In brief: Intel's new 5G strategy involves a combination of server chips, ASICs, and base station SoCs that are needed to power the growing 5G infrastructure around the world. After losing the consumer side of things to Qualcomm, the silicon giant is instead focusing on what it sees as a "$25 billion silicon opportunity by 2023."

Intel finalized the sale of its modem business to Apple in December 2019, which to many signaled a significant retreat from that market. Couple that with the news that the silicon giant is partnering with MediaTek to bring 5G connectivity to laptops using its mobile chips, and you have a clear image that Intel has essentially left the consumer modem space to its main competitors.

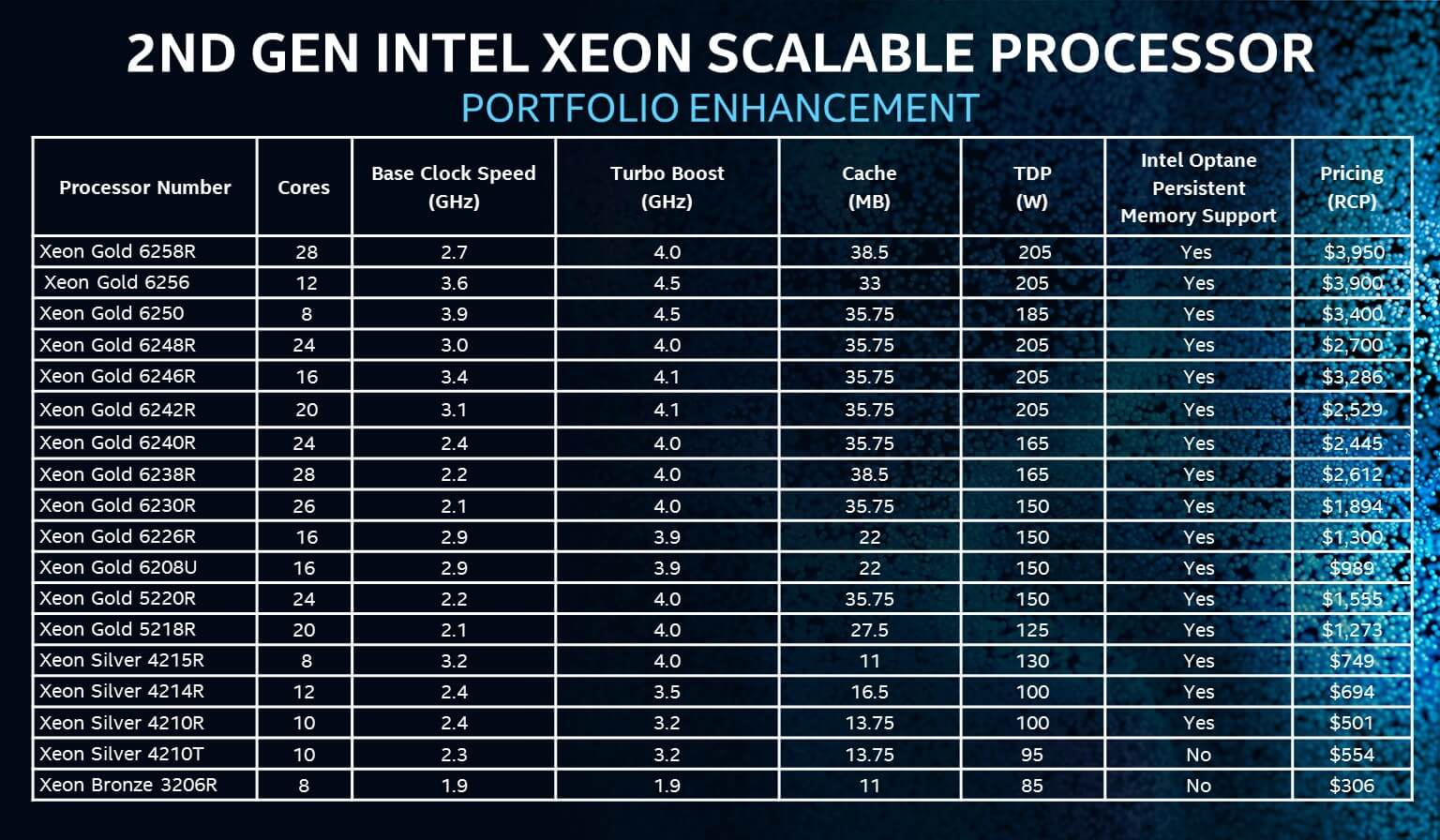

That's not to say the company has completely given up the challenge. Today, Intel announced three chips for 5G deployments, which are geared towards enterprise customers. The first is the second generation Xeon Scalable processor, which is 1.36 times faster on average when compared to its predecessor and can go up to 3.9 GHz or 4.5 GHz depending on the model. It is also 1.42x cheaper on average in exchange for being limited to dual-socketed servers, likely in an effort to make it much more competitive with AMD's EPYC Rome lineup.

There is now support for 2TB of memory per Xeon chip, and the new price matrix was designed to encourage customers to spend more on Intel's Optane DC Persistent Memory DIMMs.

Intel says the first generation sold 30 million units to the likes of Amazon, Microsoft, and Alibaba - so it wanted to give companies that deploy 5G infrastructure the beefy hardware they need for data-driven services, since one of the main benefits of 5G is reduced latency. The 2nd Gen Intel Xeon Scalable is also geared to take on IoT and AI workloads thanks to something called Deep Learning Boost, and Intel claims it has a 600 percent speed advantage here when compared to the competition.

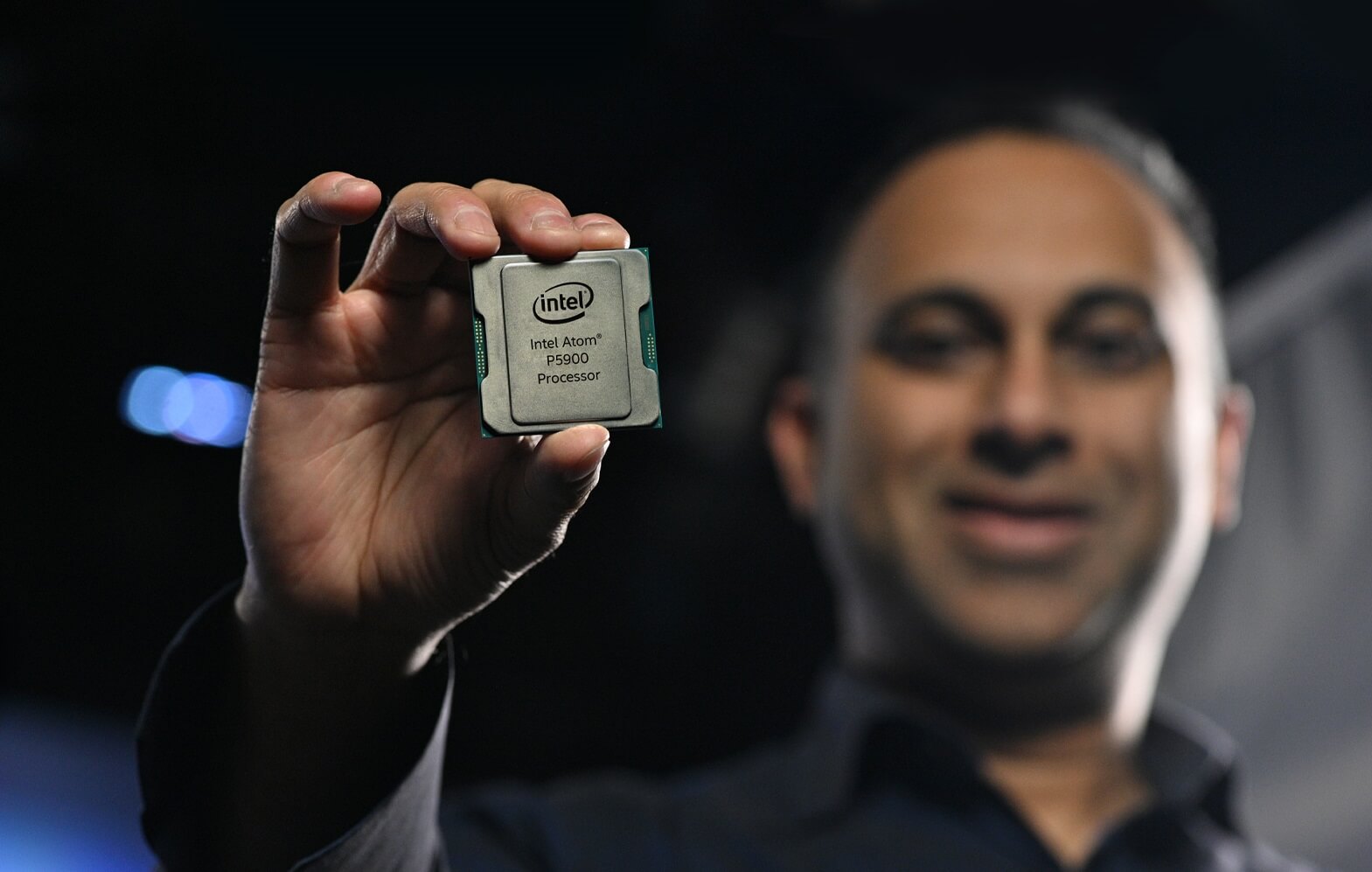

The second chip announced is the Intel Atom P5900, which is the company's first 10 nm SoC designed for use in wireless base stations. Intel says the new chip is capable of delivering 100 Gigabit worth of bandwidth to radio access networks and hardware-based load balancing. The company expects to dominate this market segment by 2021 and well into 2024, when six million 5G base stations are estimated to ship to various customers like Ericsson, ZTE, and Nokia.

The third announcement is a 5G ASIC called Diamond Mesa. The company describes it as the "first next-generation structured ASIC for 5G network acceleration," designed to complement its existing FPGA-based solutions. Diamond Mesa is supposed to deliver two times the performance per watt for workloads that don't require the flexibility of FPGAs, such as military and industrial applications.

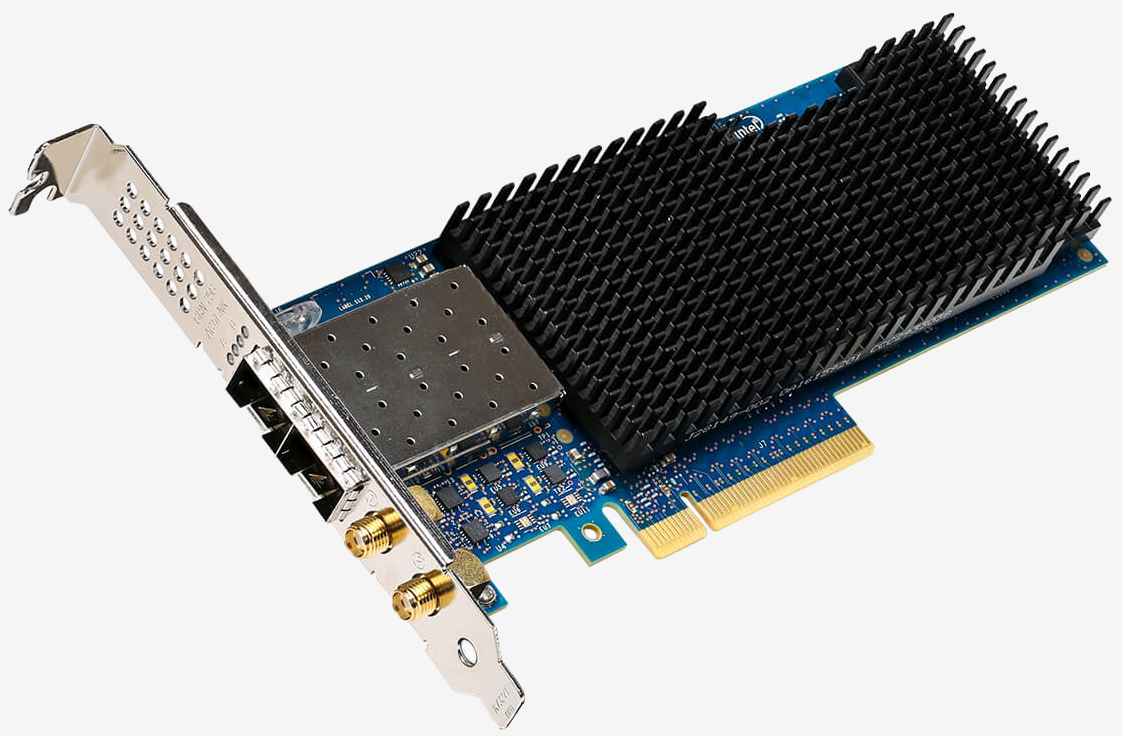

Lastly, Intel also introduced the Ethernet 700 Series Network Adapter which is optimized for 5G and able to maintain GPS-based time synchronization across networks, which is ideal for financial services, video-on-demand, and emergency alert systems.

Overall, it looks like Intel conceded the consumer side of 5G to others so that it can focus on the infrastructure needs of the companies that will ultimately deliver the new tech to the masses. The silicon giant may be upset about selling its modem business to Apple at a multi-billion dollar loss, but it is now in a strong position to capitalize on the transition of carriers to a new network architecture.