In brief: Qualcomm had a strong quarter following the release of Apple's iPhone 12, and the company is confident it can leverage Huawei's misfortune to expand the addressable market for its mobile chips.

Qualcomm's earnings report landed today, and it looks like the company rode the iPhone 12's wave of success and impressed investors with better than expected financial results.

For the fiscal quarter ending December 27, 2020 (Q1 of FY2021), Qualcomm made no less than $8.24 billion in revenue, a 62 percent year-over-year increase. And while that did fall short compared to the projected $8.27 billion figure thrown around by analysts, net income was $2.46 billion, almost 18 percent higher than expected and nearly two times as much as the same quarter of the previous fiscal year.

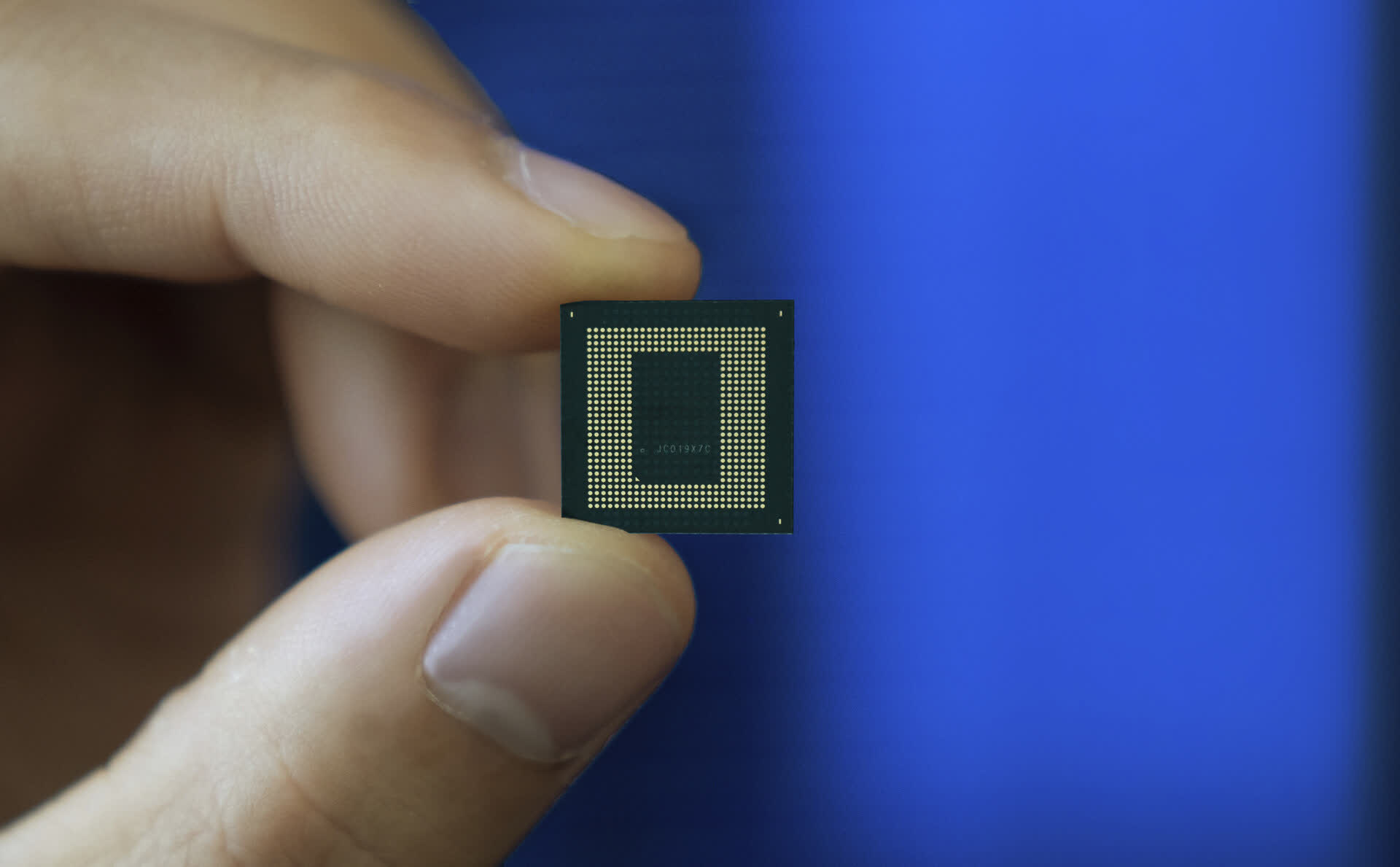

Outgoing CEO Steve Mollenkopf noted during an investor call, "the chip business is growing like crazy," attributing the good financial results on the insatiable demand for its Snapdragon Mobile Platform as well as strong sales of its modems. Part of that is thanks to a deal with Apple to supply 5G modems for iPhone, but the company also makes money from licensing its extensive list of patents to other companies.

Mollenkopf believes Qualcomm's outlook for the coming year looks particularly good in the light of ever-growing trade restrictions imposed on Huawei by the US. Simply put, demand for Huawei phones outside of China is slowing down, which is covered by other smartphone vendors that buy their chips from Qualcomm as fast as they can be made. The only problem left to figure out is supply shortages, as the executive acknowledged it would directly impact how much the company will capitalize on the opportunity.

In the meantime, Huawei is exploring the idea of building a chip manufacturing plant in Shanghai, but that's several years away from turning the tide for the Chinese company.