Why it matters: Huya has reportedly agreed to buy out Chinese game streaming competitor DouYu. The new merger will see the two companies combine users and cut marketing costs that would have otherwise been dedicated to gaining market dominance over each other. The deal will see Tencent become a majority shareholder in the new enterprise.

Tencent currently has stakes in both Huya and DouYu and will have approximately 68 percent combined voting shares once the new firm is formed. Post-merger, Huya and DouYu shareholders will get fully diluted shares of the combined companies, with DouYu's Chen Shaojie and Huya CEO Dong Rongjie becoming co-CEOs once the deal gets regulatory approval in the first half of 2021.

Tencent will additionally allow the integration of its game streaming platform, Penguin e-Sports, into the newly merged Huya ecosystem. The company will receive $500 million in compensation for the sell-off.

The new agency is expected to dominate the Chinese market due to the sheer number of users. It will have over 300 million monthly active users before the consolidation of parallel subscriptions. DouYu currently has an estimated 158.1 million monthly active users, as outlined in its quarterly report, while Huya has 151 million. Combined, the two companies currently account for over 50 percent of the Chinese game streaming user base.

The merger is expected to help Tencent gain greater control of the value chain. The company is already a leading video game publisher in the country. It also has shares in key gaming enterprises across Europe, Asia, and the United States. These include Activision Blizzard, Ubisoft, Epic, and Grinding Gear Games.

Dominating the live streaming gaming industry will allow the firm to gain more esports revenue and a bigger audience for the distribution of its titles.

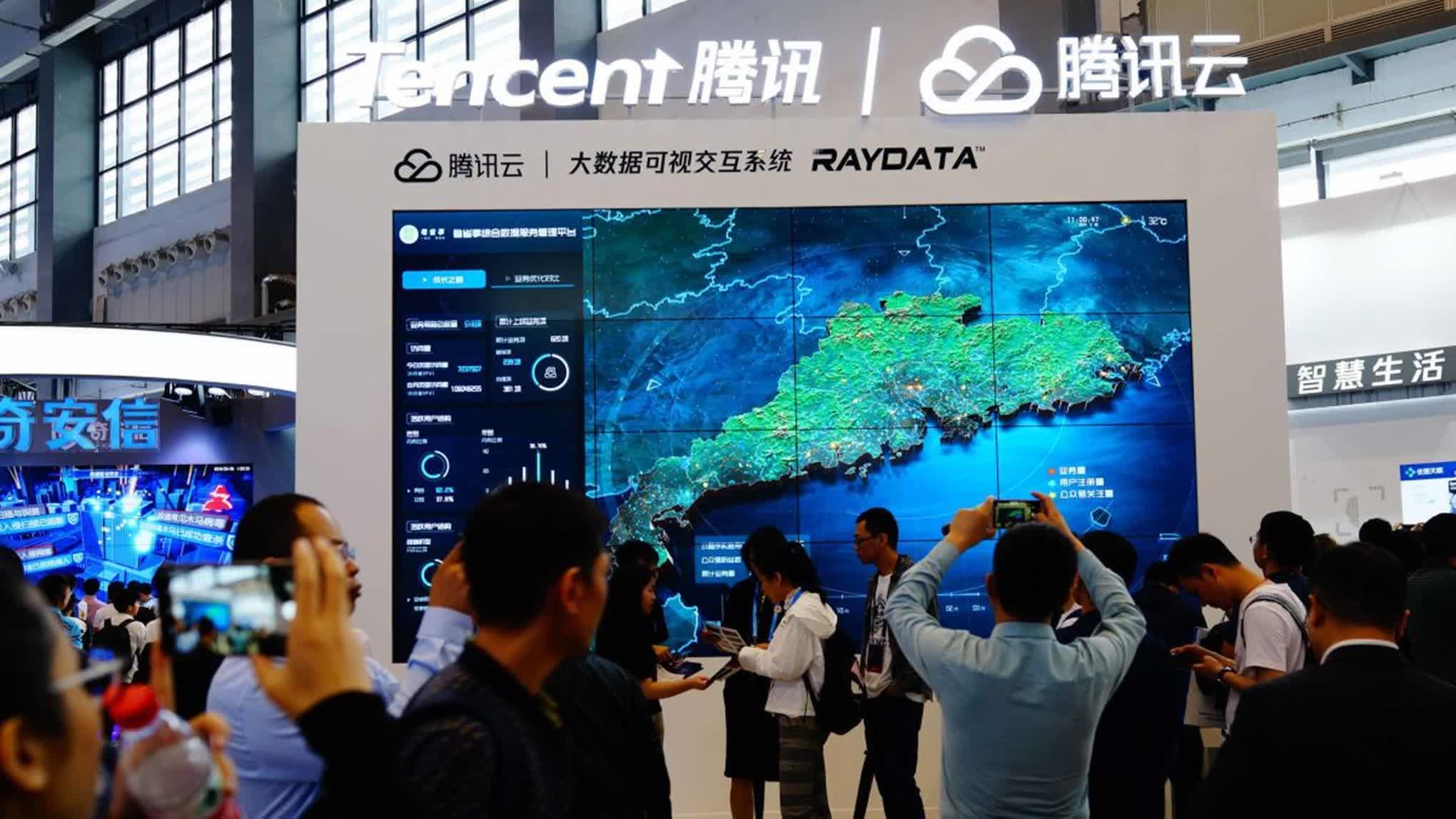

Tencent has shares in key gaming enterprises across Europe, Asia, and the United States. Image: CNN

The Chinese live-streaming gaming industry is estimated to have raked in over $1.6 billion in annual revenues last year. This is according to data compiled by Statista. That said, a sizeable chunk of the funds is spent on acquiring new users. Star players are responsible for drawing droves of users to the gaming platforms, and publishers routinely pay huge sums to have them on their streaming sites. Consequently, bidding wars are a common occurrence. The new collaboration will vanquish related troubles.

The Huya - DouYu pact comes at a time when the US government is actively scrutinizing Chinese tech firms for anti-competition overreach and questionable data-sharing practices. The authorities have previously targeted Tencent's WeChat application. This is as U.S. President Donald Trump seeks to ban popular social media apps made by Chinese companies.

The greatest benefit for Huya and DouYu is that while they are listed on the New York Stock Exchange and Nasdaq, respectively, their reach is largely limited to China.

Masthead credit: Bloomberg