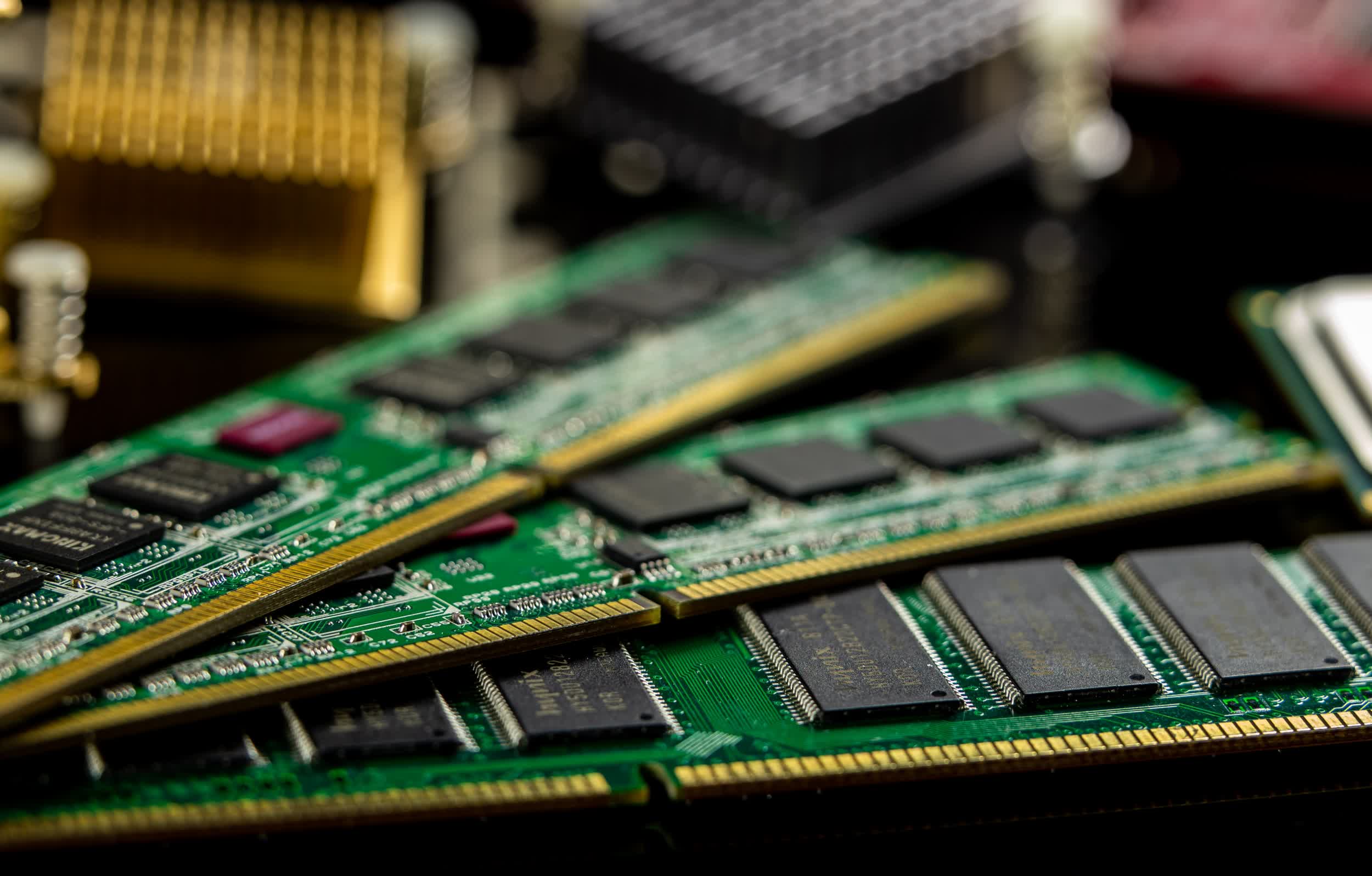

The big picture: DRAM pricing continued its decline in the most recent quarter, further evidence that the pandemic-induced demand boom for electronics may finally be in the rearview. That's great news for shoppers, but the chain reaction from replenished inventory levels is only going to create more headaches for manufacturers.

TrendForce (paywalled, via The Wall Street Journal) said the average contract price of DRAM fell by 10.6 percent in the second quarter compared to the same period a year earlier. According to the market research firm, it's the first year-over-year decline in two years. Further declines are expected in the coming months.

DRAM pricing peaked in the fall of 2021 as demand for consumer electronics spiked, largely due to the work from home trend. Semiconductor shortages and production slowdowns only exacerbated the problem. The pendulum has since swung in the other direction as demand for smartphones, PCs and other gadgets has slowed amid inflation concerns.

Looking ahead to the third quarter, TrendForce believes DRAM pricing will slide by nearly 10 percent quarter over quarter. The server segment, where demand is quite stable, could heavily influence prices and if a war develops between competitors for sales, prices could dip even more.

What we are seeing in the DRAM industry is a chain reaction. Cooling demand leads to replenished inventory levels, in turn freeing up production capacity. This could impact expansion plans that several companies announced during the pandemic to cope with unprecedented demand.

Micron, the third largest DRAM maker, recently said it would dial back expansion plans and capital expenses.

Image credit: Sergei Starostin, Sven Finger