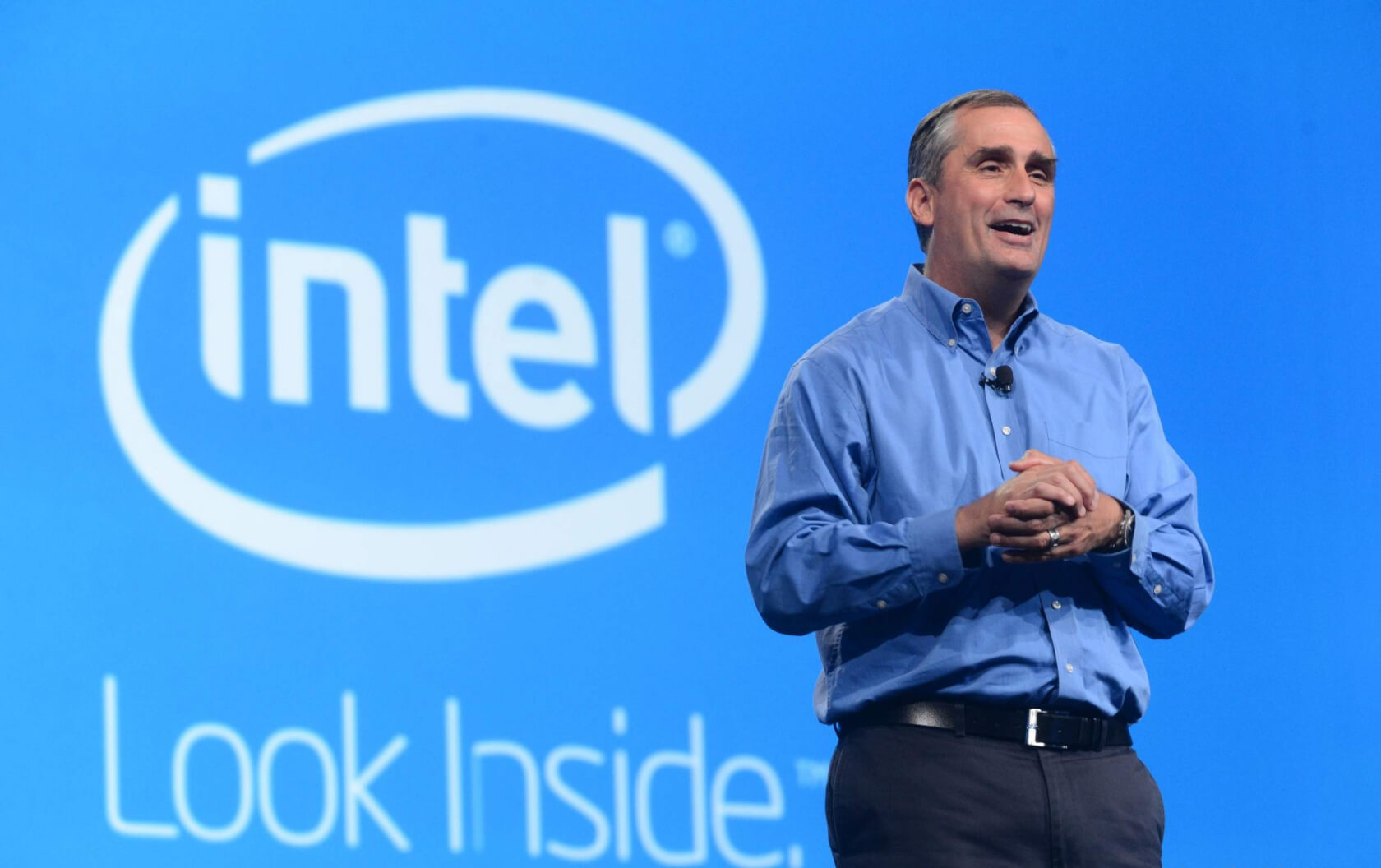

Intel CEO Brian Krzanich could be in hot water if the Securities and Exchange Commission (SEC) decides to investigate his massive sell-off of company shares and options. The stock dump came about a month before news of the Meltdown and Spectre security vulnerabilities became public this week. However, Krzanich and Intel knew of the flaws before the sale was made.

According to Business Insider, Google informed Intel of the security flaws in June of last year. Krzanich sold $24 million in stocks and options back on November 29 although an Intel spokesperson claims the sale was part of a planned divestiture program (PDP) and had nothing to do with the vulnerabilities.

"Brian's sale is unrelated. [He] continues to hold shares in line with corporate guidelines."

The Intel boss only initiated the PDP sale in October meaning he was still aware of the problem when he planned the divestiture. What is even more fishy about the story is that this was not just a simple planned sale of a few stocks. Krzanich sold all of his Intel stock - except for 250,000 shares which he is required to hold as part of his employment contract - and exercised all of his stock options.

It is a relatively common practice for CEOs and other executives to put PDP plans into place to avoid being accused of insider trading in case something happens to occur around the time they sell off some shares. This particular sale was filed under Rule 10b5-1(c) with the SEC which is the rule governing planned divestitures. The transaction included 245,743 in stock plus another 644,135 shares he received by exercising his options. By law, the sale was legal.

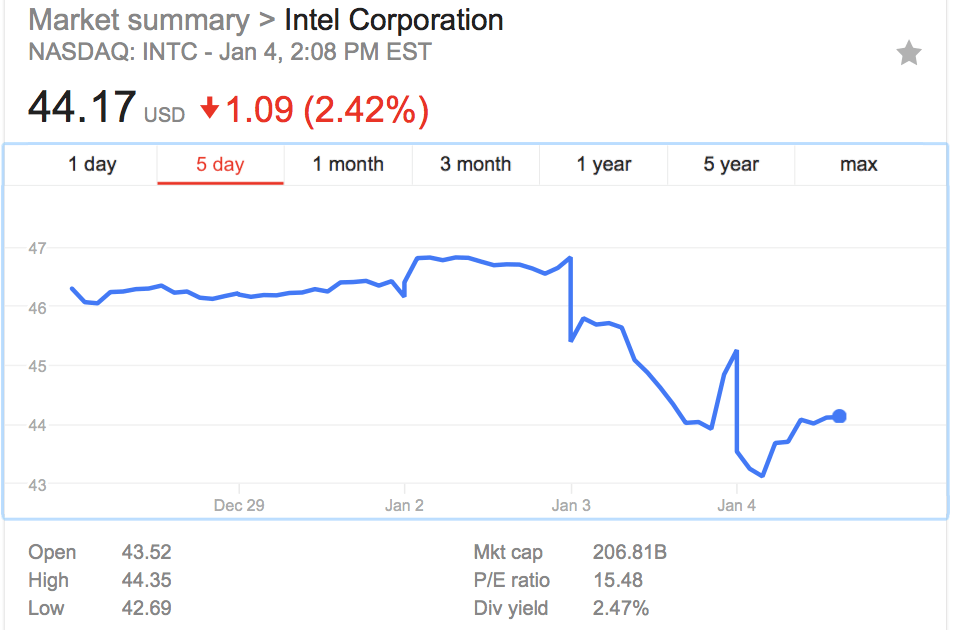

However, according to the SEC filing, Krzanich only put that plan in place on October 30, 2017, meaning he knew about Meltdown and Spectre. Despite the representative stating the plan was unrelated, it certainly seems convenient for Krzanich that it occurred before news of the flaws caused shares to drop 3.4 percent on Wednesday. So far today, Intel is down another 2.42 percent with less than three hours of trading before close.

Even the Motley Fool was reporting back in December that the sale was raising red flags for them.

"Given that Krzanich seems to have sold all the shares he could save for those he is required by Intel's corporate bylaws to hold, the impression that I get is that Krzanich doesn't have a ton of faith in the potential for Intel stock to appreciate."

An SEC representative refused to comment on whether or not the commission was looking into the sale.