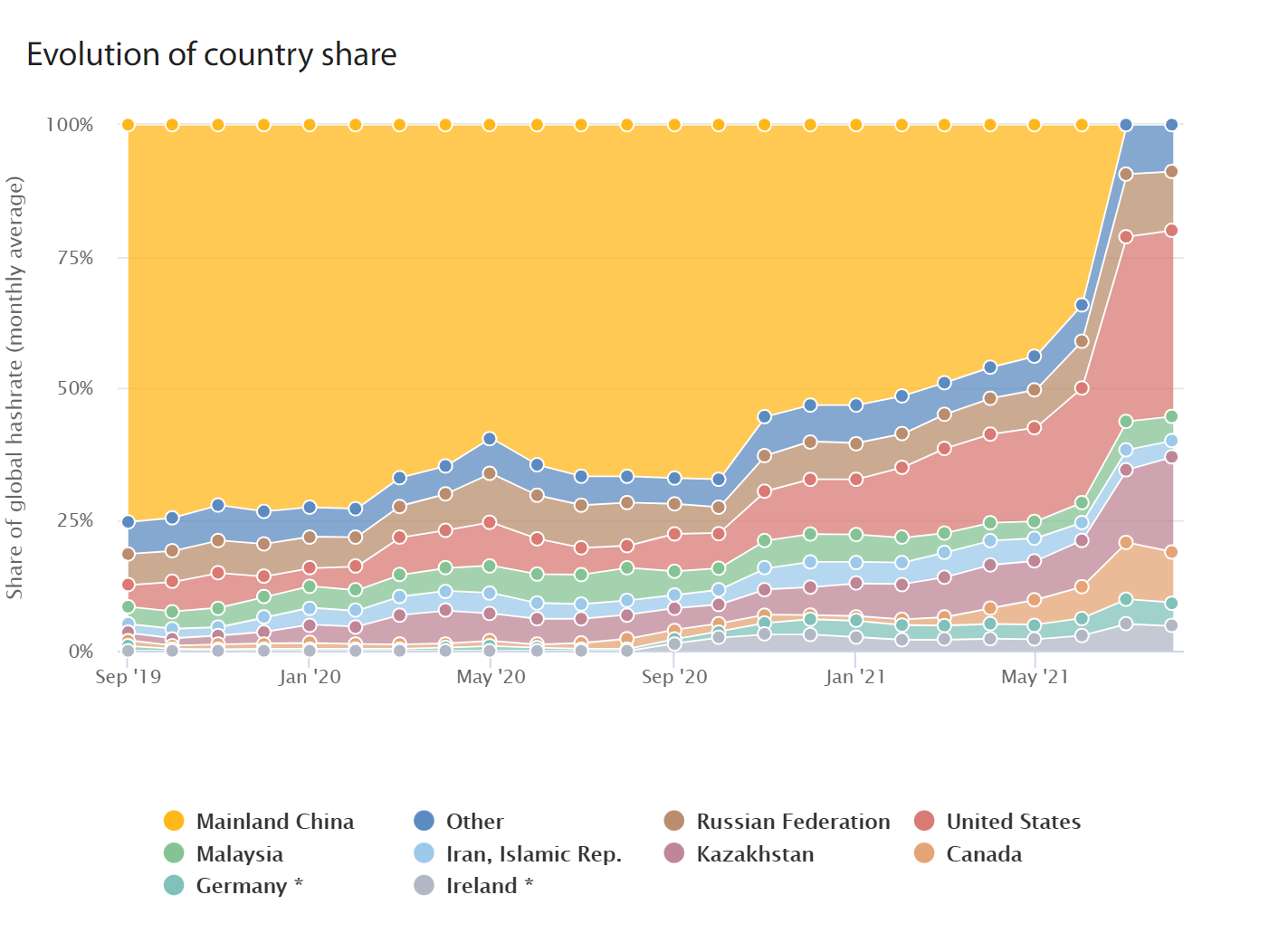

What just happened? For the first time, the US has surpassed China to become the global crypto mining leader. It follows months of cryptocurrency clampdowns by the Asian nation, which has led to miners and mining companies moving to more welcoming locations.

Despite the Chinese government's obvious dislike of crypto, the country has long been responsible for the majority of the global bitcoin hash rate---partly because of its cheaper electricity---taking a 75% share in September 2019. But this year has seen China push down harder on the industry than ever before: a big crackdown back in May resulted in miners closing down their businesses; authorities started shutting down more operations in June; and China recently declared all crypto transactions illegal.

According to figures published by the Cambridge Centre for Alternative Finance, the new crackdowns have seen China's share drop by 60% in just a few months. Now, it stands at zero.

Image credit: Cambridge Centre for Alternative Finance

China's loss is other countries' gain. The US share of the global BTC hash rash jumped from 17% in April to a world-leading 35.4% share in July. Second-place Kazakhstan went from 8% to 18%, while third-place Russia is on 11% after being at 6.8% three months earlier. Canada is fourth with a 9.6% share, having been on just 3% in April.

"The whole narrative of China controls bitcoin is now completely destroyed," Boaz Sobrado, a London-based fintech data analyst, told CNBC.

The migration of crypto miners from China has resulted in increased power demands for the countries taking them in. A single Bitcoin transaction, including the resources needed to mine the coin and to verify the transaction, can total upwards of 1,700 kilowatt hours (kWh). One mining company bought a Pennsylvania power plant that produces enough power for 1,800 Bitcoin miners, with output increases planned to support more than 20,000 miners by 2022.

In other crypto news, Intel this week confirmed that its first Arc graphics card series, Alchemist, would have no Nvidia LHR-style mining limiter. We also heard that new software is able to circumvent team green's limiter by dual mining crypto.

The rising interest in mining and increasing coin values are impacting graphics card prices and availability, though Nvidia is still rumored to be releasing more products in January, which seems strange considering people can't even find or afford its current offerings. But it's expected that Ethereum's move from a proof-of-work (PoW) model to proof-of-stake (PoS) will help ameliorate the situation.

Image credit: TimeShops