Telecom equipment makers were once giants, today they often seem like afterthoughts. Last month Nokia and Ericsson reported earnings, and investors were not impressed with the stocks going down ~10% in the aftermath.

The fall off in their results is largely cyclical driven by a big slowdown in telecom operators buying 5G gear. The 5G buildout is largely complete in most markets, at least in terms of the big upfront capex spending which drives the equipment vendors' results, but we cannot remember the last time either company reported anything to excite investors. Both companies face a bigger problem.

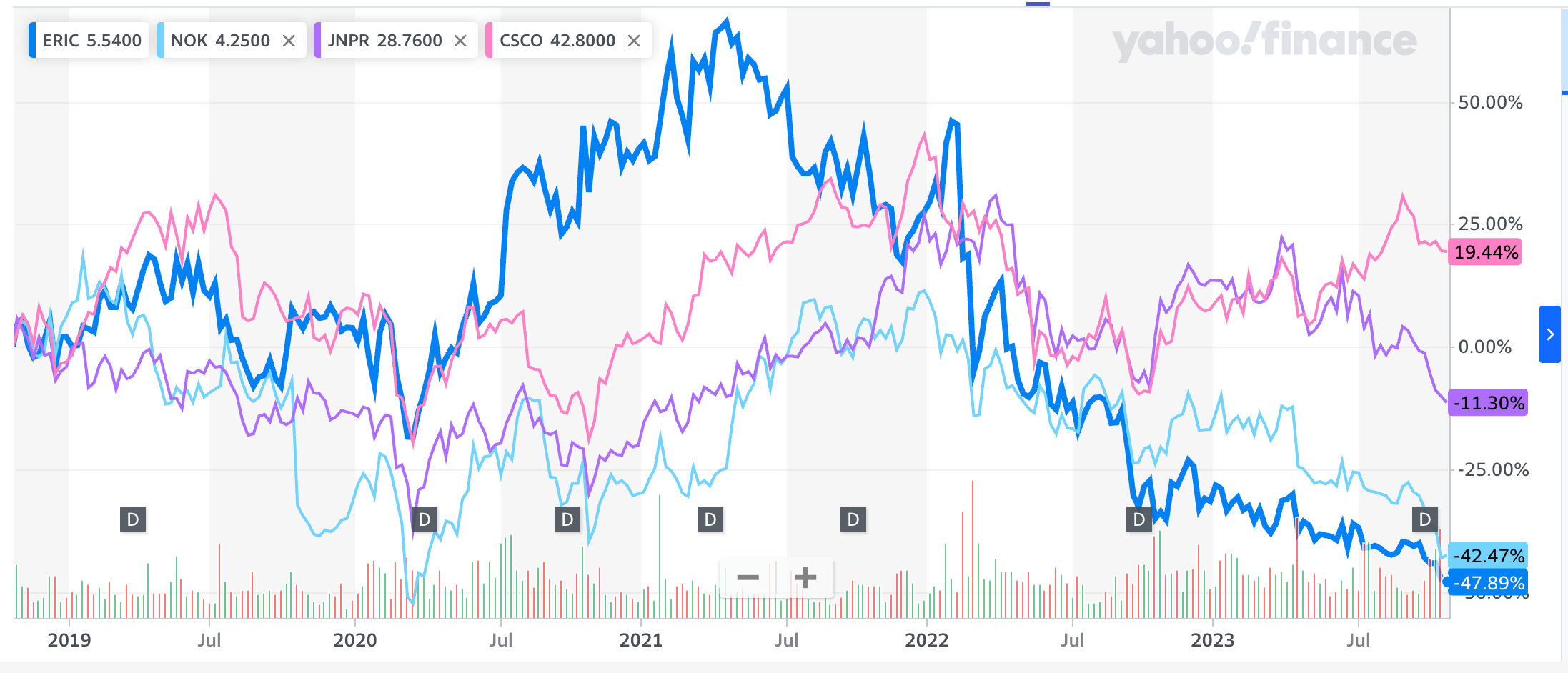

Zoom out to a five year look at their stocks and that problem becomes more apparent.

Ericsson had a bit of a run up in the heat of the pandemic 5G capex spend when operators actually pulled forward investment because the lockdowns allowed them easier access to many sites (i.e. no one in the office to complain about the construction noise on the roof). But other than that brief spurt, both companies have underperformed noticeably.

Editor's Note:

Guest author Jonathan Goldberg is the founder of D2D Advisory, a multi-functional consulting firm. Jonathan has developed growth strategies and alliances for companies in the mobile, networking, gaming, and software industries.

We chose a 5 year time horizon because that coincides with the US restrictions on Huawei, their most formidable competitor. If these companies could not outperform when their largest competitor was on its knees, how capable can they actually be?

Both Nokia and Ericsson face a severe identity crisis. In the 1990's telecom bubble they were a major force in building the internet and then making that internet mobile. But then the internet took over everything, greatly reducing the need for the special-purpose networking gear the companies produce. This trend has worsened as spending on the "cloud" came to dominate technology capex.

Note on the chart above that Cisco and Juniper, with their much more diversified customer bases have fared much better, or at least not as bad. Not shown is Arista, with their deep exposure to data center builds, so their stock performance is literally off the charts.

Put simply, Ericsson and Nokia make equipment for a very special set of customers, the mobile operators, and while those customers still need what the companies offer, pretty much no one else does. Both companies have tried strategies to diversify this – partnering with the internet giants, partnering with Cisco, partnering with integrators to go after the enterprise, building their own clouds, helping others build clouds, and a few more.

Some of these strategies were just poorly thought out or implemented – see Ericsson's recent write down of its $6.2 billion acquisition of Vonage. Other strategies never had a chance to be proven out, abandoned after a change in management which happened enough at both companies to induce vertigo among partners and customers.

At this stage, there are no easy solutions. The market is so concentrated between the two of them (even with Huawei now seemingly waking up) that a merger between the two would be blocked by regulators. Investors at both firms will be reluctant to sign on to some new strategy after so many others have been tried.

True believers in the cult of shareholder value would argue that the companies should just buckle down and focus solely on their core competencies in mobile gear. This is probably the least bad idea out there. It comes with the drawback that both companies will essentially give up on growth until 6G which is many years away.

Prune everything not directly related to serving telecom operators, take those savings and invest on R&D around telecom software, further entrenching on the service side, improve their licensing (both of software and IP). Taken all together, with a healthy dose of concentrated execution, and this might at least allow the companies to someday contemplate a return to growth. The benefit of this approach is that we have seen it already – this is essentially what Cisco has become – a software and service company built on top of hardware. This is not an easy path, but it is achievable and looks better than any other alliterative.

Global telecom revenue comparisons

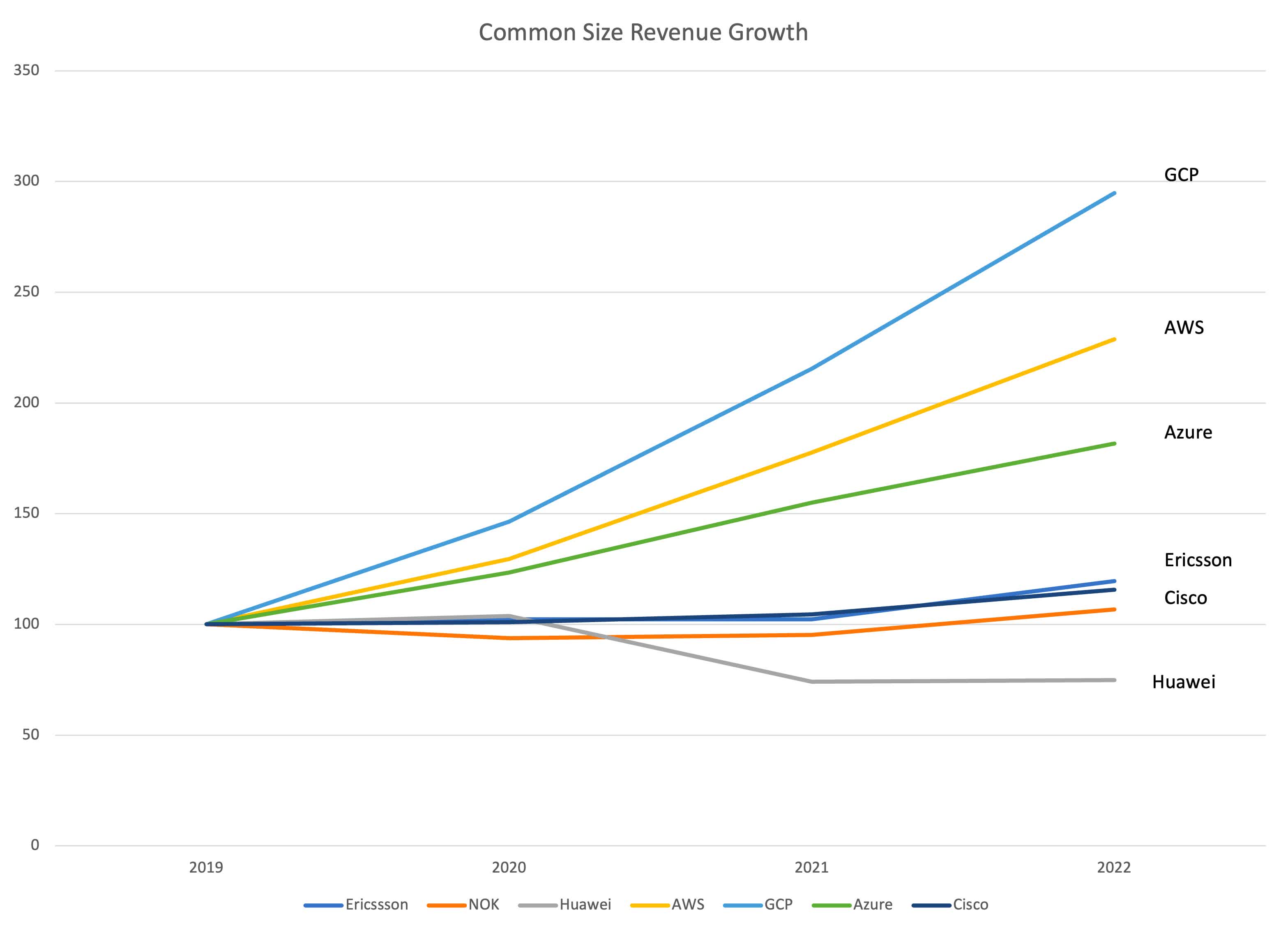

So how does this plays out in the company's financials? Here's a comparison in revenue growth for the global telecom equipment makers and the cloud service providers.

Sometimes unfair apples-to-oranges comparisons are the most telling.

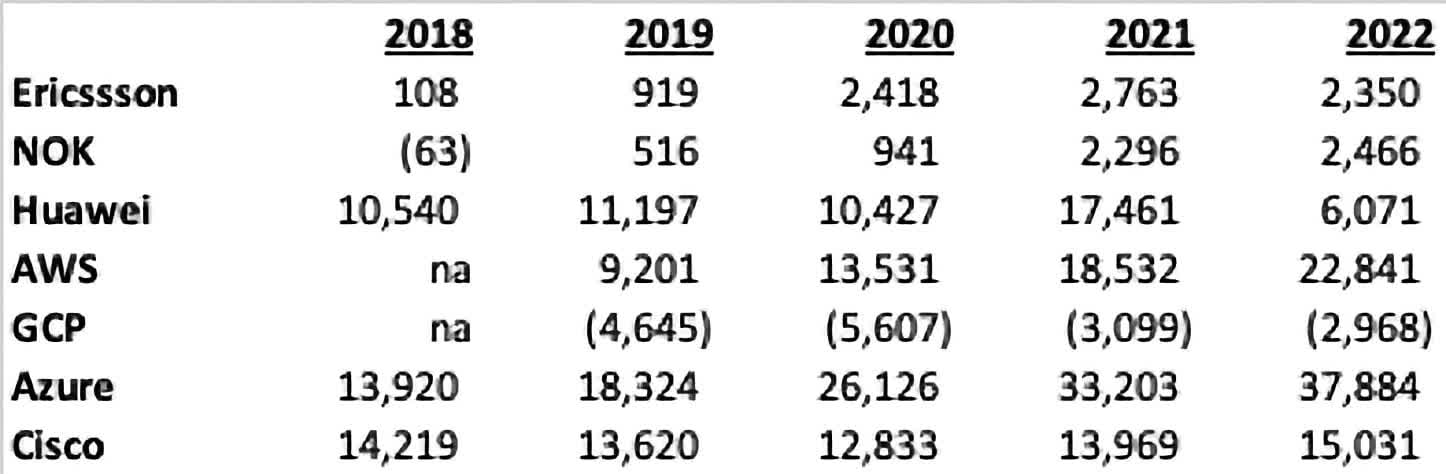

Below are the revenue figures Nokia and Ericsson, set in comparison to peers Huawei and Cisco, as well as the the three leading cloud service providers – Amazon AWS, Microsoft Azure and Google Cloud (USD, millions).

A few notes on these numbers. Amazon and Google do not break out cloud revenue prior to 2019, and Azure only goes back to 2018. Ericsson, Huawei and Nokia report results in other currencies (Swedish Krona, Euros and Renminbi, respectively). We used the most recent exchange rates for all three, and for Nokia and Ericsson there is probably some difference.

Huawei is total revenue, including handsets, but obviously their numbers reflect the downturn after the US government cracked down on their operations. All numbers were sourced from company annual reports.

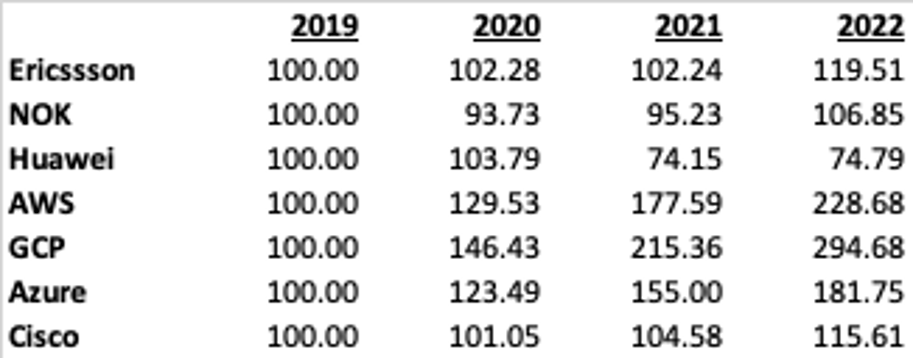

Raw numbers can only tell us so much. Since we are interested in these companies' respective revenue growth, we prepared the chart below showing common size growth with 2019 = 100 as the base.

And here is the data behind the pretty pictures.

Seen in this light, the trend is fairly clear. The cloud service providers are seeing strong growth, The telecom equipment vendors are not. Note that this series covers the period when 5G deployments were running full tilt, including the very strong pandemic years. Those years are now over, with both Ericsson and Nokia reporting year on year declines in their latest quarterly revenue.

So even with that massive 5G tailwind, neither company grew much. It is also worth noting that even as Huawei was forced out of many markets, neither Ericsson nor Nokia picked up much share. True, their 2022 revenue was up a bit, but that goes back to the 5G surge and Huawei's decline seemed to have bottomed out in 2022.

Last but not least, let's take a look at the companies' profitability. The same caveats as above apply. We do not have data before 2020 for GCP and AWS. Importantly, Microsoft does not break out Azure directly, it only reports "Intelligent Cloud" which includes a lot of other products. Intriguingly, Cisco is among the most profitable of the group reflecting their long transition from technology growth company to Oracle-like software and licensing company.

Some will argue that comparing these companies with the cloud service providers is an apples to oranges look. Which is fair enough, we are talking about very different businesses here. That being said, the cloud service providers are building infrastructure for global data networks, which is theoretically what Nokia and Ericsson's equipment is used for as well.

All of this to say that Nokia and Ericsson look to be increasingly positioned as afterthoughts in the market to build out global telecommunications systems.