Why it matters: Intel's latest earnings report is the last with Bob Swan at the helm and looks surprisingly positive given the company's recent manufacturing hurdles. Incoming CEO Pat Gelsinger says the company is on track to deliver its first 7 nm chips in 2023 but at the same time acknowledged the need to outsource some of its chip manufacturing while it catches up.

Intel's latest earnings report is in, and it looks like the company made a record $77.9 billion in revenue in 2020, which an 8 percent year-over-year increase compared to its 2019 performance. At the same time, Intel says it generated a profit of $20.9 billion and paid $19.8 billion to shareholders.

For the three months ending in December, the silicon giant posted revenues of $20 billion and net income of $5.9 billion, both of which are lower than the results from Q4 2019. However, it is also a bit above expectations for public investors and certainly better than Intel's prior projections. The company attributed the results to strong PC sales, particularly at the low end, fueled by a rapid transition to working and studying from home.

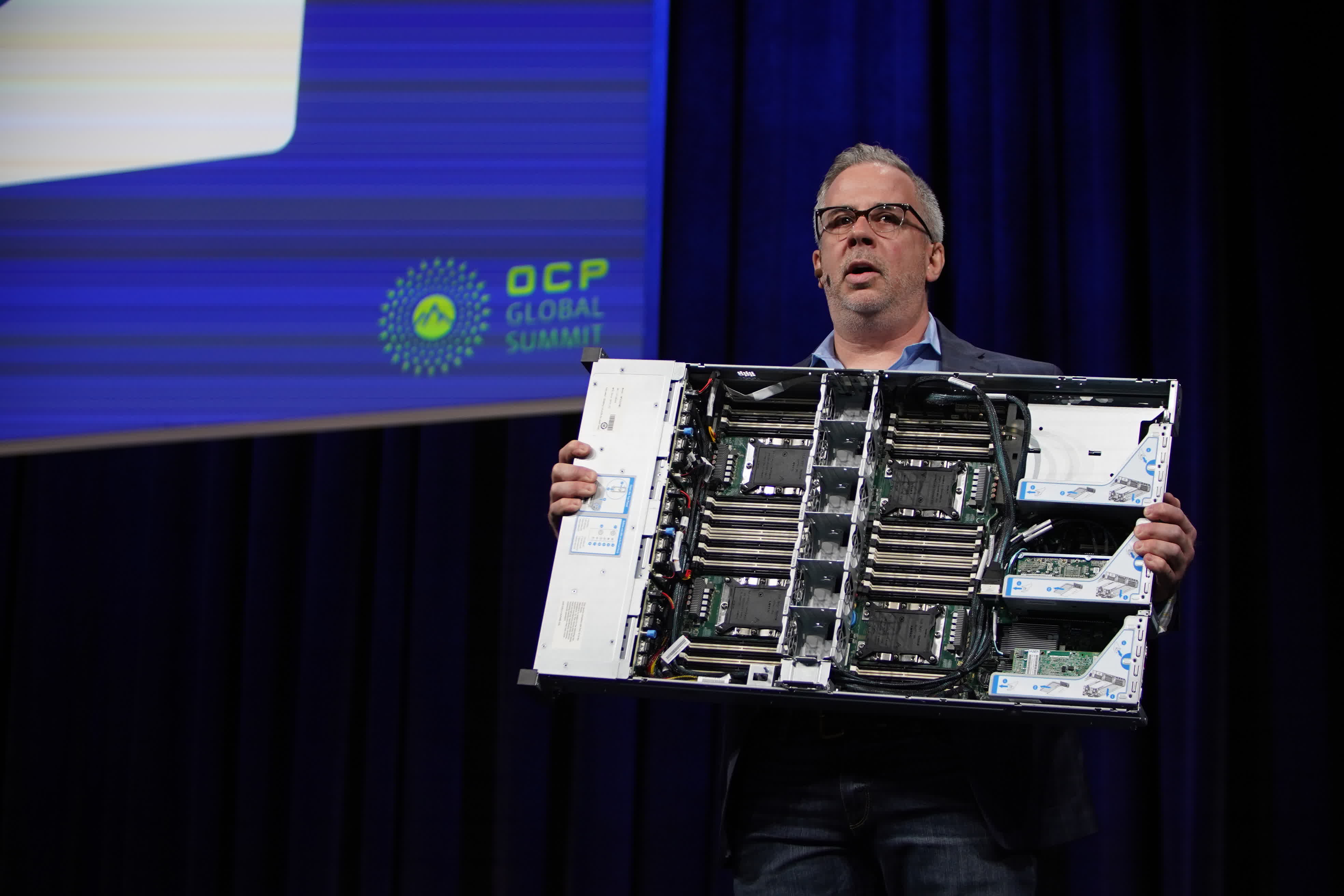

Intel's data center group saw a 16 percent drop in sales compared to Q4 2019, but overall sales for the full 2020 fiscal year were 11 percent higher than the previous year. Interestingly, the company's Mobileye self-driving car division saw 39 percent more sales in Q4 2020 than the same quarter in 2019. And while it's still a relatively small part of Intel, Mobileye is quickly laying the groundwork to become Tesla's biggest competitor.

In a statement during the investor call, incoming CEO Pat Gelsinger said Intel is on track to solve its 7 nm manufacturing woes fast enough to allow mass production of a majority of its portfolio of chips in 2023. Gelsinger also warned that Intel would likely have to outsource some of its chip manufacturing to external foundries. We don't know what models the company will choose to manufacture using external process technology, but this could be a gradual transition that will first involve Core i3 production.

Recently, Gelsinger told senior Intel staff that the company has to "deliver better products than certain lifestyle company in Cupertino." He was referring to Apple, of course, but he has yet to develop a plan on how to make that happen. However, Gelsinger is an Intel veteran who previously spent 30 years at the company in various roles, including CTO.

His return is encouraging other veterans to follow in his footsteps. A notable example is former Intel Senior Fellow Glenn Hinton, who previously worked as the lead architect of the company's Nehalem CPU core project, among other things. He'll be coming back from retirement to help on Intel's upcoming projects, and Gelsinger says we can expect more key people to make a return as he shifts the company's focus back to engineering.

In any case, Gelsinger says the use of external foundries is only meant as a way to close any gaps while the company solves its internal manufacturing issues. The goal is to no only close those holes but also to resume "that position of the unquestioned leader in process technology."

To that end, Intel's incoming chief executive outlines four important principles moving forward. The company will have to design and build better products, leveraging existing partnerships with OEMs. It also must become more agile so that Intel may regain its customers' trust. In the case of Apple, that's too late—the Cupertino company is moving to its own silicon and likely never coming back.

The last two guiding principles have to do with company culture, first by ensuring a renewed focus on engineering innovation and then by establishing a data-driven culture that is more in tune with what its customers needs. Gelsinger will take on his role starting on February 15 and has told investors he'll provide more details about the 2023 roadmap once "I fully assess the analysis that has been done, and the best path forward."

Image credit: Drserg

https://www.techspot.com/news/88379-intel-can-fix-7nm-problems-outsource-manufacturing-external.html