Something to look forward to: While crypto enthusiasts are no doubt interested to see the effects of Bitcoin's 'halving' slated for later this year, it looks like others are joining the fray. The question on everyone's mind is whether 2020 is the year Bitcoin reaches new heights, and the increase in awareness might well send its price well above the $20,000 mark it reached in 2017... or not.

A lot of people seem interested to see what 2020 will bring for the cryptocurrency industry. Arcane Research points out to how Google searches for related keywords have spiked this month and that might be because on May 20, 2020, the third Bitcoin 'halving' will occur.

That means the rate at which new Bitcoins are generated will decrease by 50 percent of what's been for the past few years. Bitcoin is designed as a deflationary coin that is limited to 21 million units, the last of which will be mined in 2140.

Historically, "halving" events have boosted the price of Bitcoin by an order of magnitude, while cutting rewards for miners that solve "blocks" of transactions. The current block reward is 12.5 BTC and takes place every 10 minutes, but in May it will go down to 6.25 BTC. Consider for a moment the current price of 1 BTC, which is hovering at ~$9,000 -- give or take a few hundred dollars -- as of writing.

If history were to repeat itself, it could send Bitcoin higher than the already crazy peak of almost $20,000 reached in 2017, possibly even as high as $90,000 if you believe some enthusiastic German bankers. If that sounds impossible, it's worth noting that some of the people that bought this token for pennies close to its inception didn't exactly believe it would become so valuable over time, and nowadays even the most pessimistic investor doesn't see it falling below $5,000 for the foreseeable future.

On one hand, you have people like Kraken CEO Jesse Powell, who thinks Bitcoin would still be undervalued even if it reached $100,000. And considering the sudden increase in public awareness, it's not hard to imagine people rushing to buy Bitcoin in the hopes of makings easy returns if it happens to skyrocket over night.

On the other, you have the skeptics that believe the Bitcoin halving may have already been priced in, in which case there isn't much to gain by pouring your life savings into the cryptocurrency. Then there's the hypothesis that investors and companies will mostly trade in derivatives rather than speculate on Bitcoin.

However, there's enough indication out there that newly mined Bitcoins would most likely be absorbed through Square's Bitcoin purchasing service and Grayscale's Bitcoin Trust. Add to that some 30 million Coinbase customers and people using trading apps like eToro and RobinHood, and you have a lot of variables that will affect Bitcoin's value.

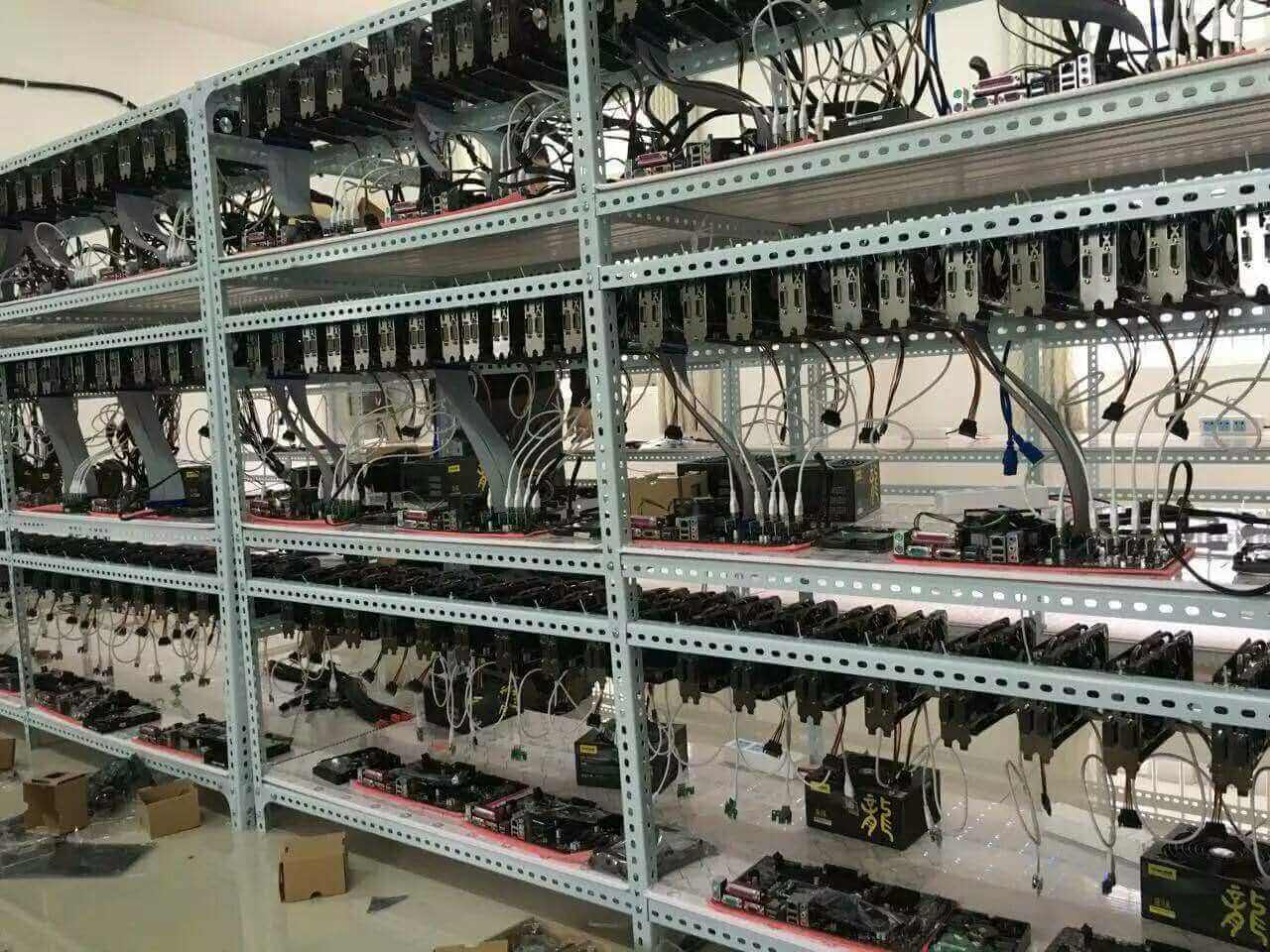

But let's forget the halving for a minute. In the last decade, the best investment you could make was Bitcoin, provided you jumped into the boat relatively early. Some were even able to ride the recent wave of miners that bought each and every capable graphics card on the market hoping to make a profit. Now you'd have to own a large mining operation with specialized equipment somewhere in a cold climate or in places like China where electricity cost is just a few cents per kWh.

Companies like Starbucks and AT&T are slowly adopting Bitcoin as a payment method, while others like Apple might never integrate it into their services. Some would be quick to dismiss it based on how transactions are very slow and not at all energy efficient, but solutions backed by tech executives like Twitter CEO Jack Dorsey are on the way to solve that in the near future.

When that happens, there is a good chance the value of Bitcoin will rise, as it has the potential to offer inexpensive financial services for the 1.2 billion people in places like Africa who can't rely on the banking system.

Governments don't like the idea of highly volatile and speculative assets like Bitcoin, but they are much more open to the idea of currency-pegged "stablecoins." After the 2020 halving, much of the effort that was previously devoted to mining will have to be directed towards greater adoption, so at least there's a low chance we'll see Bitcoin go down in price.

In any case, expect more companies to follow in the footsteps of Facebook to launch their own cryptocurrencies, which is also known to cause surges in Bitcoin's price as soon as an announcement is made. If anything, 2020 might be the year cryptocurrency hits the mainstream and governments start to take it more seriously.

https://www.techspot.com/news/83744-bitcoin-next-halving-may-could-send-currency-new.html