In context: Samsung's semiconductor division made some mistakes in the recent past that prompted companies like Qualcomm and Nvidia to go to TSMC for their chip manufacturing needs. These were Samsung's two largest foundry customers, and the company seems determined to bring them back with its 3nm GAA process technology. With better yields on this new node and TSMC busy making Apple silicon on N3, the Korean giant may be able to attract some new customers, too.

Like Intel, Samsung has been struggling to find customers for its 3nm GAA process node. This can be partly explained by TSMC cutting prices for 3nm FinFET wafers, which were hovering around the $20,000 mark last year. That said, Apple has secured the entire initial supply of N3 wafers, creating an opportunity for TSMC competitors to attract some orders from other big clients like Nvidia, Qualcomm, IBM, MediaTek, and Baidu.

Samsung has been courting these companies to become their supplier for advanced chips using its 3nm GAA process technology. The company started producing 3nm wafers at its Hwaseong facilities last summer, months before rival TSMC. Meanwhile, Intel's Foundry Services division is playing catch up and plans to start mass-producing chips on an Intel 3 node sometime in 2024.

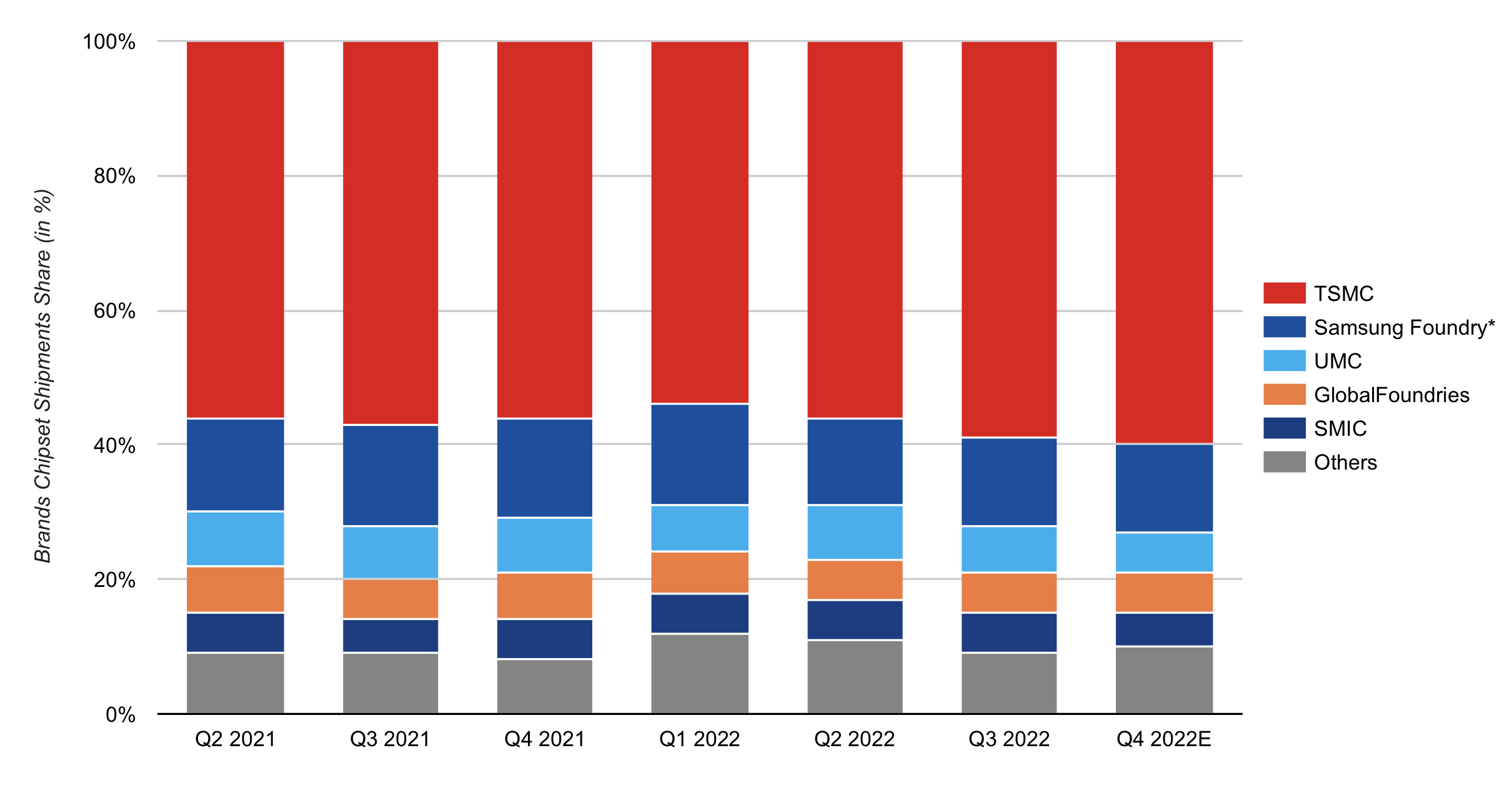

Global foundry market share by revenue | Counterpoint Research

During a recent investor call, the Korean tech giant said it achieved stable yields on 3nm GAA wafers through the first three months of this year, but didn't offer any figures. Local publication FNNews reports the company has achieved yields of around 60 to 70 percent. This represents a significant improvement compared to a year ago when Samsung was only able to achieve yield rates of around 10 to 20 percent.

For reference, TSMC's N3 yields are estimated at around 55 percent, which is why Apple was able to negotiate a price between $16,000 and $17,000 per wafer for A17 and M3 chipsets. The Taiwanese chipmaker believes it can improve yields by five percentage points every quarter, so Samsung must also improve at a similar pace if it wants to draw potential customers to its 3nm GAA process node.

Now read: There is TSMC and there's everybody else, can Samsung or Intel catch up?

Speaking of attracting customers, Samsung Electronics president Kye-Hyun Kyung said during a recent interview that he can't disclose their names, though he noted the list is growing and almost all big companies have shown interest in Samsung's 3nm GAA tech. He also remains confident the company can overtake TSMC and become the world's biggest chipmaker in the next five years.

For now, Samsung's top priority is to revitalize demand for NAND and DRAM chips, as surplus inventory coupled with low overall sales had led to profit diving to a 14-year low in the first quarter of this year. For the long term, the chipmaker plans to build the world's largest chip center, a massive undertaking that will take two decades and no less than $230 billion in capital expenditures to complete.