The increasing popularity of iOS (iPhone, iPod touch, and iPad) and Android games continue to increase their US video game market share. The magnitude of disruption is increasing, particularly in the portable gaming category, according to new data from mobile analytics firm Flurry.

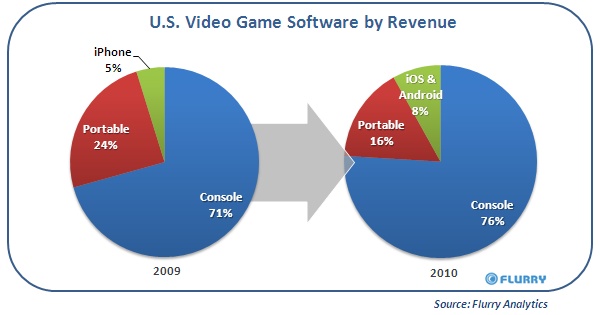

From 2009 to 2010, iOS and Android game sales increased from 5 percent to 8 percent market share within the US video game market. Specifically, Flurry estimates that iOS and Android game revenue increased from $500 million in 2009 to more than $800 million in 2010. The significant majority of revenue was generated by iPhone games. While the company does not include retail PC game revenue in its total snapshot, which it estimates at $700 million in 2010, it's worth noting that smartphone and tablet game revenue surpassed the US PC game category for the first time in 2010.

It's clear that console, smartphone, and tablet games have increased share at the expense of portable gaming. Overall, total US game revenue barely budged from 2009 to 2010: totaling $10.4 billion and $10.7 billion, respectively. While console game revenue increased slightly, from about $7.4 billion in 2009 to $7.8 billion in 2010, it appears that Android and iOS are squeezing the portable game category with their low-priced games and seamless digital distribution so near to consumers 24-hours-a-day.

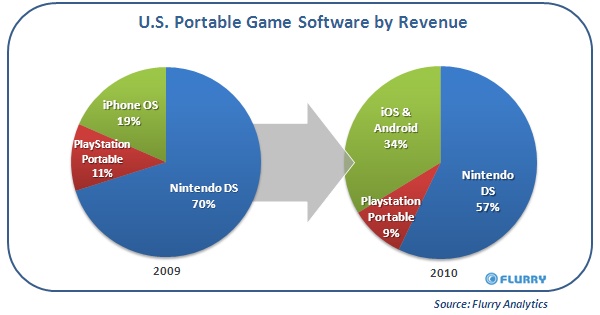

If we ignore console numbers, the picture looks even bleaker for Nintendo and Sony. From 2009 to 2010, iOS and Android game sales have spiked significantly, resulting in nearly a doubling of their market share. With both Nintendo DS and Sony PlayStation Portable shrinking in sales, while smartphone/tablet game sales simultaneously grew by more than 60 percent, iOS and Android games now represent more than one third of the portable game category. The net effect is that the US portable gaming category has declined from $2.7 billion in 2009 to roughly $2.4 billion in 2010.

Flurry combines publicly available market data in the news with its own estimates of game category revenues from iOS and Android devices. Flurry Analytics, the company's mobile application analytics service, tracks more than 12 billion anonymous, aggregated use sessions per month across more than 80,000 apps. Of this, nearly 40 percent of all consumer app sessions are spent on games.

"Over 2011, we expect to see continued and significant smart-device game growth fueled by the recent launch of iPad 2, iPhone coming into distribution on Verizon, the expected release of iPhone 5, a relentless expansion of Android devices by leading OEMs across all major U.S. carriers, and Google's enablement of in-app purchase billing, a proven key driver in iOS game revenue," a Flurry spokesperson said in a statement. "Mario may indeed be standing on a burning platform." That's in reference to Nokia CEO's memo from earlier this year, suggesting that Nintendo and Sony may have a similar problem.