Forward-looking: Samsung has decided to bolster its Chinese NAND production by committing an additional $8 billion on top of earlier investments. This comes in spite of increased pressure from competing local companies that are able to undercut its products. With a predicted increase in demand for 5G phones, Samsung is anticipating this while trying to keep memory prices low and make it harder for others to steal market share.

Samsung lost the title of world's largest chip maker to Intel this year, but that doesn't mean it isn't fighting to take it back as soon as possible. According to a Chinese media report spotted by Reuters, the company is pumping an $8 billion investment into its chip factory in the region.

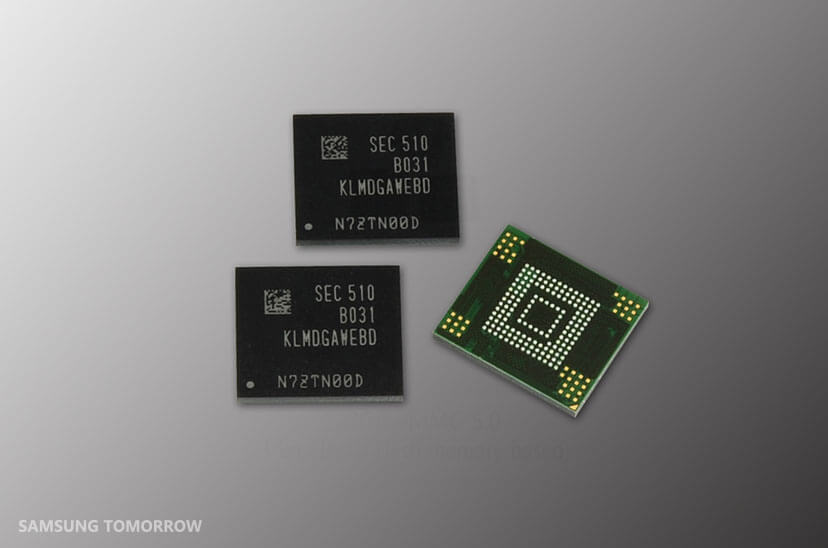

The move is supposed to help boost production of NAND flash memory and flood the market just in time for the predicted increase in demand for 2020. A big chunk of that demand will be due to an increase in the availability of 5G smartphones. According to market researchers, Samsung currently owns three quarters of that emerging market and is looking to strengthen that position in the coming years.

Interestingly, Samsung is making a bet in the memory space despite falling profits of 56 percent year-over year. Most of that loss is attributed to weak demand for its chips, which has been quite beneficial for consumers, as memory prices have been on a rapid decline.

The $8 billion investment to boost production might not make sense in that context, but the predicted surge in demand has already slowed down the decline in prices. By increasing the supply of memory chips, Samsung is looking to avoid supply issues, which could send prices back up and open the window for its rivals like Micron and SK Hynix to secure larger contracts and claw away market share.

The move will also appease the Chinese government, which has been involved in a trade war with the US. Samsung has already poured an estimated $18 billion in its Xi'an facility, which was previously used mainly for testing and packaging of NAND products.

At the same time, Samsung has been closing some of its other Chinese factories to shift smartphone production to India and Vietnam. The company is selling off its HDI printed circuit board manufacturing facility in Jiangsu, and earlier this year it closed its phone assembly facility in Huizhou, which is now effectively a ghost town.