Something to look forward to: TSMC's move to build an advanced factory in the US is an important win, even if it may never rival GigaFabs in Taiwan. On the other hand, the company will become more competitive with GlobalFoundries and Samsung Foundry.

TSMC has been reluctant about building a factory in the US, despite continuous pressure from the Trump administration to build its most advanced semiconductor foundry in the United States and in turn bolster national security at a time when China is firing on all cylinders to get ahead in the technological race.

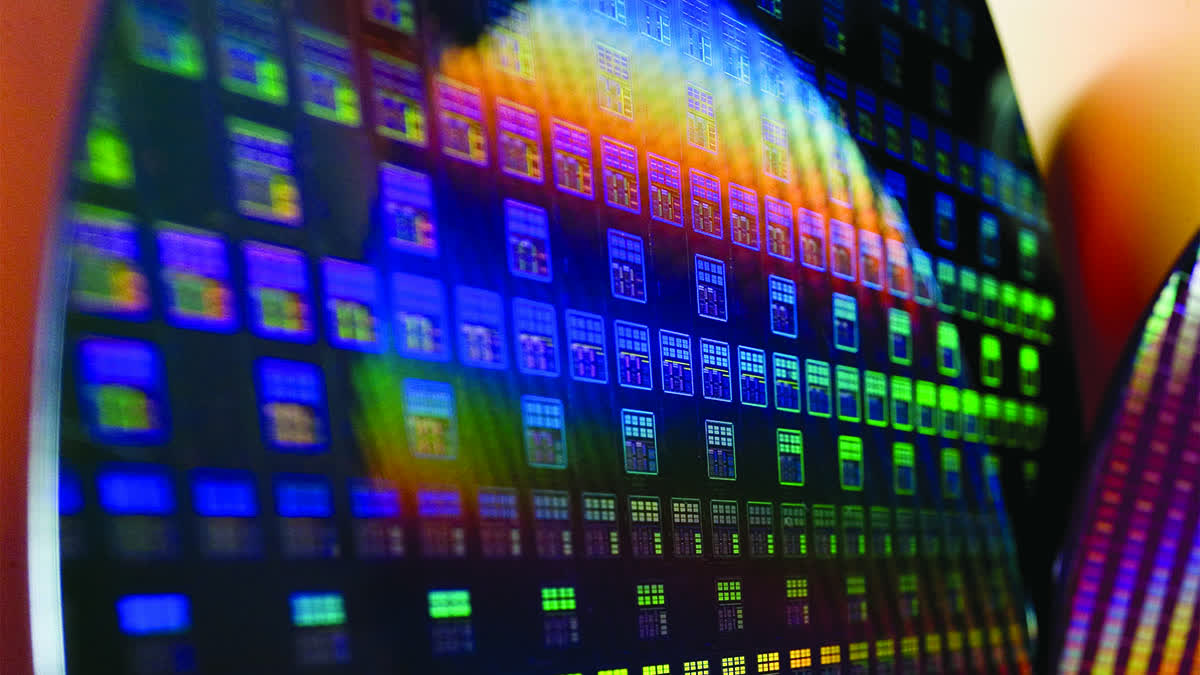

Back in January, the company's interest in such a project was merely tentative. Five months later, it announced plans to build an advanced factory in Phoenix, Arizona that would cost around $12 billion and deliver the first wafers in 2024.

This month, TSMC's board of directors approved an initial investment sum of $3.5 billion (or NT$99.8 billion) that will go towards a wholly-owned subsidiary in Arizona. The remainder of $8.5 billion will be spent through 2029, and the factory will employ 1,600 people, not to mention many thousands more at various local suppliers.

Construction will commence in 2021, with high-volume production expected to start in 2024 if everything goes to plan. Initial capacity estimates place the facility at around 20,000 wafers per month, and TSMC says it will use its 5nm process node. But more importantly, this will be the first advanced foundry built by TSMC outside Taiwan that is on the same level as its domestic facilities.

The company says 3nm production will enter volume production in the second half of 2022 at its Taiwan "GigaFabs," which are capable of more than 100,000 wafer starts per month and have now received $15.1 billion in additional funding. This means the Arizona facility will probably not serve TSMC's bigger customers such as Apple, Intel, AMD, Qualcomm, and Nvidia, at least not at first.

Still, the Arizona facility will also act as an R&D division of TSMC on US soil, and will rely on the same supply chain as Intel, which also owns multiple factories in Arizona and Oregon. Ultimately, this will help TSMC strengthen its position against rival foundries, provided it manages to attract top local talent.