Why it matters: The US is moving to prevent China's semiconductor industry from using advanced chipmaking tools, which may also impact American, South Korean, and Taiwanese companies operating in the region. Whether or not this will have the desired effect on China's semiconductor ambitions remains to be seen.

Most analysts expect China's leading tech companies will soon post their worst-ever quarterly results after being hammered by regulatory crackdowns and lockdown-related factory output issues. While this will make it harder for the country to weather the economic storm, the Chinese government's plan for technological self-sufficiency has a more pressing obstacle it has yet to overcome.

Bloomberg notes that the US is adding more restrictions on chipmaking equipment sold to Chinese foundries. This change comes in response to incredible advances made by Chinese companies in areas like NAND and DRAM manufacturing and advanced logic like CPUs and GPUs.

For instance, Yangtze Memory Technologies Co (YMTC) is already mass-producing 128-layer 3D NAND that can achieve similar performance to comparable offerings from Samsung, SK Hynix, and Micron. And while those companies can produce faster and higher-density NAND, Apple is considering using YMTC NAND for the base model iPhone 14.

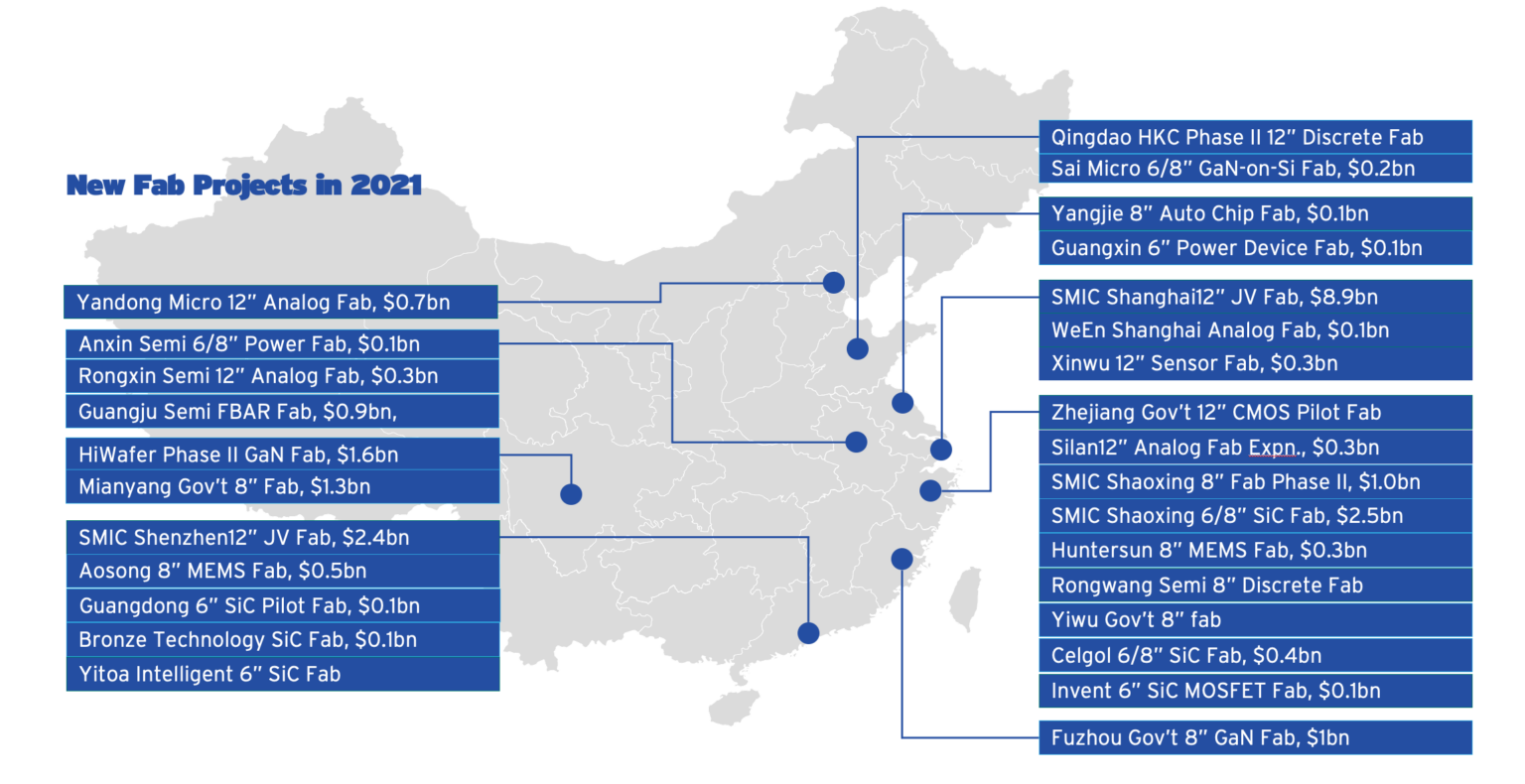

When zooming out, China is leading the world in building more chip factories, gradually reducing the number of chips it needs to import every year. In the first five months of 2022, China imported over 232 billion chips worth around $174 billion. In response, the Chinese government is considering waiving taxes on imports of materials and equipment for high-tech manufacturing until 2030, and local foundries are getting significant subsidies to expand capacity as quickly as possible.

The 10-year cost of ownership for chip foundries in China is almost 40 percent lower than in the US. By 2025, analysts expect 12 new manufacturing facilities to be operational in the US, while China wants to build as many as 31. However, Chinese chipmakers are having difficulties securing the necessary lithography tools for advanced process nodes, so they're mostly buying old second-hand machines from Japan to populate the new factories.

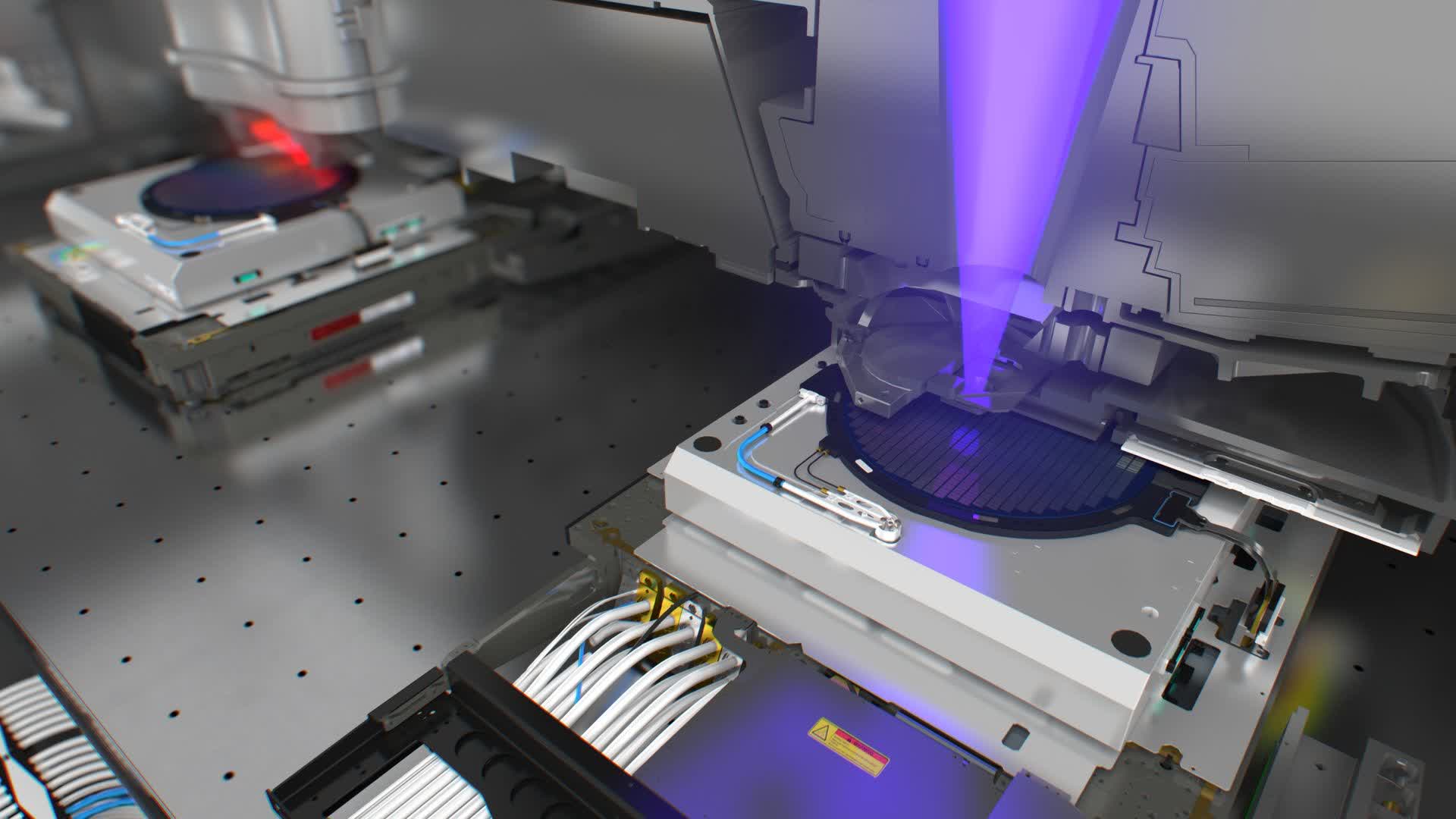

China's acquisition difficulties stem from the US pressuring ASML, which makes 95 percent of all DUV and EUV lithography tools, to stop selling equipment to Chinese chipmakers. The Commerce Department is now insisting suppliers like Lam Research, Applied Materials, and KLA Corp. apply the same treatment so that Chinese companies will be limited to using 14nm and older process technologies.

Interestingly, the new restrictions will apply to all factories operating in China, which means they would also affect companies like Samsung, SK Hynix, UMC, and TSMC. In the past two weeks, the Biden administration has sent letters to all US-based suppliers telling them not to supply equipment for 14nm and newer process nodes due to national security concerns. This mandate lends credibility to a report that White House officials had also instructed Intel to cancel its plans for a wafer manufacturing facility in Chengdu, China.

Last week, the US Senate passed the $52 billion CHIPS Act to boost US-based semiconductor manufacturing. Companies like Intel, TSMC, Samsung, and Micron are all interested in taking advantage of it. Unsurprisingly, accessing those funds will be next to impossible for firms currently operating in China and other unfriendly countries and those that plan to do so in the future.

Despite the mounting restrictions, China seems determined to make progress at all costs. The country has repeatedly poached engineering talent from Taiwan, creating yet another source of tensions in the region. Not only that, but China's SMIC has seemingly figured out how to make 7nm chips, likely by closely copying TSMC's first generation 7nm process technology.

Of course, those 7nm chips were found inside a Bitcoin miner by the folks over at Tech Insights, who believe SMIC can't yet produce more advanced logic on a 7nm process. However, China is ready to spend as much as 10 trillion yuan ($1.47 trillion) to achieve technological self-sufficiency, and it's already making progress in terms of its global market share of semiconductor sales.

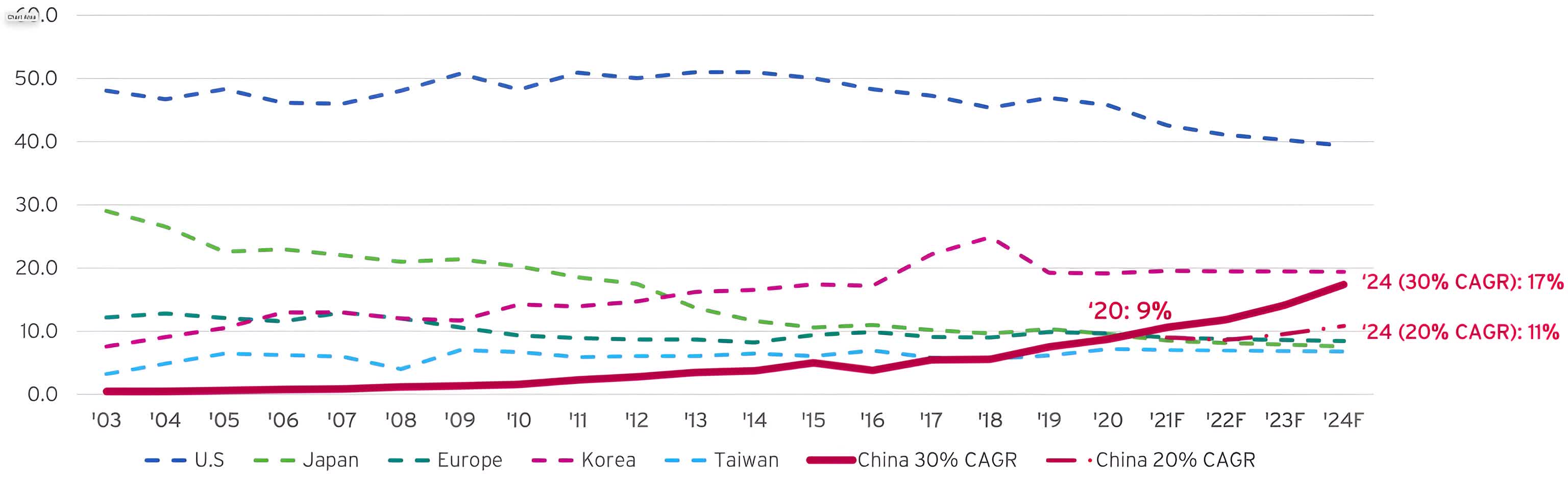

According to the Semiconductor Industry Association, China's global market share has surpassed Taiwan's and is slightly behind Japan's. Assuming the same rate of growth observed in the past two years, it could reach as high as 17 percent by 2024.

Masthead credit: LAM Research