Bottom line: Apple is walking a dangerous line with its credit card as it runs the risk of romanticizing credit and encouraging debt. That's unfortunately par for the course for most consumers but the truth is, the best way to be financially fit is to avoid debt like the plague.

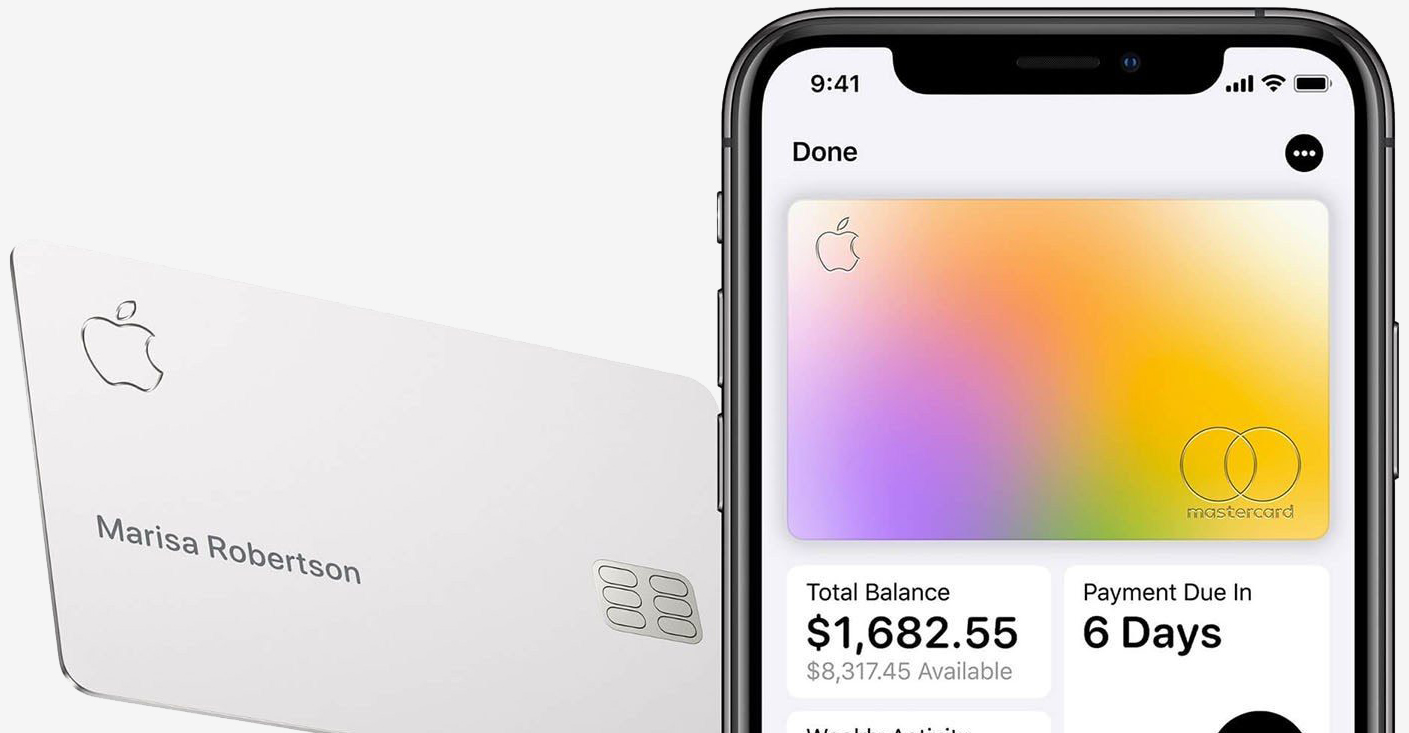

Apple earlier this month started processing applications for a branded credit card ahead of a broader rollout in the coming weeks. As it turns out, the Apple Card - issued in conjunction with Goldman Sachs - is not an entirely original idea for the Cupertino-based tech player.

According to a report from CNBC, Apple held discussions with Capital One regarding a joint credit card in the late 1990s. A former bank executive said the two even tested a card but didn't roll it out broadly, partly due to Steve Jobs "aversion" to rejecting customers for the card.

Jobs revisited the matter in 2004 with the idea of creating a credit card that would reward users with free music from iTunes. Again, it never came to fruition, this time because Apple could not negotiate the terms it wanted for the card.

Perhaps the most surprising aspect of the Apple Card launch is the seemingly wide net Apple and Goldman Sachs are casting. CNBC notes that some subprime borrowers are being approved for the card. One user got approved with a FICO score of around 620, adding that he was "absolutely shocked" he got approved.