DPennington

Posts: 88 +32

In context: A report by the Washington Post sheds light on the controversial practice by Google and others of using shell companies to negotiate incentives and land purchases for expansion across the US. Google calls this a "common industry practice," but others feel that the public in these communities is being kept in the dark until it's too late to debate Google's presence there.

According to a staggering report by The Washington Post, Google has used shell companies and fake brand names to obtain land and secure huge tax breaks for their expansion efforts across the US.

The report sheds light on how major tech companies, notably Amazon and Google, cut deals with local governments and secure both land and property without disclosing who they are. When the search giant approached the city of Midlothian, Texas, to build a data center there, it operated under a subsidiary called Sharka LLC. Other pseudonyms Google used for development projects included Jet Stream LLC and Questa LLC.

Often, Google forces both its development agencies and city officials to sign non-disclosure agreements that forbid them to announce who is actually behind the deal. This allows Google to secure potentially millions of dollars in tax breaks and other incentives without the public knowing who's moving in. In the case of the Texas data center, Google won $10 million in tax savings over 10 years.

Travis Smith, the editor in chief of the Waxahachie Daily Light, the local paper in Midlothian, sums up the problem with this practice.

“I’m confident that had the community known this project was under the direction of Google, people would have spoken out, but we were never given the chance to speak. We didn’t know that it was Google until after it passed.”

In a statement to the Post, Google defended its methods, calling them "common industry practices."

“We believe public dialogue is vital to the process of building new sites and offices, so we actively engage with community members and elected officials in the places we call home,” Google spokeswoman Katherine Williams said. “In a single year, our data centers created $1.3 billion in economic activity, $750 million in labor income, and 11,000 jobs throughout the United States. Of course, when we enter new communities we use common industry practices and work with municipalities to follow their required procedures.”

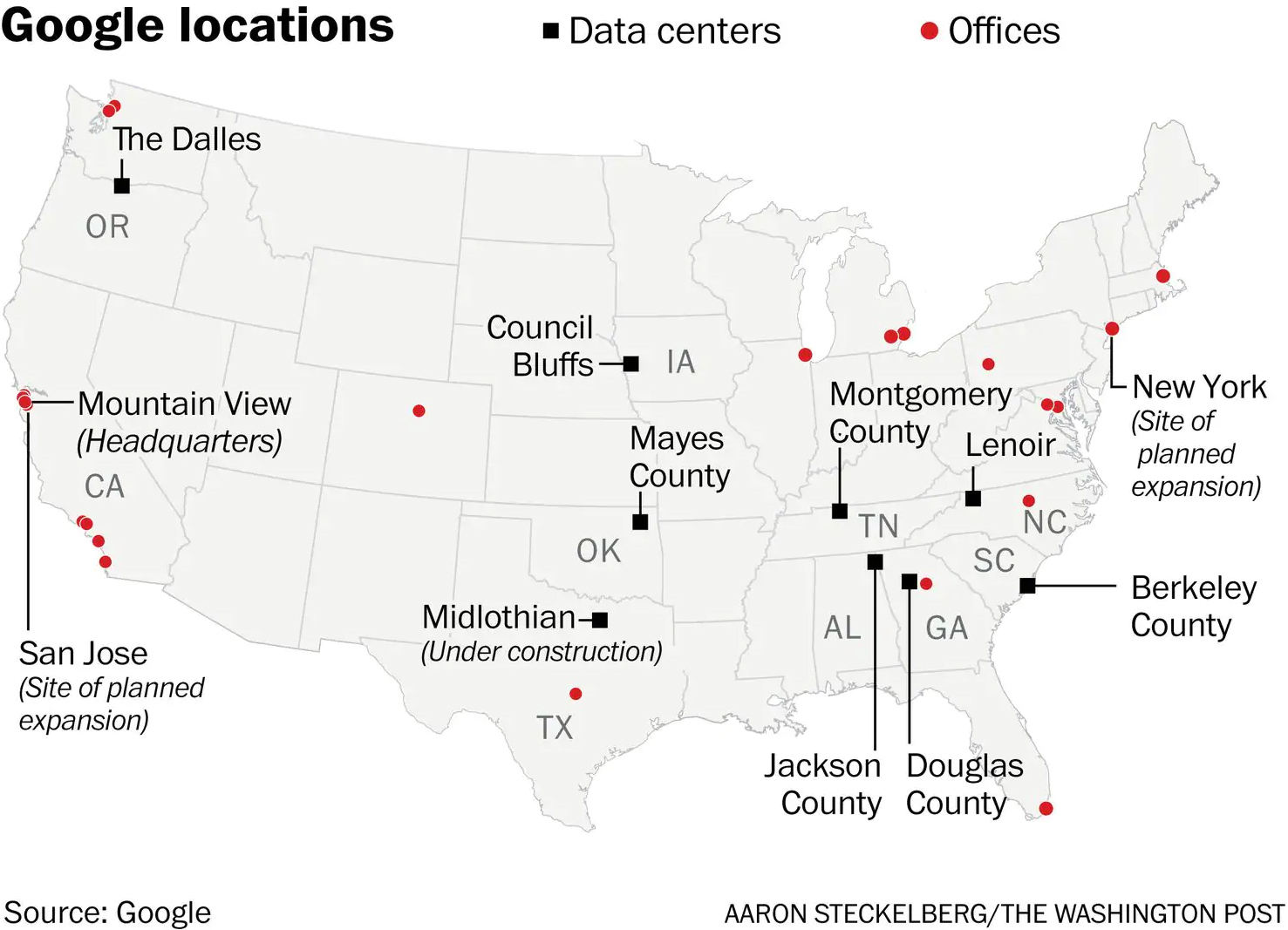

While the report focuses largely on the Texas data center, shell companies were also used to secure incentives and property in Iowa, South Carolina, North Carolina, and Tennessee.

In all of these cases, Google was revealed as the deal maker too late in the process for the public to debate their presence there.

While it's true that these new sites will create jobs, at the center of the debate over this practice is whether or not the public should have more say in the process. If Google, and others, are operating under shell company names, the public is kept in the dark until it's too late to do anything about it.

The Post report comes to light after the recent decision by Amazon to scrap plans for their new HQ in New York City. That project was subject to massive public outcry over tax breaks and incentives given to the company, prompting Amazon to pull the plug.

https://www.techspot.com/news/78809-google-hiding-behind-shell-companies-score-tax-breaks.html