Recap: When it's not busy trying to acquire Qualcomm for the exorbitant sum of $117 billion, Broadcom is forging new deals with big tech giants like Apple for essential components. The latest was spotted in a recent SEC filing and shows the two companies reached a new multi-year agreement that sent Broadcom's shares up two percent in after-hours trading.

Broadcom's tech is slowly eating the world, even as many of us are unaware of its presence in many of our favorite gadgets. The company's reach is so powerful that it has US and EU regulators probing every aspect of its business to make sure it doesn't abuse its dominance in key semiconductor markets.

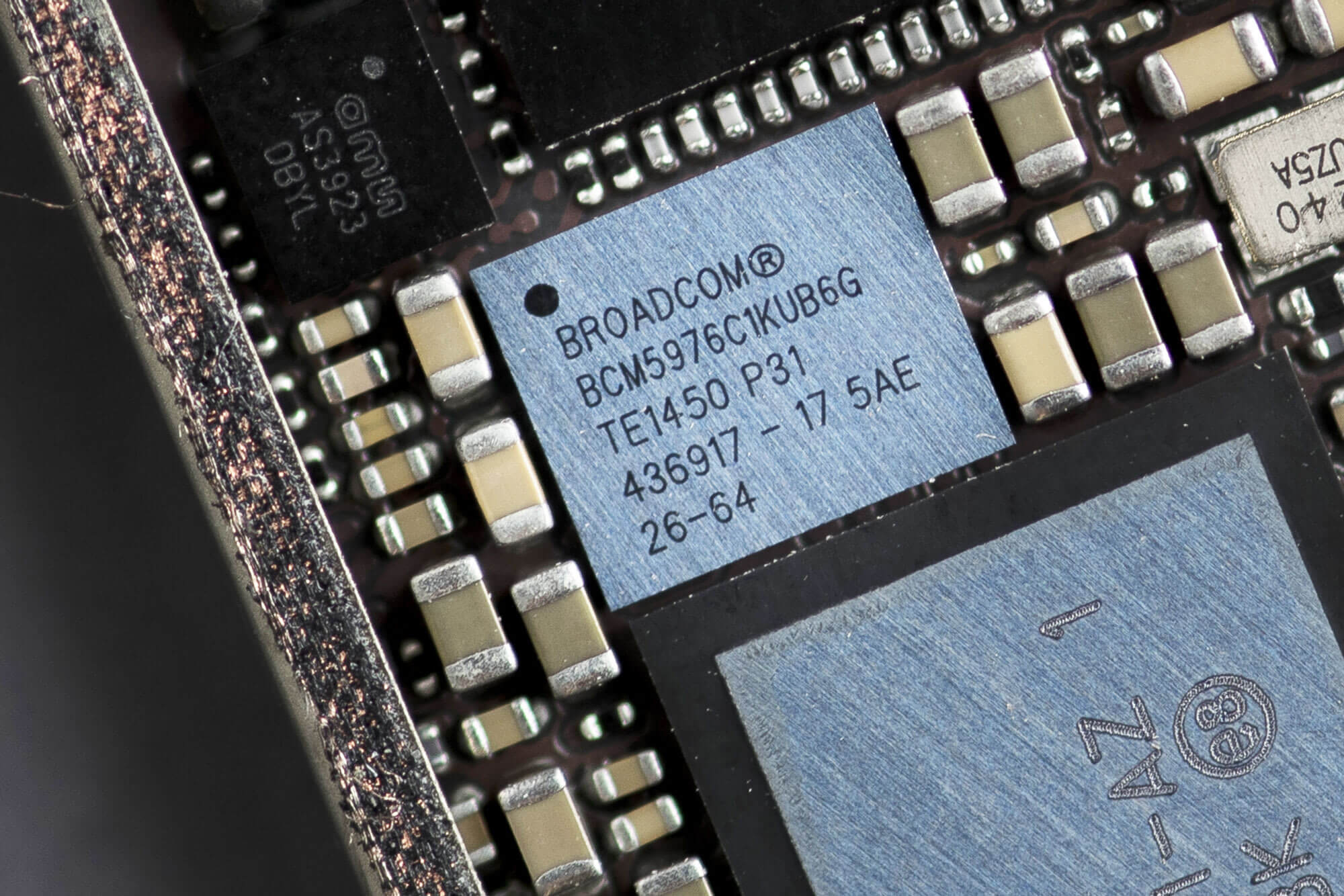

Recently, the silicon giant revealed in an SEC filing spotted by the Wall Street Journal that it has signed a new agreement with Apple for "the supply of a range of specified high-performance wireless components and modules." The company already has a deal inked in 2019 for "RF components and modules" which are used in iPhones and iPads, making up about $10 of the bill of materials if you go by JP Morgan's estimates.

This could mean that Broadcom could rake in no less than $15 billion in revenue over the next three and a half years, which is a big win for the company.

It's no secret that Apple is one of Broadcom's largest customers, accounting for somewhere between 20 to 25 percent of its net revenue over the last two years. Back in December, the rumor mill was abuzz with reports that Broadcom was exploring a potential sale of its RF division for around $10 billion.

Given Apple's appetite for strategic acquisitions that give it more control over key components that go into its products, it wouldn't be surprising to see it snapping Broadcom's RF unit. The only deal-breaker might be the asking price, as Apple only paid $1 billion for Intel's modem division in a deal latter described by one of the parts as grossly undervalued.