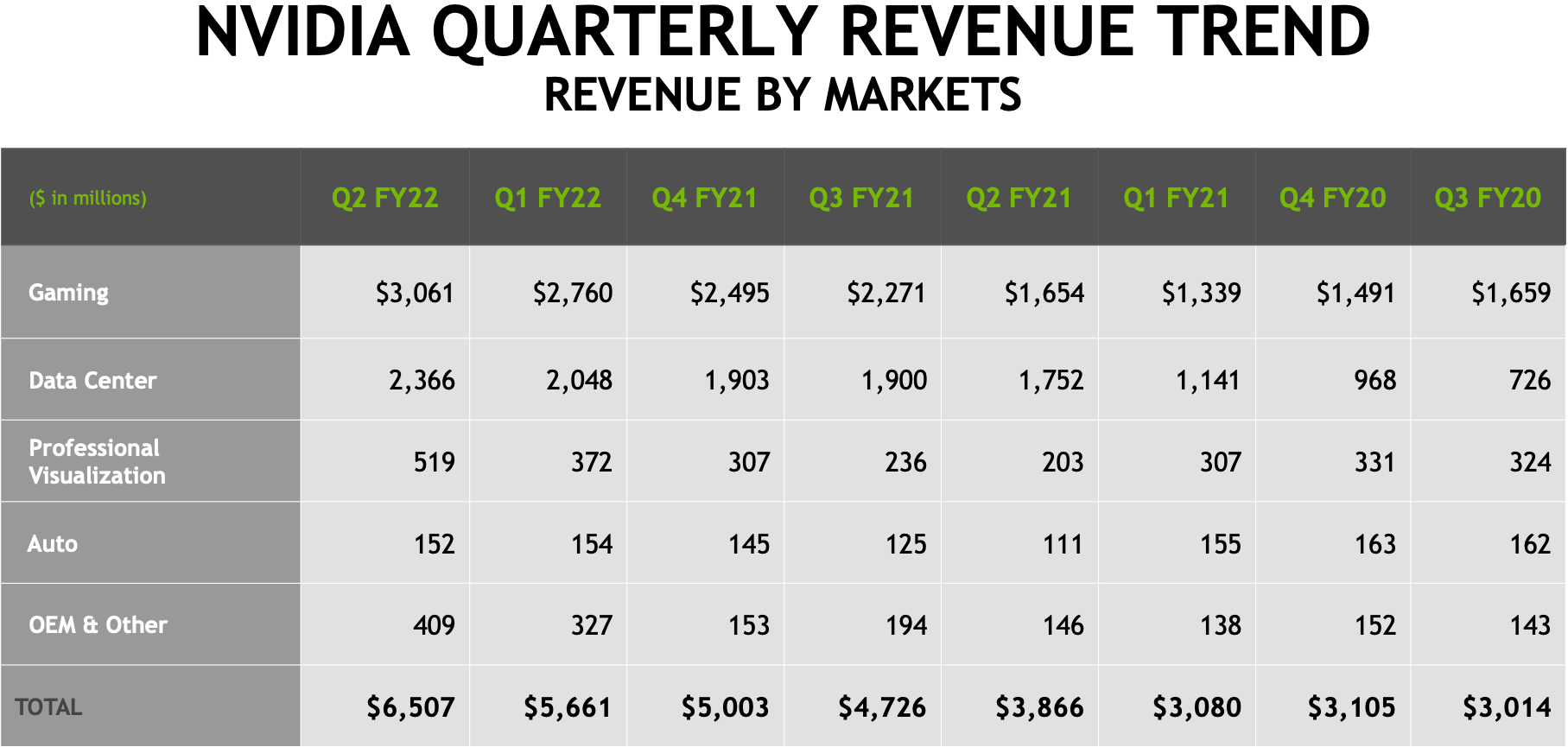

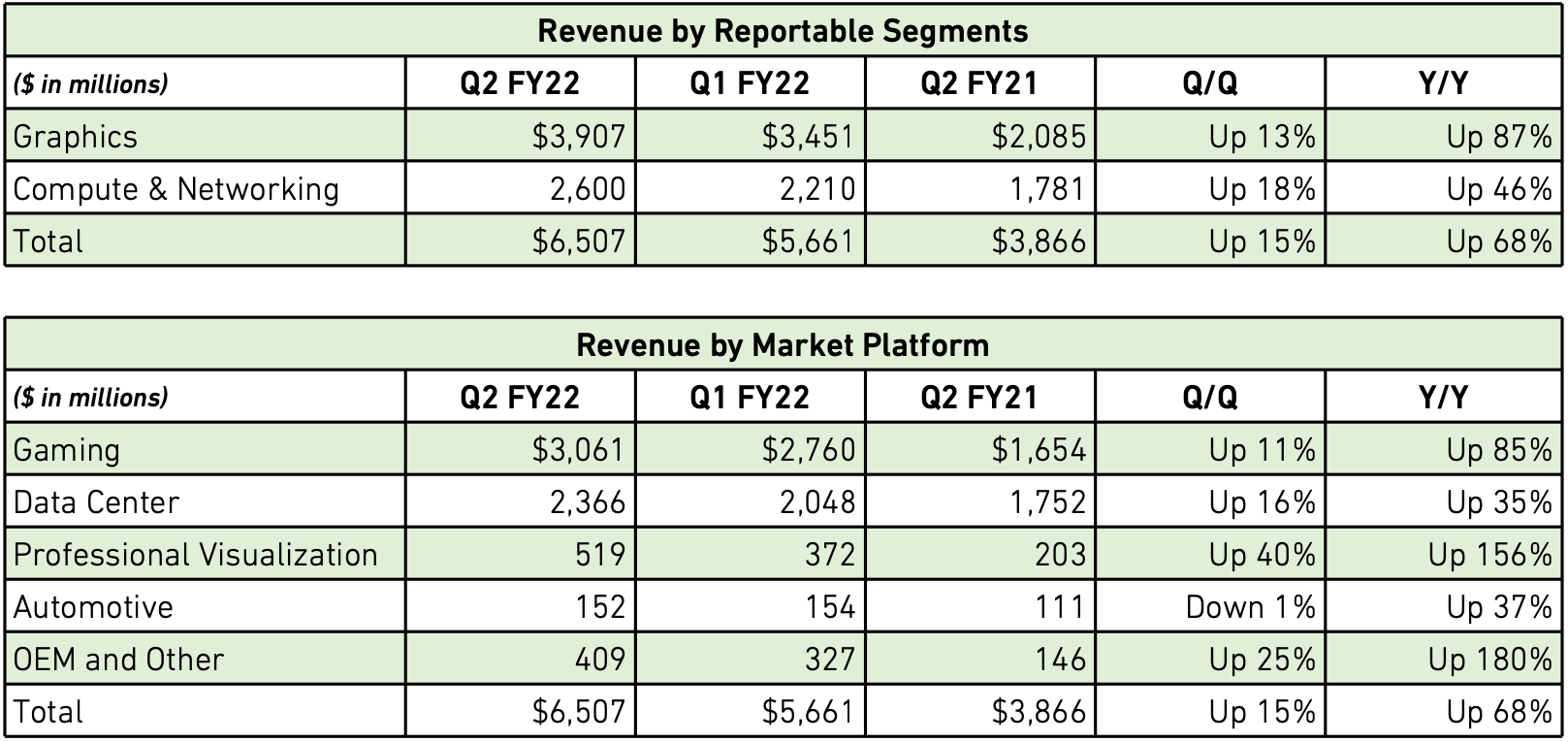

In brief: Nvidia's revenue for the second fiscal quarter of 2022 not only beat Wall Street expectations but also reached an all-time high. The company generated $6.507 billion, up a massive 68% compared to the same quarter a year earlier, and its gaming revenue jumped 85% to $3.06 billion.

Nvidia's net income has also skyrocketed compared to last year: $2.374 billion Q2 FY2022, up 282% compared to the $622 million recorded in Q2 FY2021. Its gross margin was also up YoY, from 58.8% to 64.8%.

While it does have fingers in many pies, gaming is Nvidia's primary earner. Demand for Ampere products has been through the roof since the first cards launched last year, and their high selling price is helping inflate the company's bottom line. The success of the Switch, for which Nvidia provides the Tegra X1, is also boosting gaming sales. In addition to the yearly revenue increase, the sector jumped 11% from the previous quarter.

Interestingly, Nvidia revealed that 80% of the new Ampere GPUs it shipped during Q2 FY2022 were the Low Hash Rate (LHR) versions. That suggests most of the cards sold ended up in the hands of gamers rather than miners, though we recently heard of a hack that restores 70% of LHR cards' unlocked hash rates.

As for Nvidia's dedicated Crypto Mining Processor (CMP) line, its sales were $266 million for the quarter. While that is up from the previous quarter's $150 million, the company in May said it was expecting CMP sales to reach $400 million in Q2 FY2022. Nvidia CFO Colette Kress said that it expects a "minimal contribution" from its CMP sales going forward.

Elsewhere, Nvidia's data center business also reached an all-time high of $2.37 billion, up 35% YoY, and the professional visualization segment was up 156% to $519 million. Not every sector experienced gains, though; its automobile business' $152 million in sales was down compared to the last quarter. It was still up 37% YoY, but the pandemic had a devastating effect on the auto industry last year.

For the third quarter, which has always been Nvidia's most successful, it expects revenues to hit $6.80 billion ±2% and gross margins to decrease to 65.2%. Shares in the company were up 2% in after-hours trading.

On the company's earnings call, CEO Jensen Huang, speaking about graphics card supply issues, said, "I would expect that we will see a supply constrained environment for the vast majority of next year is my guess at the moment." Read more about that statement here.