Hoping to get OCZ back on track, newly appointed chief executive Ralph Schmitt has revealed plans to reduce costs and streamline the company's lineup. OCZ has repeatedly missed earnings expectations, including a $6.3 million loss in its first quarter that ended in May. Although it hasn't filed a Form 10-Q for its fiscal second quarter yet, the company recently said it expects to post a significant loss for the period.

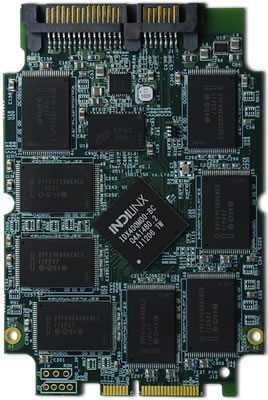

This is mostly blamed on customer incentive programs such as rebates and the aggressive pricing you'll find across the company's SSD offerings, which are now responsible for a bulk of its revenue ($106.5 million of its $113.6 million net revenue in the first quarter was attributed to SSDs, up 54% from the year-ago period, in which it purchased South Korean SSD controller manufacturer Indilinx for $32 million).

As part of its new strategy, OCZ has taken the initial steps toward discontinuing roughly 150 product variations, including an 80% reduction in budget-oriented products that have lost relevance due to the aforementioned incentive programs, which the company will presumably cut back on as well. By gutting its value category, the company can focus on delivering high-end enthusiast gear with wider profit margins.

Additionally, as is common when companies look to lower expenses, OCZ has let some of its staff go. The company said it has laid off about 28% of its global workforce, including a 32% drop in employees and contractors at a Taiwan manufacturing facility, which OCZ said has increased in efficiency and production levels. The SSD maker said it plans to trim fat anywhere else it can, but it didn't mention any specifics.

As a side note, you may want to keep an eye out for some steeply discounted OCZ drives – even more so than they have been. To better align its products and free up cash for the business, OCZ said it would make adjustments to "monetize" some of its inventory. In plainer English, it sounds like the company's about to offer some tantalizingly priced SSDs (just in time for holiday sales, conveniently enough).