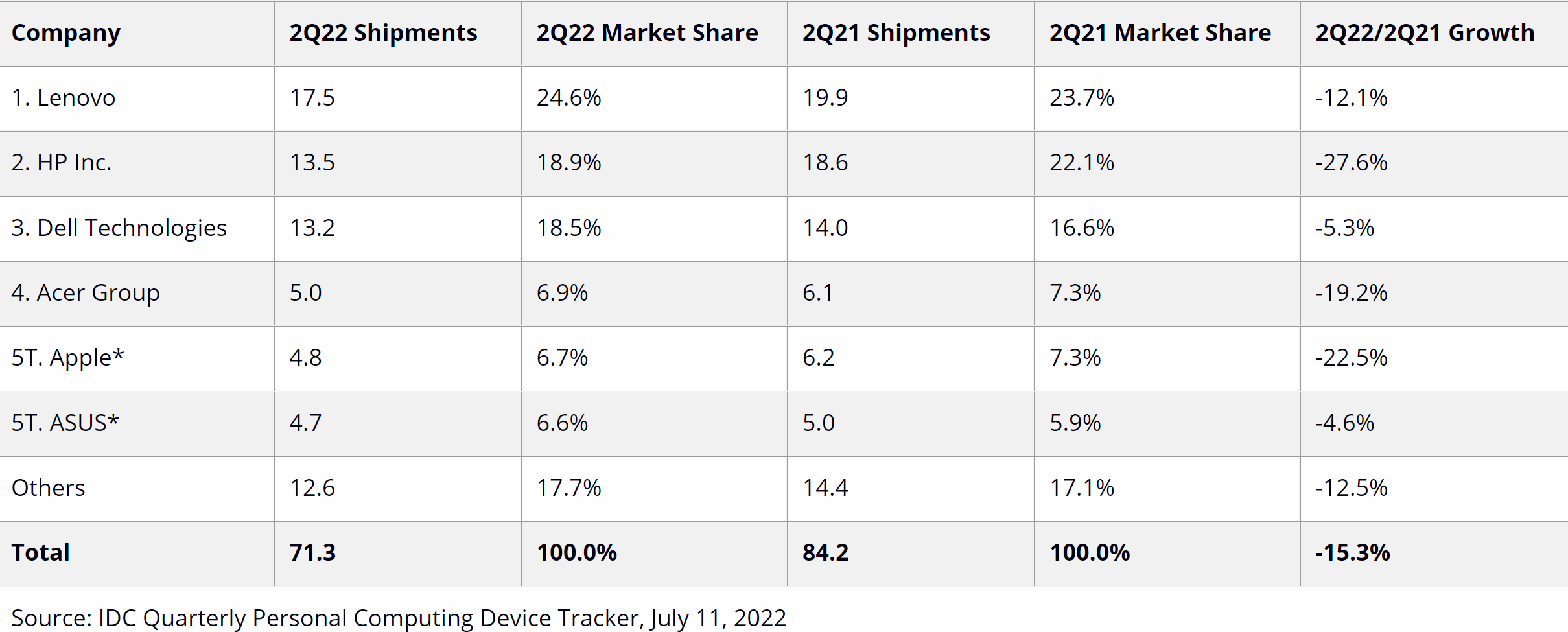

In brief: Another industry analyst firm has reported a significant fall in global PC shipments following two years of pandemic-induced growth. The 71.3 million units shipped in the second quarter represent a 15.3% year-on-year decline and the second straight quarter of falling shipments.

While a slowdown in PC shipments was always expected---the result of China's covid lockdowns and weak demand as consumers tighten their purse strings over fears of a recession---the double-digit decline was worse than expected.

"Fears over a recession continue to mount and weaken demand across segments," said Jitesh Ubrani, research manager for IDC's Mobile Device trackers. Macroeconomic global trends such as rising inflation and fuel prices also impacted the market.

"Consumer demand for PCs has weakened in the near term and is at risk of perishing in the long term as consumers become more cautious about their spending and once again grow accustomed to computing across device types such as phones and tablets," Ubrani explained.

While that might all sound very depressing, it's important to remember the pandemic's influence. Demand for electronic items, video games, streaming services, etc., skyrocketed while most of the world worked, learned, and played at home, and we're now seeing the market return to normal. Compared to the pre-Covid years of 2018 (62.1 million) and 2019 (65.1 million), Q2 2022 shipments were up by quite a margin.

Looking at individual OEMs, Lenovo managed to hold the top spot with a 24.6% share (17.5 million units). It was followed by HP (13.5 million) and Dell (13.2 million). Acer was fourth, and Apple slipped one place to fifth, tying with Asus. Every company on the list saw a yearly shipment decline, with HP (-27.6%) and Apple (-22.5%) hit hardest.

"With education PC appetite saturating and consumer demand stagnating, the U.S. PC market is staring at another quarter of double-digit decline across most segments," said Neha Mahajan, research manager with IDC's Devices and Displays team. "Commercial PC demand is also showing signs of a slowdown, however there are still pockets of growth expected in certain commercial sub-segments where demand for low-mid range Windows devices remains active and unfilled."

IDC's report backs up Gartner's Q2 figures, which had PC shipments falling 9.5% YoY. It'll be interesting to see if the arrival of new hardware later this year from AMD, Nvidia, and Intel boosts the market. However, a recent report suggests we could be waiting as late as December for the RTX 4000-series graphics cards, and people might not rush out to buy one.