In context: Solid-state drive buyers could be in for a rough ride as client SSD prices are expected to see a double-digit rise in Q2, following a substantial increase in the first quarter. While the price hike in the first three months of this year has already impacted consumers by adding significant costs to their PC builds, things are only expected to get worse.

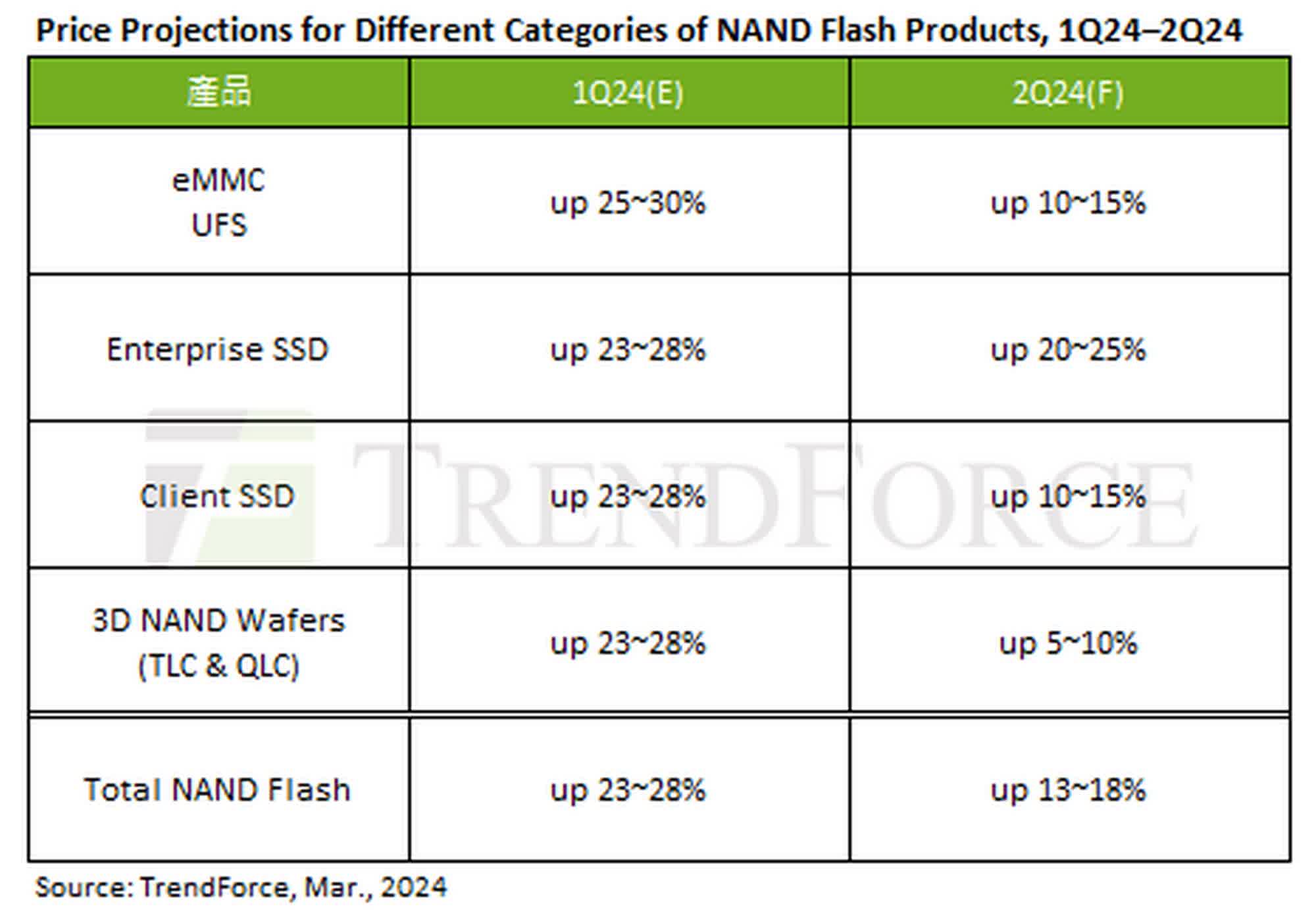

According to a report from IT market analysis firm TrendForce, client SSD prices increased 23-28 percent in Q1 and are projected to go up a further 10-15 percent in the current quarter despite subdued demand in the retail market.

The report, which claims NAND Flash contract prices could increase 13-18 percent in Q2, 2024, also provides a comparative analysis of price trends for several different NAND flash products, including mobile NAND (eMMC and UFS), client and enterprise SSDs, and 3D NAND flash wafers (TLC and QLC).

Also read: Bad News, SSDs Are Getting More Expensive

It is worth noting here that enterprise SSD prices surged significantly last year, with the fourth quarter alone seeing a 15 percent increase. The upward trend in pricing continued in Q1, 2024, with prices increasing by a further 23-28 percent in keeping with client SSDs. This quarter, enterprise SSD prices are tipped to jump further 20-25 percent, fueled by heavy demand from CSPs in North America and China.

In sharp contrast to the enterprise SSD market, client SSDs are reportedly seeing "a more cautious buying strategy," with some PC OEMs said to be reducing their 2Q24 orders. The substantial price increases will likely further encourage vendors to cut their orders in the second half of the year. Despite the cautiousness in the market, NAND Flash wafer contract prices are expected to continue to rise thanks to manufacturers that are "keen on reaching profit targets quickly."

In the mobile NAND segment, eMMC demand is predominantly driven by Chinese smartphone brands, while the UFS market is upbeat due to increasing demand in India and Southeast Asia. This is expected to increase both eMMC and UFS contract prices by 10-15 percent in Q2, 2024.