The big picture: After missing predicted targets in their most recent quarterly reports, both Facebook and Netflix saw shares tumble. But it's not the same story for Amazon. While the online retail giant's revenue was slightly below earning estimates, profit was double expectations, pushing Jeff Bezos's firm ever closer to becoming the first $1 trillion company.

Again, it was Amazon's cloud computing arm and advertising business that helped it to yet another strong quarter. Earnings per share were $5.07, smashing analysts' estimations of $2.50. That meant quarterly profit was a record $2.5 billion, marking an incredible 1286 percent YoY increase---Amazon's profit was 'only' $197 million in Q2 2017.

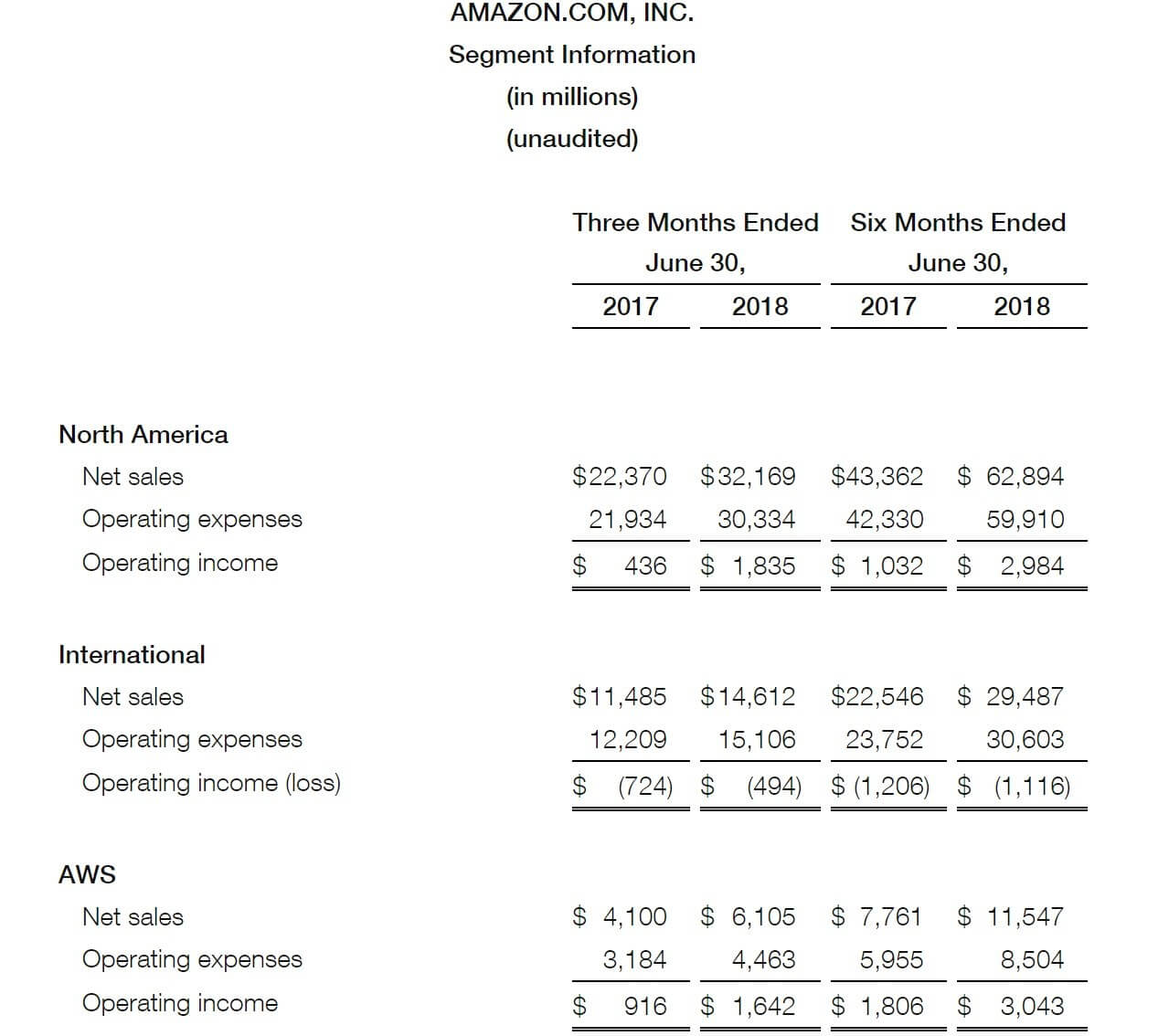

Revenue grew 39 percent YoY to $52.89 billion, which was slightly lower than the expected $53.41 billion. Amazon Web Services sales hit $6 billion, marking a yearly growth rate of almost 50 percent, while the segment's profit was $1.64 billion.

North American sales were up 44 percent year-over-year to $32.17 billion, with operating income at $1.84 billion. Internationally, sales were up 27 percent to $14.6 billion, while net loss fell from $724 million to $494 million.

Despite increasing subscription costs, Amazon Prime subscription revenues grew 57 percent to $3.4 billion.

Amazon shares were up 4.4 percent in after-hours trading. The firm is getting ever closer to beating Apple and Alphabet to become the world's first trillion-dollar company. It's a stark contrast to Facebook, which saw its stock drop 24 percent yesterday on the back of slow user growth and missed targets, while Netflix shares fell 14 percent after missing subscriber expectations.

Amazon mentioned in the report the success of its recent Prime Day. the company's biggest global shopping event ever saw members purchase 100 million products, with the best-selling items worldwide being the Fire TV Stick with Alexa Voice Remote and Echo Dot. The success was even more remarkable considering the slew of technical problems it faced at the start of the day.