In brief: With workers moving from traditional work environments to home offices due to the ongoing pandemic, PC manufacturers had to ramp up shipments to respond to the increasing needs. That has now come to an end, as analysts are reporting a decline in the number of PCs sold to distribution channels and end-users.

After two years of continued growth, PC shipments are now declining, as we see a 5.1 percent decrease in the first quarter of 2022 compared to the same period in 2021. This is likely a result of companies calling workers to return to their offices, even if they don't want to.

The reported decrease doesn't mean we're witnessing the start of a crash. Instead, we should look at these numbers considering the existing supply chain and logistical issues. Even facing these challenges, manufacturers shipped 80.5 million PCs (down from 84.8 million in Q1 2021).

Ryan Reith, VP of IDC's Worldwide Mobile Device Trackers, stated there has been a decrease in the shipment of education and consumer PCs, but demand for commercial devices remains high. Moreover, he believes the consumer market will improve soon.

The table below gives you a better understanding of how these companies fared compared to the same period in 2021 (shipments are in millions of units):

| Company | 1Q22 Shipments | 1Q22 Market Share | 1Q21 Shipments | 1Q21 Market Share | 1Q22/1Q21 Growth |

|---|---|---|---|---|---|

| Lenovo | 18.3 | 22.7% | 20.1 | 23.7% | -9.2% |

| HP Inc. | 15.8 | 19.7% | 19.2 | 22.7% | -17.8% |

| Dell Technologies | 13.7 | 17.1% | 12.9 | 15.3% | 6.1% |

| Apple | 7.2 | 8.9% | 6.9 | 8.1% | 4.3% |

| Asus | 5.5 | 6.9% | 4.7 | 5.6% | 17.7% |

| Acer Group | 5.4 | 6.8% | 5.8 | 6.8% | -5.9% |

| Others | 14.5 | 18.0% | 15.1 | 17.8% | -4.0% |

| Total | 80.5 | 100.0% | 84.8 | 100.0% | -5.1% |

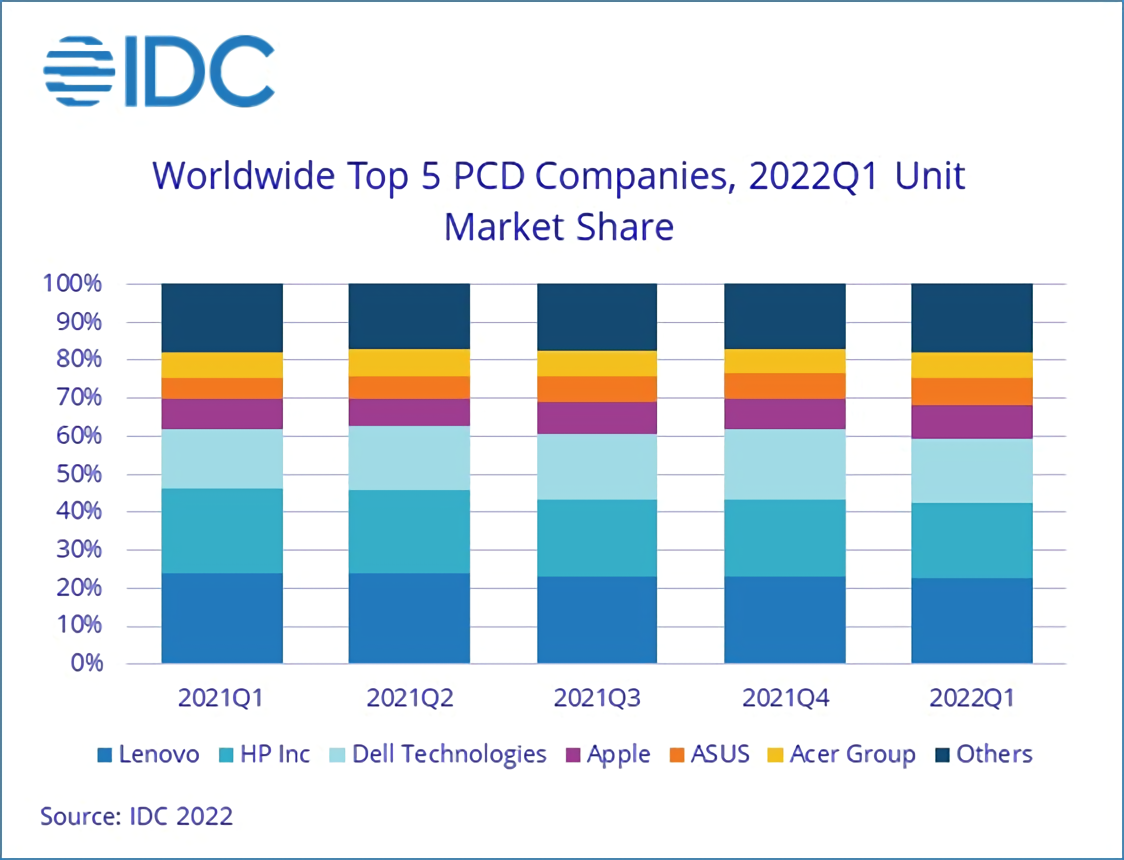

Lenovo held its top position year-over-year, followed by HP and Dell. Apple came in fourth, while Asus and Acer fought for fifth place in the ranking. Out of these six vendors, only Asus, Apple, and Dell reported an increase in year-over-year shipments.

"Even as parts of the market slow due to demand saturation and rising costs, we still see some silver linings in a market that has reached an inflection point towards a slower pace of growth," said Jay Chou, research manager for IDC's Quarterly PC Monitor Tracker. "Aside from commercial spending on PCs, there are still emerging markets where demand had been neglected in the earlier periods of the pandemic, and higher end consumer demand also has held up."

If history serves us right, shipments should improve in the following quarters, peaking in Q4 with the holiday season. By then, we should better understand what the future holds for the PC industry.