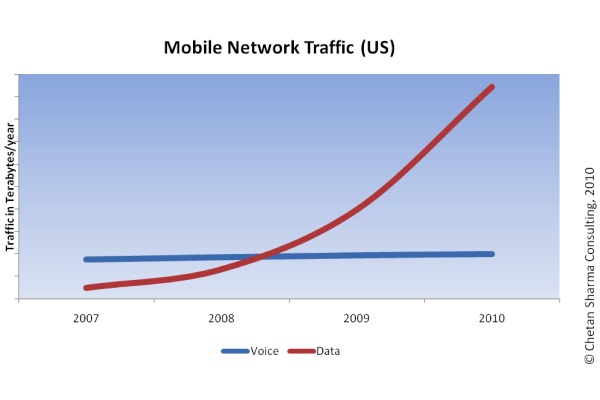

We all know that US mobile data usage is skyrocketing, but the latest numbers from Chetan Sharma, an analyst who tracks the wireless-data industry, are staggering. The data market grew 25 percent year over year, and brought in $14 billion in service revenue in the last quarter (Q3 2010) alone. The mobile data revenues for the US market are likely to reach $55 billion in 2010. Between Q2 and Q3, connected devices grew 12 percent. Within five years, their revenue is expected to exceed the entire prepaid market.

Here are some other interesting figures from the report:

- Verizon and AT&T accounted for 85 percent of the increase in data revenues in Q3 2010.

- T-Mobile's 3G drive is starting to pay off: while the postpaid net-adds were still in the red, its data growth is starting to match its peers.

- AT&T and Verizon now account for 70 percent of the market data services revenues and 62 percent of the subscription base.

- Overall, Verizon and AT&T are tied in terms of total connected devices on the network though AT&T has a much more diverse revenue base.

- Sprint extended its streak of positive net-adds to two quarters by adding over 600 subscriptions while T-Mobile reversed its customer losing streak thanks to the growth in the prepaid and connected devices segments.

- The national prepaid penetration is hitting 20 percent.

- Non-messaging services continues to grab 60 to 65 percent of the data revenues for the US carriers.

- The usage and data consumption trends are enabling carriers to accelerate their 3.5G/4G plans and develop long-term business and technical strategies.

As you can see above, data traffic is now significantly more than voice traffic. By the end of 2010, Chetan Sharma expects the average US consumer will have consumed approximately 325MB/month (up 112 percent in the last year). This puts US second only to Sweden in per capita mobile data consumption. While the US lags Japan and Korea in 3G penetration by a distance, due to higher penetration of smartphones and datacards, it has a much higher consumption than its Asian counterparts. The fact that the US becoming the largest deployment base for HSPA+ and LTE also helps as the latest research for data management and experimentation with policy, regulations, strategy, and business models is taking place on the networks of US operators.