In context: Intel and Arm have been rivals for many years, having fought a bitter battle for supremacy in the mobile market a decade ago. While Intel has since admitted defeat and given up the ghost in the smartphone sector, Arm has been making steady inroads into the server market, thanks to chips developed by companies like Amazon, Qualcomm and Ampere. Now, however, the two rivals have joined forces in a development that could potentially change the dynamics of the entire industry.

Intel and Arm have announced an agreement to develop Arm-based processors using the former's 18A process, which is expected to be manufacturing-ready in the second half of 2024. The collaboration will initially focus on mobile SoC designs before potentially expanding to automotive, Internet of Things (IoT), data center, aerospace and government applications.

In a joint press release, the two companies said that the Arm-based mobile SoCs manufactured by Intel will deliver new transistor technologies for improved power and performance. They further claimed that customers (fabless semiconductor companies) will also benefit from Intel Foundry Services' (IFS) existing manufacturing footprint in the US and the EU.

The agreement with Arm is expected to help Intel broaden its IP portfolio significantly by adding to its existing intellectual property in x86 and RISC-V. The tie-up will also expand the market opportunity for Intel's foundry business and offer a new option for fabless clients like Apple that design their own chips but rely on third parties like TSMC to manufacture them.

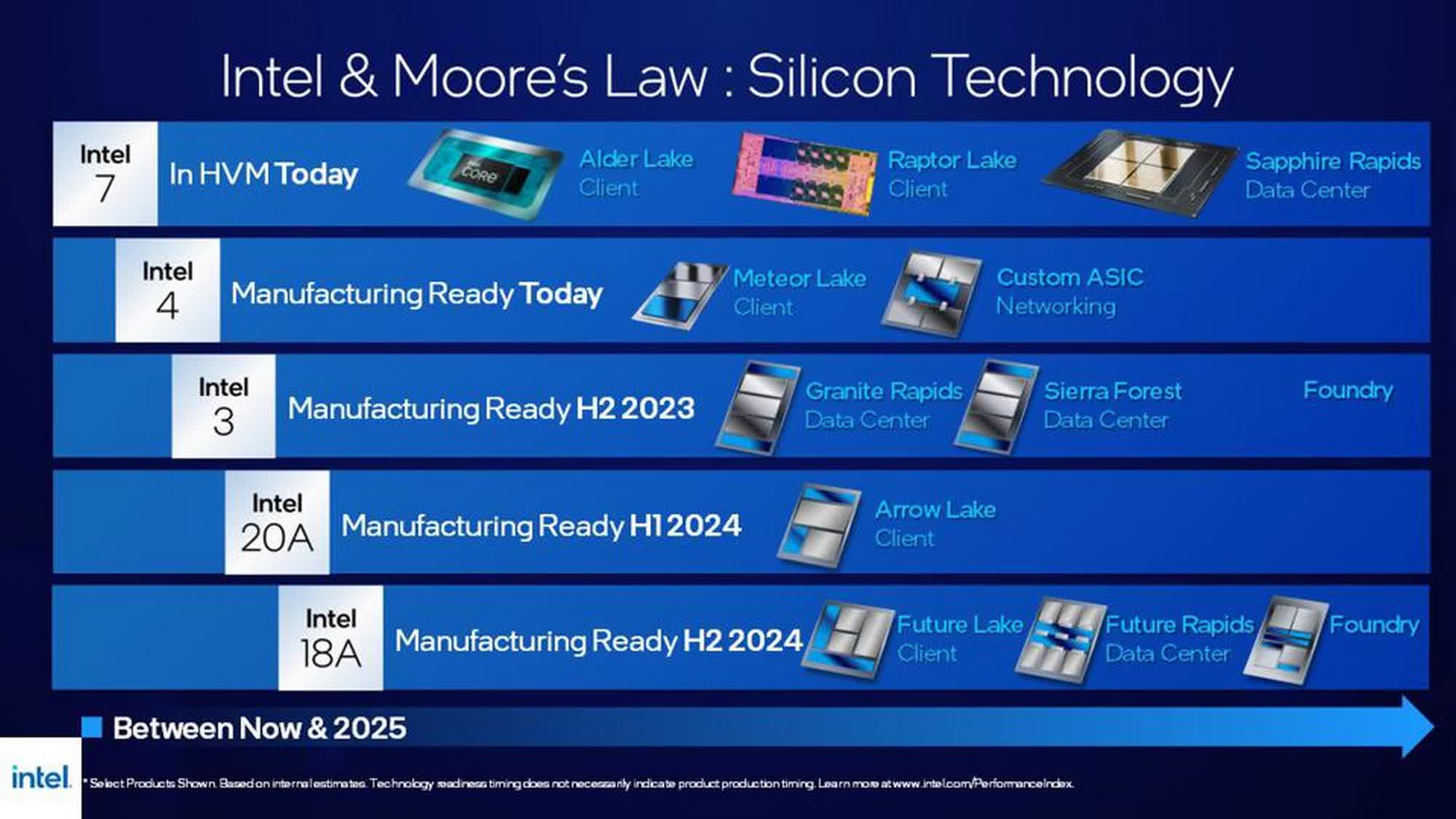

18A is the fifth and most advanced process in Intel's roadmap that includes multiple manufacturing technologies slated to be deployed between 2022 and 2025. The plan starts with Intel 7 (10nm) for Alder Lake, Raptor Lake and Sapphire Rapids, and incorporates Intel 4 (7nm) for the Meteor Lake chips that are expected to debut next year.

That will be succeeded by Intel 3, which will be manufacturing ready in H2 2023, and will be used for the Granite Rapids and Sierra Forest data center chips. The 20A process is expected to be manufacturing ready by H1 2024 for the company's Arrow lake processors, while the 18A is expected to be ready by H2 2024 and used for the Future Lake desktop lineup and Future Rapids data center processors.

Intel has been having a tough time of it in the past few years, having lost market share to AMD in desktops, laptops and servers. The company has also been losing hundreds of millions of dollars in recent quarters, largely due to a sudden drop in demand for PCs amid an uncertain global economy. Intel will be hoping that its relatively new foundry business will be able to stem the tide and help it get back to black in the coming years.