Why it matters: After a gangbuster performance on the stock market for the last several years, AMD, CEO Dr. Lisa Su, and its executive leadership team have been under the glare of a lot of media attention recently. Despite the apparent pressure, however, the company keeps coming out swinging and the announcements from last week's Financial Analyst Day indicate that AMD is showing no signs of letting up.

In fact, the key takeaway from the event was that the company leadership---and apparently many of the financial analysts who attended---now have even more confidence in the business' future. The company was even willing to reiterate its guidance for the first quarter, which, given the impact of the coronavirus on many its customers and the tech industry as a whole, was an impressively optimistic statement.

As a long-time company observer, what particularly stood out to me was that the company has now built up a several-year history of achieving some fairly grand plans based on big decisions it made 4-5 years back. In the past, previous AMD leadership has also talked about big ideas, but frankly, they weren't able to deliver on them. The key difference with the current leadership team is that they are now able to execute on those ideas. As a result, the credibility of their forward-looking plans has gone up significantly.

And what plans they are. The company made a number of important announcements about its future product strategies and roadmaps at the event, most all of which were targeted around high-performance computing, both for CPUs and GPUs.

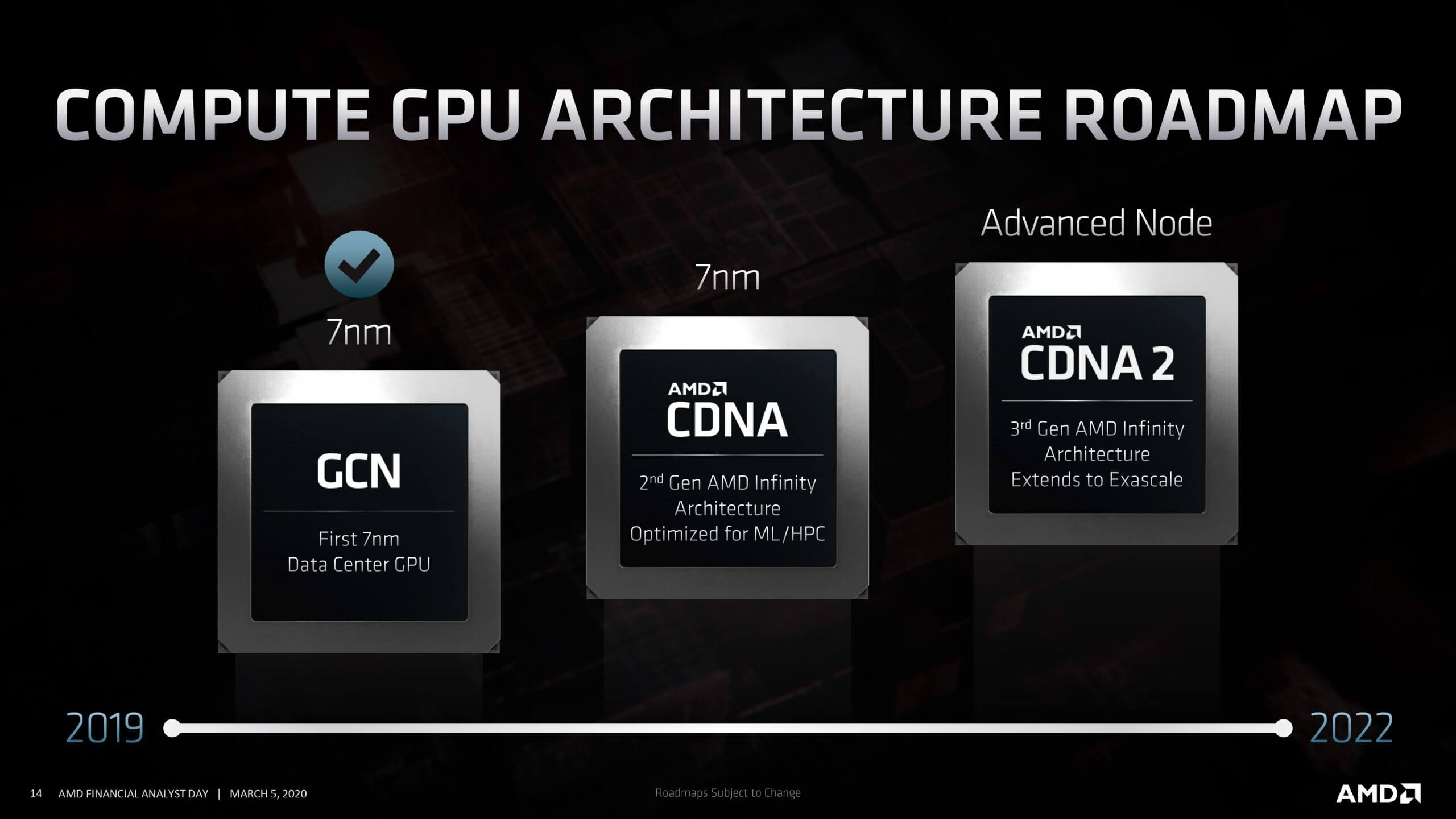

On the GPU roadmap, a particularly noteworthy development was the introduction of a new datacenter-focused GPU architecture named CDNA ("C" for Compute)---an obvious link to the RDNA architecture currently used for PC and gaming-consoled focused GPU designs. Full details around CDNA and specific Radeon Instinct GPUs based on it are still to come, but the company is clearly focusing on the machine learning, AI, and other datacenter-focused workloads that its primary competitor Nvidia has been targeting for the last several years.

One key point the company made is that the second and third generation CDNA-based GPUs would leverage the company's Infinity interconnect architecture, allowing future CPUs and GPUs to share memory in a truly heterogenous computing environment, as well as providing a way for multiple GPU "chiplets" to connect with one another. The company even talked about offering software that would convert existing CUDA code (which Nvidia uses for its data center GPUs) into platform-agnostic HIP code that would run on these new CDNA-based GPUs.

AMD also talked about plans for future consumer-focused GPUs and discussed its next-generation RDNA2 technology and Navi 2X chips, which are expected to offer hardware-accelerated support for ray tracing, as well as improvements in variable rate shading and overall performance per watt.

Notably, the hardware ray tracing support is expected to be a common architecture between both PCs and gaming consoles (both the PlayStation 5 and next-generation Xbox are based on custom AMD GPU designs), so that should be an important advancement for game developers. The company also mentioned RDNA3, which is expected in the 2020-2021 timeframe and will be manufactured with what is described as an "Advanced Node." Presumably that will be smaller than the 7nm production being used for current RDNA-based GPUs and those based on the forthcoming RDNA2 architecture.

"It's clear that AMD is here to stay. For the sake of the overall semiconductor market and the competitiveness that it will enable, that's a good thing."

Speaking of production, the company discussed how it intends to move forward aggressively, not only on smaller size process nodes, but also to add in 2.5 and 3D chip stacking (which it termed X3D). Over the past year or so, packaging technologies have taken on new levels of importance for future semiconductor designs, so it will be interesting to see what AMD does here.

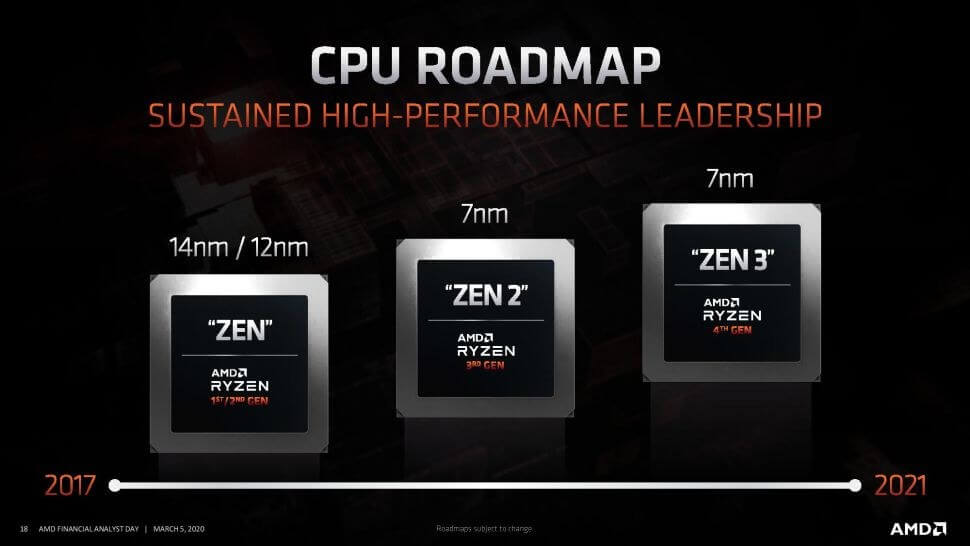

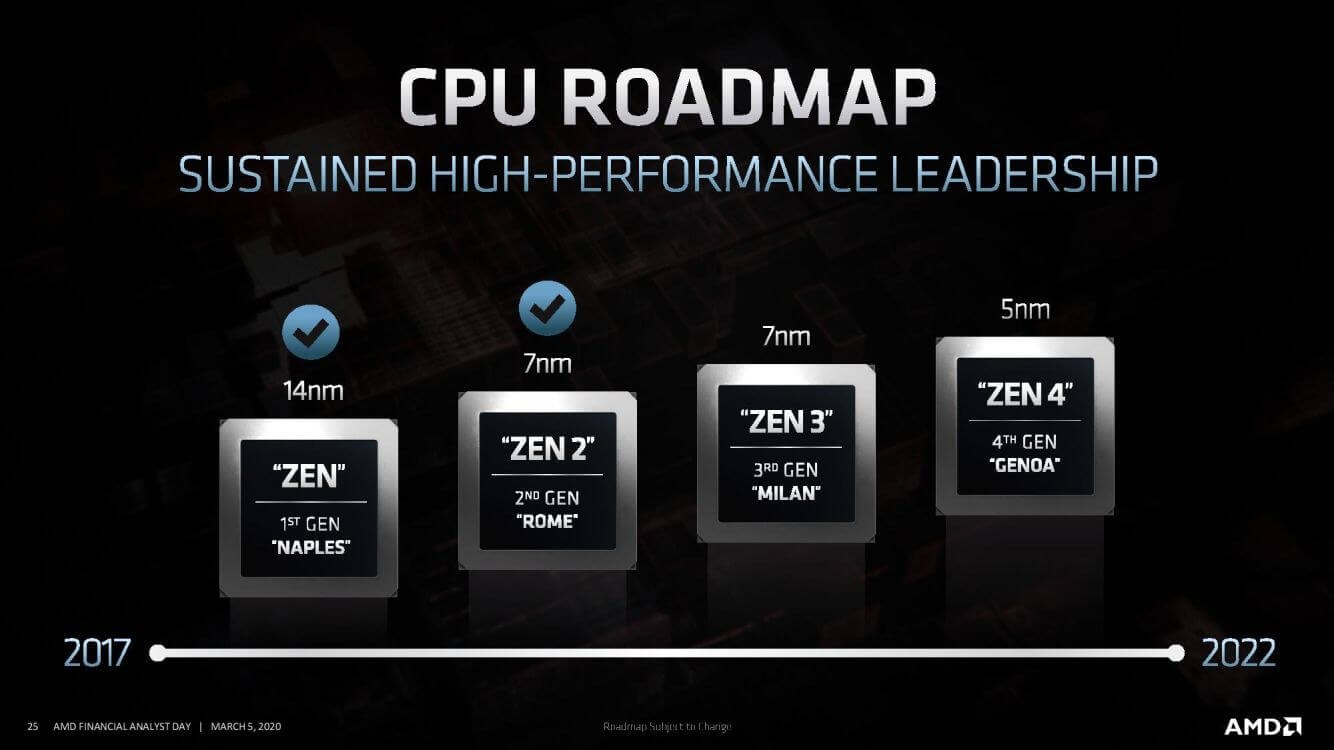

On the CPU side, the company laid out its roadmap for several new generations of its Zen core CPU architectures, including a 7nm-based Zen 3 core expected in the next year or so, and the company's first 5nm CPU, the Zen 4, planned for 2021 or 2022.

AMD made a point to highlight the forthcoming Ryzen Mobile 4000 series CPUs for notebooks, expected to be available later this month, which the company expects will boost them to the top of the notebook performance charts, just as the Ryzen Zen 2-based CPUs did for desktops. The company also mentioned that its 3rd-generation Epyc server processor, codenamed Milan and based on the forthcoming Zen 3 core, is expected to ship later this year.

For even higher-performance computing, the combination of Zen 4-based CPU cores, 3rd generation CDNA GPU cores and the 3rd generation Infinity interconnect architecture in the late 2022 timeframe is also what enables the exascale level of computing powering AMD's recent El Capitan supercomputer announcement.

Built in conjunction with HPE on behalf of Lawrence Livermore Laboratory and the US Department of Energy, El Capitan is expected to be the fastest supercomputer in the world when it's released and, amazingly, will be more powerful than today's 200 fastest supercomputers combined.

All told, it was a very impressive set of announcements that highlights how AMD continues to build on the momentum it started to create a few years back. Obviously, there are enormous questions about exactly where the tech market is headed in the short term, but looking further out, it's clear that AMD is here to stay. For the sake of the overall semiconductor market and the competitiveness that it will enable, that's a good thing.

Bob O'Donnell is the founder and chief analyst of TECHnalysis Research, LLC a technology consulting and market research firm. You can follow him on Twitter @bobodtech. This article was originally published on Tech.pinions.