In brief: TSMC has traditionally shied away from building manufacturing capacity outside of its home country. However, in the face of ongoing chip shortages and a fragile supply chain that's been strangled by trade wars and pandemic-induced lockdowns, the company is now planning a global expansion that includes the US, Japan, and possibly even Germany, despite the higher cost of operating fabs in these countries when compared to Taiwan.

In April, TSMC revealed it would spend no less than $100 billion over the next three years in an effort to expand its manufacturing capacity and build more research and development facilities. The main driver of that initiative is the ongoing shortage of chips that's expected to last well into 2022 and possibly 2023 before chipmakers will be able to catch up with demand.

The 5G and AI megatrends are also driving demand for advanced silicon, while countries and private companies are racing to upgrade their infrastructure. The pandemic accelerated the digitalization and automation process for tedious and repetitive tasks, and a shift to remote work and study has led to the first surge on the PC market in years.

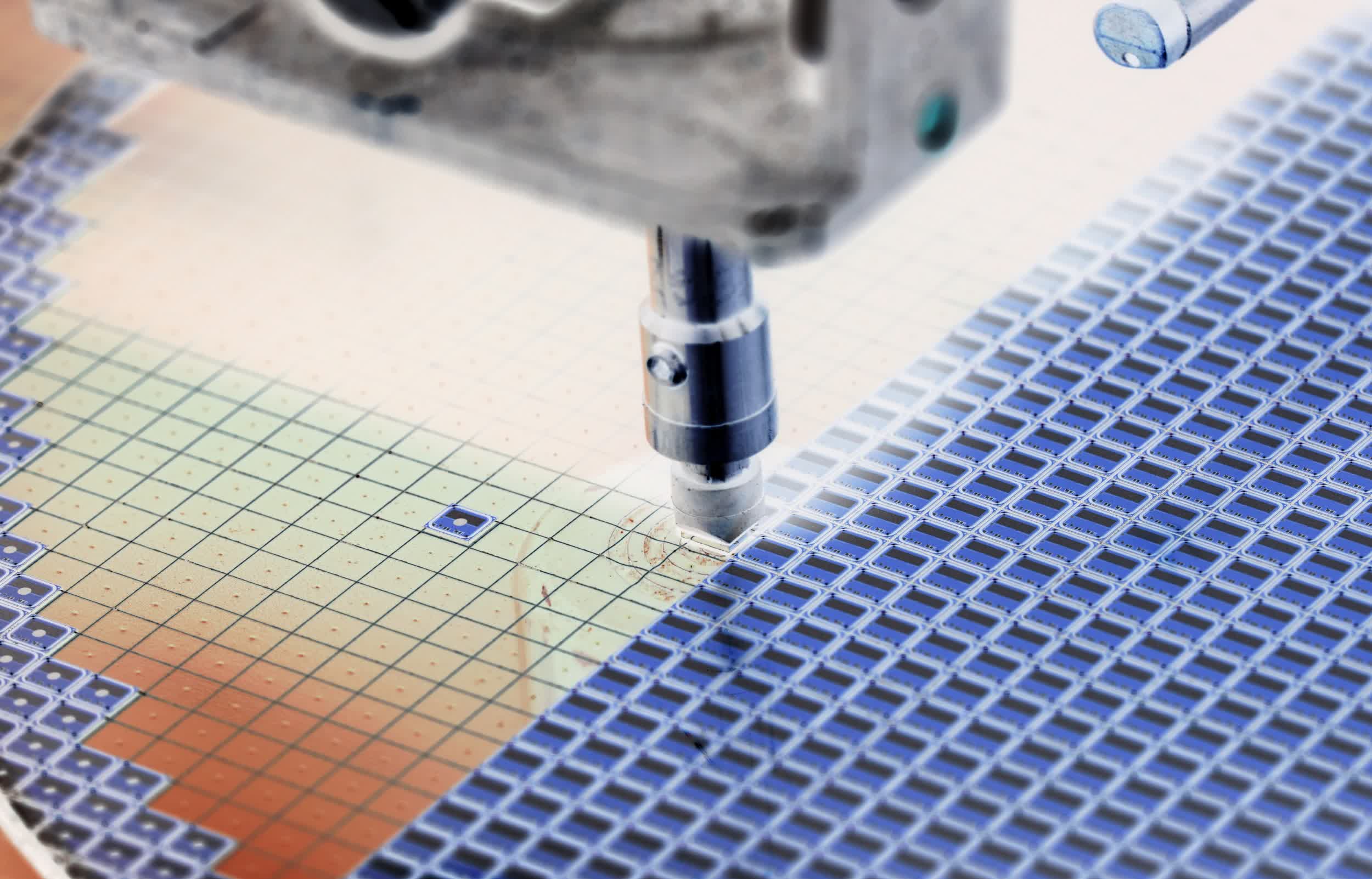

TSMC benefitted from the increase in demand for chips, and all of its fabs have been running at full capacity while the backlog of orders has only increased over time. On the other hand, the company had to navigate the first serious drought affecting the water supply of Taiwan, its home country and the place where two thirds of the global semiconductor manufacturing capacity is located.

This has prompted TSMC to look for new locations for new fabs in places like the US and the EU. According to a Nikkei report, the chipmaker has its eyes set on Germany for its first fab in the EU, and is currently in talks with several local clients about the feasibility of such a project.

TSMC chairman Mark Liu says the talks are in the early stages, so the company has yet to decide if this is the ideal place to set up shop. Ultimately, this will depend on the local supply chain, the needs of TSMC's customers, and the overall cost of building and operating the fabs.

The European Union has shown strong interest in boosting local manufacturing capacity – particularly when it comes to 7nm, 5nm, 3nm, and 2nm process nodes.

It's all part of a new "strategic autonomy" agenda that hinges on €145 billion ($175 billion) from the bloc's Recovery and Resilience Funds, with the aim of of reducing the EU's vulnerability to supply chain disruptions outside of its jurisdiction.

In the meantime, TSMC has more concrete plans to build a $12 billion factory in the US state of Arizona. Construction is "well under way," and the facility is on track to produce chips on a 5nm process node in 2024.