Q1 was the rapid growth of the low-end smartphone segment, defined by devices priced under $100. This category became the fastest-growing in the industry, accounting for nearly 20 percent of all global smartphone sales.

The Samsung Galaxy A06 exemplified this surge, climbing four spots in the rankings compared to its predecessor, with emerging markets fueling much of the demand. The increased supply of affordable components further accelerated this growth.

Xiaomi's Redmi 14C 4G stood out as the only handset in the global top ten not from Apple or Samsung, achieving a remarkable 43 percent year-over-year growth over the Redmi 13C 4G. The Redmi 14C's success was also largely rooted in emerging markets, highlighting Xiaomi's strength in delivering value-driven devices to price-sensitive consumers.

Looking ahead, despite ongoing tariff tensions and broader market uncertainties, Counterpoint expects that the share of the top ten best-selling smartphone models will remain relatively stable.