Highly anticipated: In 2020, Tesla somehow managed to create a stock market valuation as large (or larger, depending on the day) than the next 7 largest carmakers combined, but chalk that up to Wall Street insanity rather than the actual progress of the market. The truth is that car tech adoption has been modest at best, and traditional carmakers are showing signs of life. Plus, we're still many, many years away from a day when you can walk into an auto dealership and drive away in a fully autonomous car. Despite that plunge through the hype cycle, it really does seem that 2021 is shaping up to be a big year for automotive tech.

Several years back, the tech industry was abuzz with what looked to be an enormous and imminent opportunity to completely reshape the automotive industry. Powerful new chips were poised to bring autonomous driving to the masses, tech companies were positioning themselves as disruptive innovators destined to turn mobility into a service, and traditional car companies were thought to be lost causes. Needless to say, five years on, that's not exactly what happened.

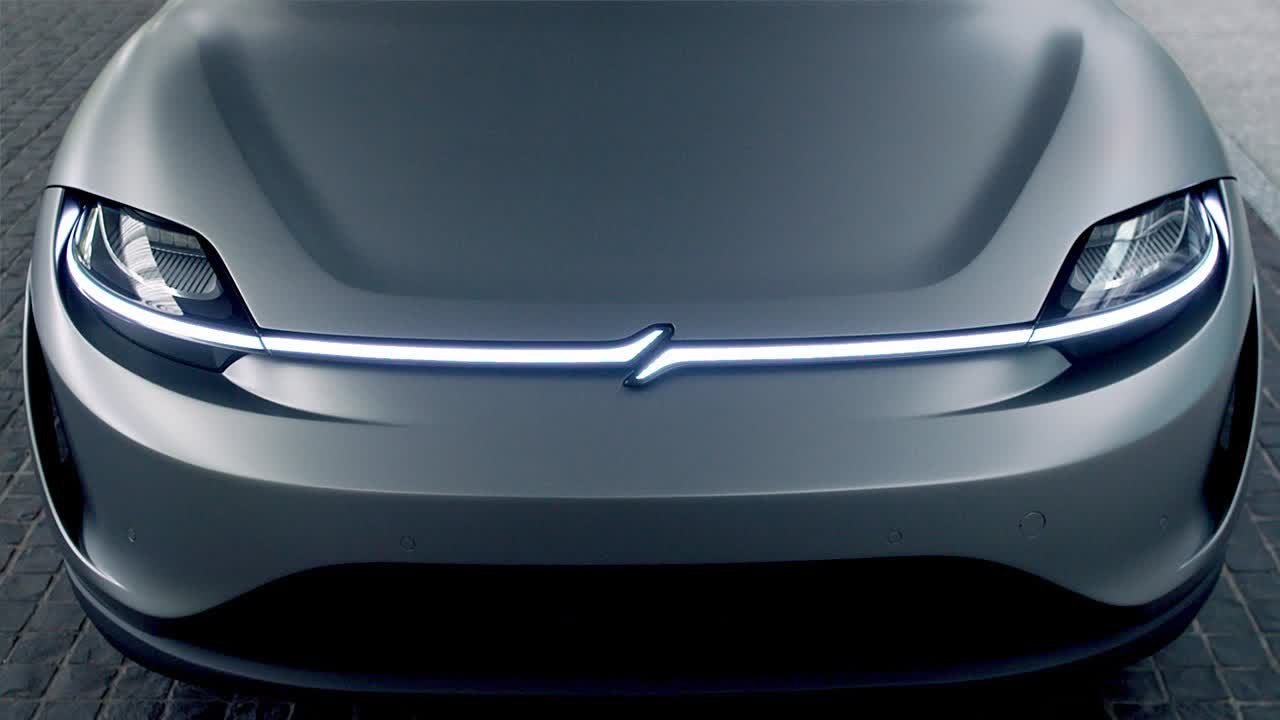

However, it really does seem that 2021 will be a very big year for automotive tech. The signs are everywhere. Some of the biggest stories coming out of this year's virtual CES were automotive related: the impressive, forward-looking keynote by GM CEO Mary Barra, the college lecture-like discussion on the current state of autonomous driving by the CEO of Intel-owned Mobileye Amnon Shashua, the enormous 56" Hyperscreen display from Mercedes Benz' forthcoming EQS electric sedan, and even the latest iteration of Sony's concept car the Vision-S. Toss in a significantly reinvigorated round of rumors on Apple's "Titan" car project, and the stage is clearly set for a big year in automotive tech.

This time, however, things are a bit different. First, of course, there's the widely acknowledged reality that achieving fully autonomous Level 5 vehicles (on the 5-level scale of self-driving technology) is significantly harder to do than many first predicted.

There is also the recognition that the move to fully electric vehicles---which many consider a prerequisite to achieving autonomy---is also happening at a significantly slower pace than many thought. Most importantly, however, there's a growing awareness that a huge continuum of opportunity exists for automotive tech between where we are now and a fully autonomous electric vehicle. In other words, not all automotive tech has to be focused on self-driving vehicles---there's a huge range of things that can be done to make the time we spend in our cars more enjoyable, more productive, and safer.

The reality of that mindset came through loud and clear in the aforementioned GM CES keynote. While the company is indeed working on things like battery technology for electric cars and driverless "pods", much of what it revealed/demonstrated was the more practical enhancements that technology can bring to the driving and overall automotive experience, everything from lighting to interior displays, software-based feature upgrades, and assisted-driving functions.

Much of that same pragmatic perspective seems to be behind the latest automotive-related developments from chipmaker Qualcomm as well. The company unveiled a number of new chips, software, and platform partnerships all designed to improve the enjoyment, capability, connectivity, and safety of vehicles that we'll actually be able to purchase over the next few years---including some from GM, with whom Qualcomm announced a new extended partnership.

The big debuts are fourth generation chip and platform architectures for its Snapdragon Automotive Cockpit platforms, as well as expansion of its Snapdragon Ride assisted and autonomous driving platforms. In addition, the company talked about the ongoing momentum it is seeing with its 4G and 5G modem-based telematics solutions for car connectivity (including forthcoming C-V2X support for car-to-car and car-to-infrastructure communications) and the currently shipping third generation digital cockpit platforms.

The latest chip offerings feature some of the same 5nm-based core architecture advancements as its popular Snapdragon line of smartphone chips, but they are purpose-built for the car market and include automotive grade functional safety capabilities, such as redundancy, to meet requirements such as ASIL-D and ISO 26262 safety standards.

On top of the hardware, Qualcomm also announced a growing range of partnerships with software companies, both for low-level operations, such as virtualization with companies like Blackberry-owned QNX and Green Hills Software, as well as consumer-facing features such as Alexa integration with Amazon, automatic valet parking features from Valeo, and precise lane-level positioning (even in places like covered parking garages) with Alps Alpine. All told, it's an impressive array of hardware, software, and partnerships now necessary to advance automotive tech in a meaningful way.

In fact, one of the most interesting things about the Qualcomm automotive news is that it highlights how complex and how interdependent the world of smart car technology has become. Getting to fully functional cars with advanced capabilities is clearly going to take a large number of partners working together. This is another significant change from the last round of automotive tech hysteria when many companies were trying to achieve too much on their own.

Qualcomm also made a point to highlight the range of choices that it now offers to meet the widely varying demands of different automakers and even different car lines within a given automaker. For digital cockpits, the company offers three levels of capability, and its newly expanded Snapdragon Ride platform is expected to scale from basic Level 0 functions in a single chip to Level 4 autonomy through the combination of multiple chips within a single drive computer.

The company also acknowledged the new reality that we could easily start to see multiple different chip vendors parts being used in a single car---such as one for digital cockpit and IVI (in-vehicle infotainment) functions and another for ADAS (advanced driver- assistance systems)---or even multiple vendors each taking on different tasks within each of those major subsystems.

The bottom line is that all of these developments---and many more to come---are pointing to the reality of software-defined, always-connected cars. While that too was a popular talking point many years back, the truth is that we're finally starting to get the hardware that's necessary to power these new capabilities, the range of software tools required to enable them, and the collective experience and perspective needed to turn a more realistic set of automotive tech goals into a more compelling reality.

The signs are encouraging---let's hope this really is a big year for automotive tech.

Bob O'Donnell is the founder and chief analyst of TECHnalysis Research, LLC a technology consulting firm that provides strategic consulting and market research services to the technology industry and professional financial community. You can follow him on Twitter @bobodtech.