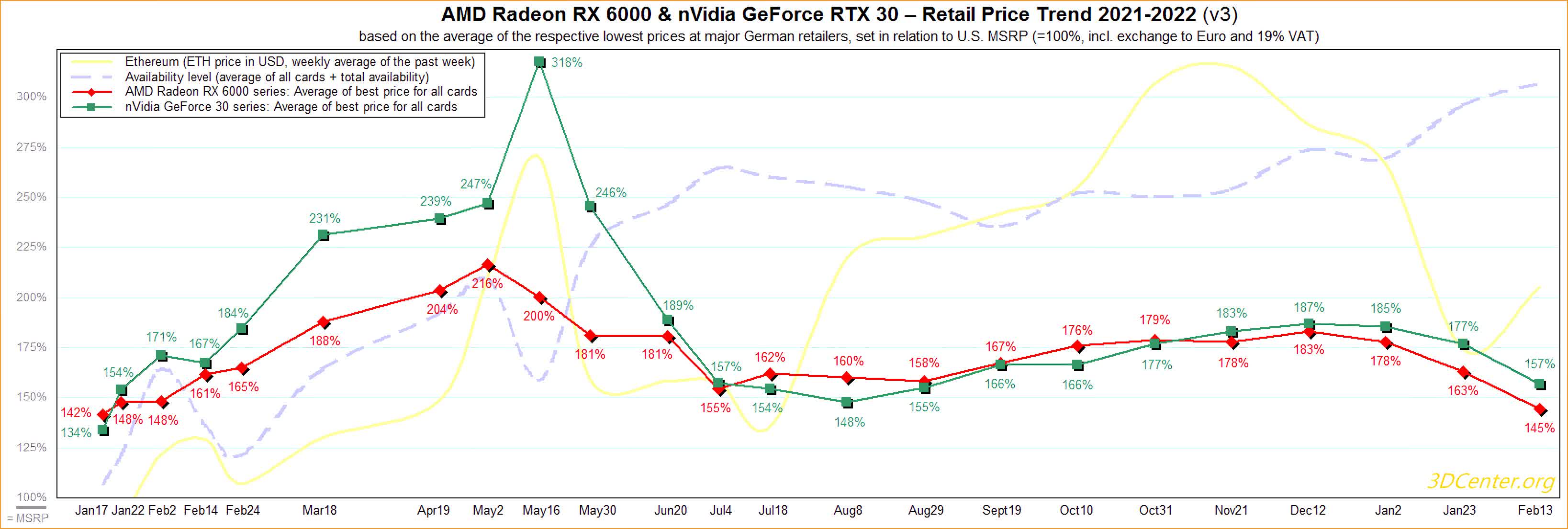

In brief: Prices for graphics cards are dropping again, mostly due to improving retail inventories and lower demand from cryptocurrency miners. The situation is still far from ideal, but there are enough signs to warrant some cautious optimism for gamers.

Last month, a rise in Ethereum mining difficulty coupled with tumbling cryptocurrency values saw GPU prices trend downward for the first time in months. The decline has continued for the last few weeks, but it’s still too early to celebrate a return to sane pricing for consumer graphics cards.

According to the latest report from German publication 3DCenter, we’re clearly in a better spot than January. At least in Central Europe, Nvidia’s GeForce RTX 30 series are priced, on average, at 57 percent over MSRP, a significant improvement over the 77 percent premium observed last month. Retail pricing for AMD’s Radeon RX 6000 series now sits at an average of 45 percent over MSRP, which is even better.

Mid-range and high-end graphics cards are still ridiculously expensive, with the 10-gigabyte RTX 3080 and the RX 6800 being the worst offenders with price tags of 72 percent and 73 percent over MSRP, respectively. Lower-end models like the RX 6600 XT and RX 6500 XT are more reasonably priced, with the latter model found at 17 percent over MSRP.

The RTX 3080 Ti now looks like great value with a markup of “just” 32 percent over its Nvidia-suggested retail price of €1,199. The same can be said of AMD’s RX 6900 XT, which can be found for around €1,400, or 33 percent more than the ideal price.

It’s important to note that availability has been steadily improving over the past few months, particularly at the low-end. Retailers now hold hundreds of graphics cards in stock, which is in stark contrast to the supply conditions we’ve seen throughout 2021.

Nvidia may be looking to make a cheaper RTX 3050 based on a smaller die and smaller VRAM, which could improve things further. AIB partners like Gigabyte, Asus, MSI, and ASRock are expecting an increase in GPU shipments in the coming months, and industry watchers believe the supply chain is gradually recovering from material and component shortages. The main obstacles right now are GPU mining and scalping, both of which are notoriously difficult to solve.