In brief: The smartwatch market is now 27 percent larger than it was a year ago, mostly thanks to strong demand for sub-$100 models. Apple, meanwhile, has crossed the 100 million milestone, but its leadership is eroding as brands like Samsung, Garmin, and Chinese companies making budget smartwatches are slowly gaining ground.

The latest report from Counterpoint Research is in, painting what has now become a familiar picture of the smartwatch market where the Apple Watch leads the pack, along with a few signs of positive change in the Wear OS land.

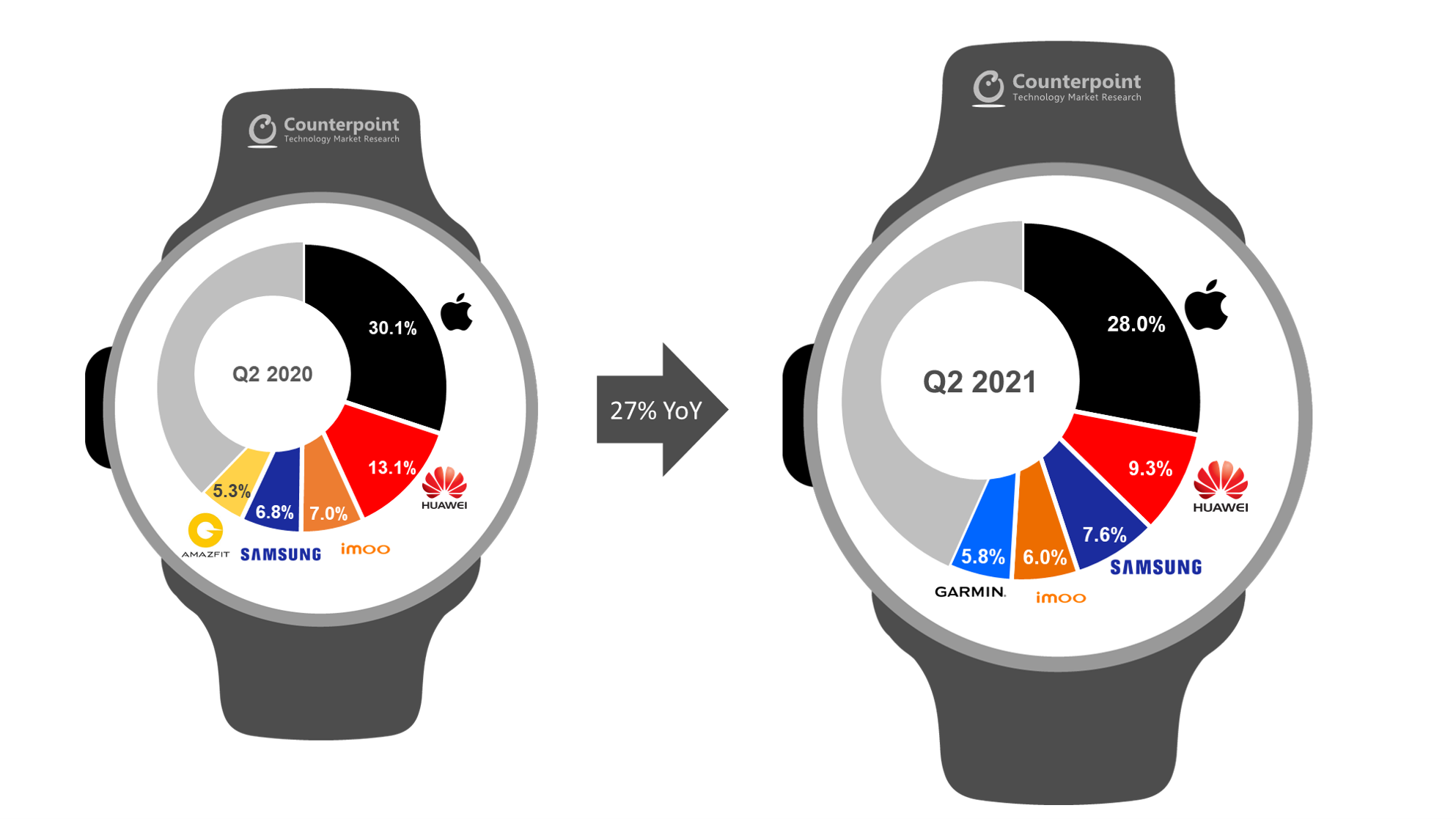

Global smartwatch shipments for the second quarter of this year showed a healthy 27 percent year-over-year increase, showing that appetite for wearables has improved as Covid-19-related restrictions eased. The Apple Watch accounted for a slightly smaller (28 percent) share of the total shipments volume when compared to the same quarter of last year, but at the same time its user base has grown to more than 100 million.

Huawei still holds the second place among global smartwatch brands, but its market share has shrunk by 29 percent compared to last year, following the same trajectory as its smartphone business as a result of US sanctions reducing the Chinese company's ability to secure essential components and software licenses.

Samsung has climbed to third and is now in the best position to benefit from Huawei's decline. The Korean giant's Galaxy Watch line now accounts for 7.6 percent of total shipments, and this number is expected to increase as a result of renewed interest shown for the Galaxy Watch4 that was unveiled earlier this month.

Surprisingly, the fastest-growing brand was Garmin, which now accounts for 5.8 percent of smartwatch shipments, a 60 percent year-over-year increase. Budget smartwatches in the sub-$100 price category sold over five times better this year, but the five top-selling models globally were the Apple Watch Series 6, Apple Watch Series 3, Apple Watch SE, Samsung Galaxy Watch Active 2, and the Imoo Z6-4G.