What just happened? South Korean chip giant SK Hynix has announced it is buying Intel's flash-memory business for $9 billion. The deal includes Intel's SSD, NAND flash, and wafer businesses, along with its manufacturing facility in Dalian, China, but the company is hanging on to its Optane unit.

SK Hynix expects to receive government approvals for the deal by the end of 2021, at which point it will pay the first payment of $7 billion. The remaining $2 billion is expected to be paid when the last of Intel's NAND memory and storage business assets are handed over in March 2025. Intel will continue to manufacture NAND wafers at its Chinese foundry until the final closing.

Intel says it will use the proceeds from the sale to invest in its "long-term growth priorities," which include artificial intelligence, 5G networking, and edge computing.

"For Intel, this transaction will allow us to further prioritize our investments in differentiated technology where we can play a bigger role in the success of our customers and deliver attractive returns to our stockholders," said Intel CEO Bob Swan.

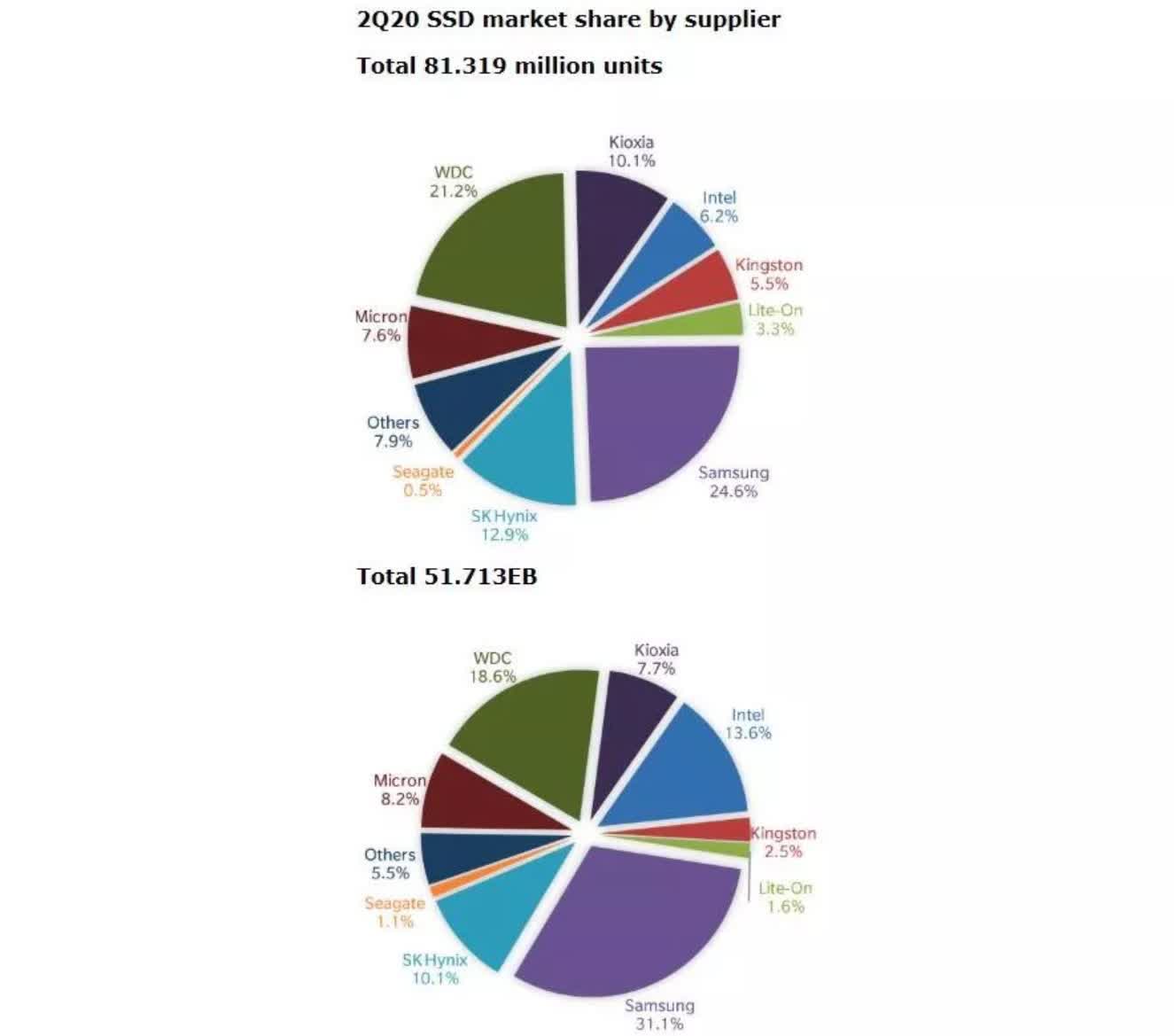

SK Hynix's acquisition will turn the company into the world's second-largest NAND memory manufacturer, sitting behind only Samsung. The deal will consolidate the NAND flash industry, shrinking the number of companies in the market.

Earlier this year, Intel said it was unable sell enough SSDs to make a profit from the 3D NAND chips made at its Dalian facility---its only major foundry in China. CFO George Davis said the firm was looking at various options, including closing the factory.

Back in August, we heard that the NAND market was suffering from oversupply that has been pushing down prices. The SK Hynix deal should help address some of those issues.

SK Hynix CEO Seok-Hee Lee said the deal would help the company "optimize our business structure, expanding our innovative portfolio in the NAND flash market segment, which will be comparable with what we achieved in DRAM."

The deal is one of several massive tech acquisitions we've seen this year, the most significant being Nvidia's $40 billion buyout of Arm. AMD, meanwhile, is reportedly in the process of acquiring FPGA-maker Xilinx for more than $30 billion.

With the selling of its flash-memory business, Intel is further streamlining the company as it focuses on other areas. It was only last December when the firm finalized the sale of its mobile modem division to Apple.

Image credit: Sundry Photography