Why it matters: We are slowly watching Nvidia dominate the GPU market, and whether we like their technology or not, a lack of competition is a sure-fire way to get price hikes and lack of innovation. Just ask Intel.

A report by Taiwanese analysts at Digitimes claims that graphics card makers are being pressured into doing more than their share for Nvidia.

For the most part the report is a 'matter of fact' statement on Nvidia's recent financial disclosure, nothing new there. However, it hits home when it says Nvidia is forcing "more than 10 graphic card makers" to "swallow contracted shipments released by Nvidia to deplete its inventories, in order to secure that they can be among the first batch of customers to get sufficient supply quotas of new-generation GPUs."

Considering the reports that Nvidia's tardiness in the cryptomining market left it sitting on a treasure trove of GeForce 10 Series GPUs, this means that AIB partners are now being forced to take on the surplus GPUs in order to secure supply to meet their own GeForce 20 Series card production targets.

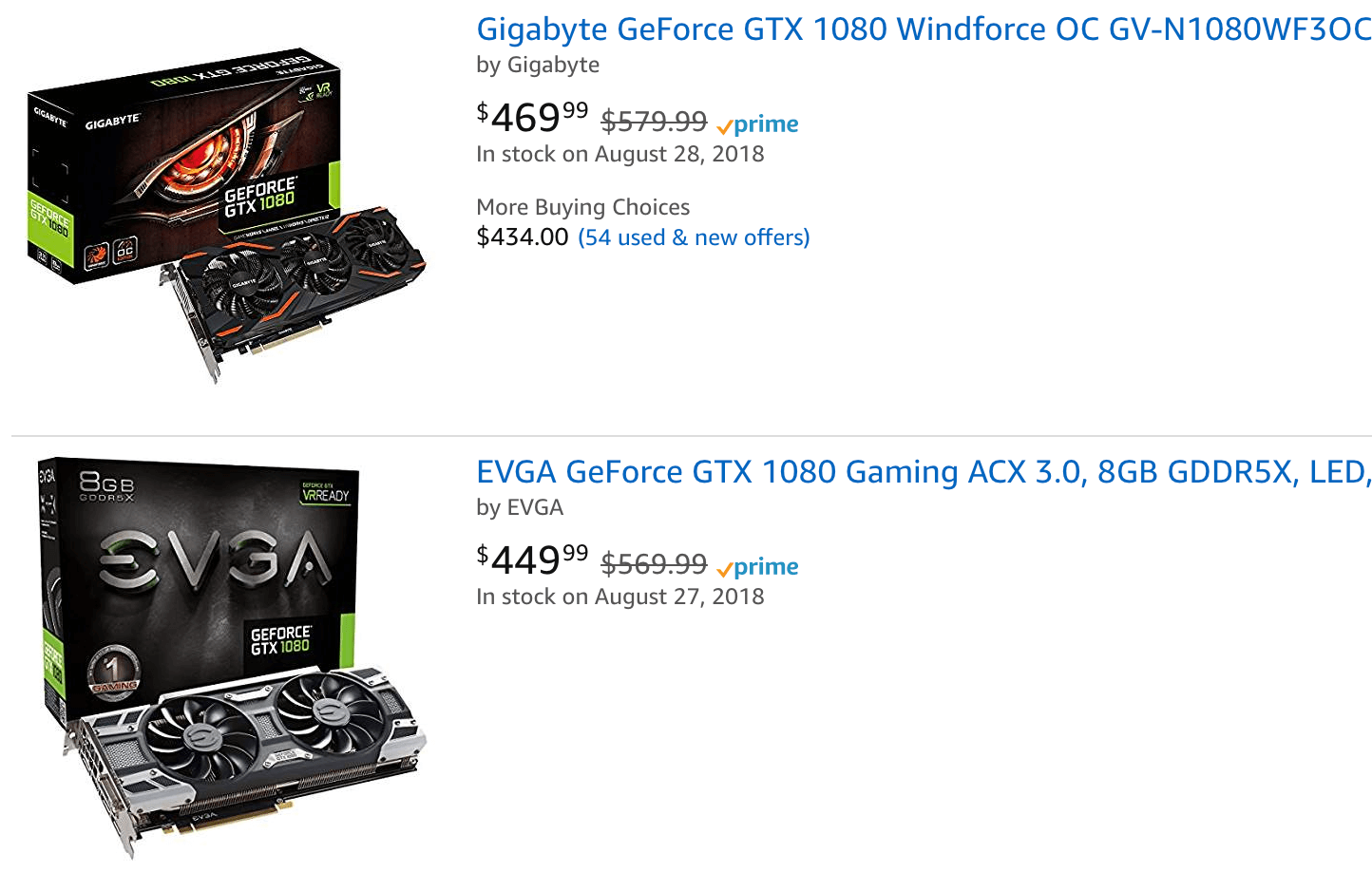

This will likely have a dual effect on the market. On the one side, we are starting to witness a glut of cheap 10-series cards, and on the other the new pricing will erode AMD's mid-market position, prompting even more consumers to switch over to Nvidia, and putting AMD further under pressure in the graphics arena.

With the announcement of the GeForce RTX 20-series cards, the gaming GPU market seems to have slid into a one-horse show with no word of AMD's Navi and Intel having made clear its discrete GPU plans are only relevant for 2020. This is allowing Nvidia to put the squeeze on partners, much like a monopoly.