What just happened? Intel is bolstering its AI efforts with the purchase of the Israeli-based startup for $2 billion. The bold move goes in line with the company's new strategy of looking for growth outside the CPU space.

Intel has been struggling to hold its chip dominance as of late, so much so that it even asked rival Samsung to make some of its processors and alleviate supply issues. They also sold its modem business to Apple, in a deal it considers to be a major loss inflicted by Qualcomm's anticompetitive practices.

However, Chipzilla has a renewed strategy it thinks is more productive – instead of trying to remain a dominant force in the now mature PC market, it will seek new areas where its silicon prowess can translate into growth.

One such area is artificial intelligence, a market that Intel says will exceed $25 billion by 2024, $10 billion of which represents the data center, one of Intel's strong suits. To that end, the company has decided to snap AI chip maker Habana Labs for around $2 billion, a big bet for a startup in a field that's ripe for disruption.

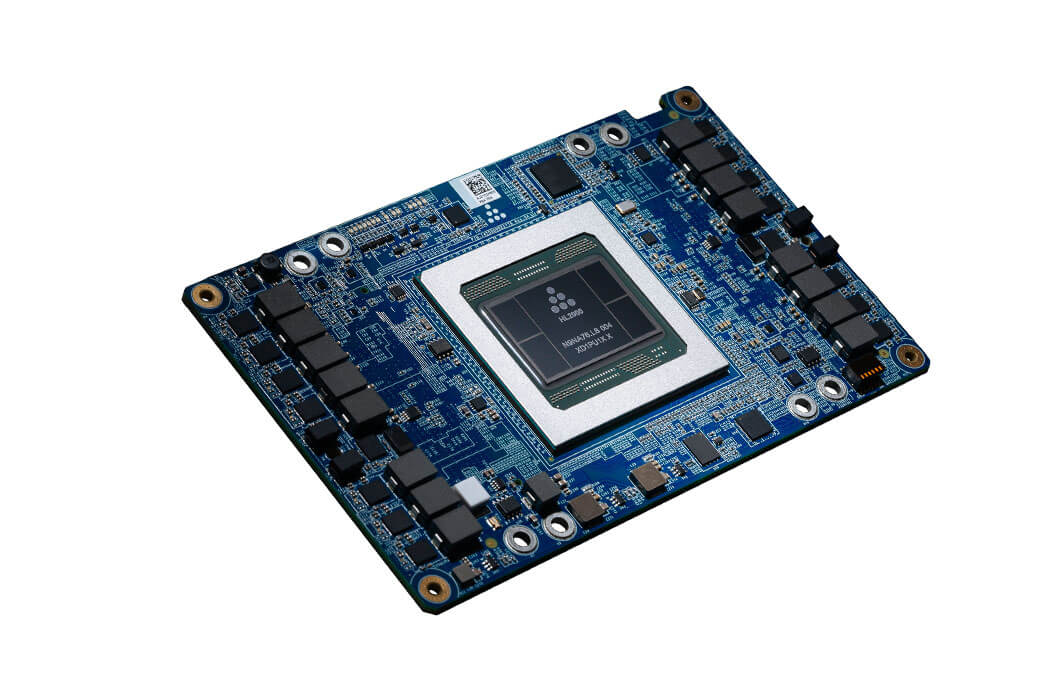

The Israel-based company is an interesting acquisition as its expertise lies in programmable deep learning accelerators for the data center. Intel says that's going to become an important part of its AI business, which is estimated at $3.5 billion for 2019, a 20 percent increase over last year.

To get an idea of how good Habana's AI tech is, the company's Gaudi AI training processor is reportedly four times faster than a similar system designed using GPUs, while also saving on with energy usage, something of particular use in the data center.

And Intel's AI efforts don't just cover enterprise needs. The company wants to design chip clusters that mimic the human brain and medical devices that help bypass severed spinal nerves, among other things.

As for Habana, it will still operate as an independent division inside Intel, and its management team will report to the latter's data platforms group currently led by Navin Shenoy.

Acquiring Habana was arguably a necessary move for Intel, as Nvidia has also set its eyes on the AI market, especially for self-driving cars, but also to improve medical imaging and diagnostics. It too, acquired an AI company called Mellanox to pull an advantage on the competition. But in doing so, it likely overpaid for the privilege of not letting Intel buy it.