As Bitcoin continues to gain credibility and traction, the one hurdle it hasn't yet overcome is ease of use in the real world. In the rare event the merchant you're doing business with accepts the virtual currency, there's still the hassle of processing the payment (which doesn't always go according to plan).

Fortunately, there's now an alternative that makes the process as easy as swiping a debit card... because that's exactly what you'll be doing.

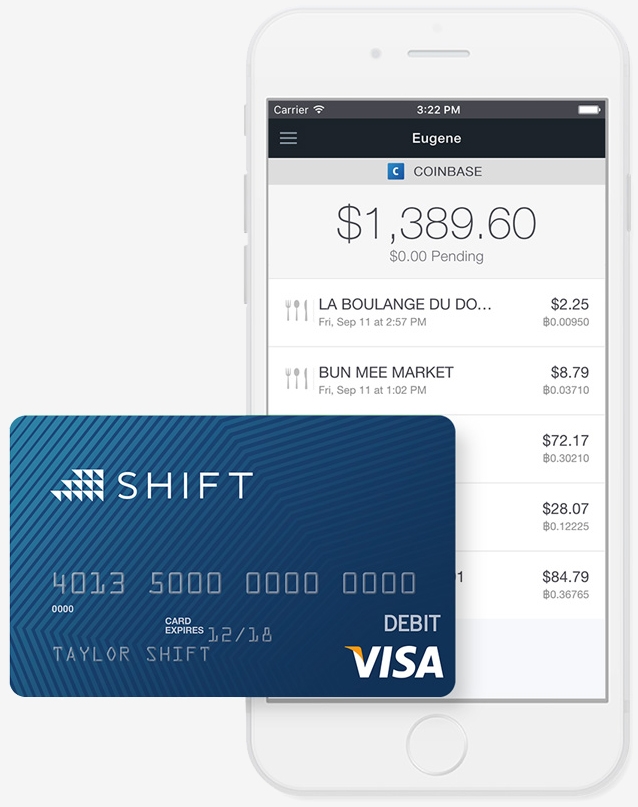

The Shift Card from Shift Financial is the first US-issued Bitcoin debit card. It links directly with your Coinbase or Dwolla account and because it's backed by VISA, the card can be used to pay for goods and services online and in the real world at more than 38 million merchants around the globe. It also carries the same consumer protections as a standard VISA-based card and can be used at ATMs to withdrawal cash (albeit for a small fee).

Naturally, there are a few limitations you'll want to be aware of. At this time, it's only being offered to residents of the following 24 states and territories: Alabama, Arizona, California, Delaware, Georgia, Idaho, Iowa, Kansas, Maine, Mississippi, Nebraska, Nevada, New Jersey, North Carolina, North Dakota, Oklahoma, Pennsylvania, Puerto Rico, South Dakota, Texas, Vermont, Washington, West Virginia and the District of Columbia.

The daily spending / withdrawal limit is set at $1,000. If you're looking to pull cash out of an ATM, the daily limit is set at $500 for Dwolla users and $200 for Coinbase-funded accounts.

As of now, Coinbase and Dwolla aren't charging a transaction fee although Swift says both companies reserve the right to do so in the future. You'll pay $10 up front for the plastic debit card and $10 to replace it should it become lost, stolen or damaged. There's also a $2.50 domestic ATM transaction fee and a $3.50 fee internationally. Additionally, when shopping with the card internationally, you'll be subject to a three percent transaction fee.

Shift said it plans to connect banks, airline miles and other alternative currency to the card in the future.