Bottom line: Big Tech companies including Amazon, Google, and Microsoft have poured significantly more money into generative AI startups than traditional venture capital firms in 2023. VC firms historically have had to follow the tech industry closely and be ready to strike early. That's still true today, but now they are having to compete with tech titans that have more than just deep pockets to attract startups.

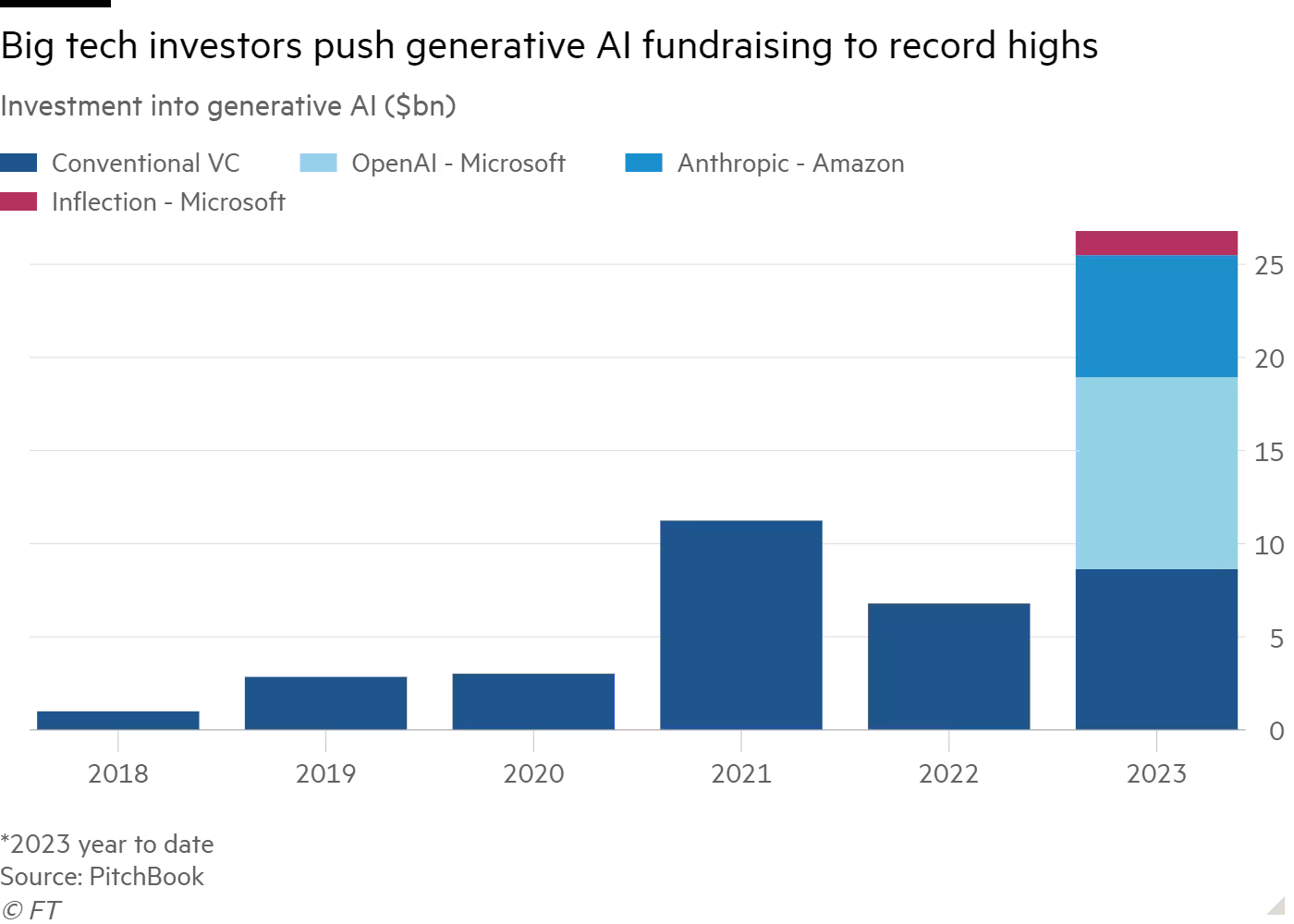

As Ars Technica highlights, venture investing in technology reached a record high in 2021 thanks in part to historically low interest rates. Tech investing cooled a bit in 2022 but soared this year thanks to Big Tech's involvement.

In January, Microsoft announced a "multibillion-dollar" investment in OpenAI, the firm behind ChatGPT and DALL-E. A few months later, Redmond pumped cash into Inflection AI alongside Nvidia. Amazon in September said it was investing $4 billion into OpenAI competitor Anthropic, and Google came in with another $2 billion the following month.

Big Tech also has an ace up its sleeve that traditional VC firms can't match. In addition to buckets of cash, companies like Amazon, Google, and Microsoft can provide startups with cloud infrastructure and access to powerful hardware that can be used to help train AI.

Big Tech's deep pockets have also inflated the valuations of private startups, making it even more difficult for VCs to get meaningfully involved.

Patrick Murphy, a founding partner at early stage venture capital firm Tapestry VC, said most of the potentially one in a million AI companies appear so far to have been captured by Big Tech incumbents already.

Despite all of this, traditional firms are still finding inroads. New York-based Thrive Capital is leading OpenAI's employee stock sale, and Mistral AI out of Paris has taken money from several traditional VC firms including Andreessen Horowitz and General Catalyst.

AI is forecasted by many to be the next big thing and should it pan out as some expect, it could revolutionize how we interact with technology.

Image credit: Markus Winkler