The big picture: As part of their last quarterly report, Arm has revealed that the popularity of their processor designs has continued to increase exponentially. Manufacturing partners have recorded shipments of 6.7 billion chips based on Arm designs, which is roughly 842 chips produced every second, an unprecedented rate.

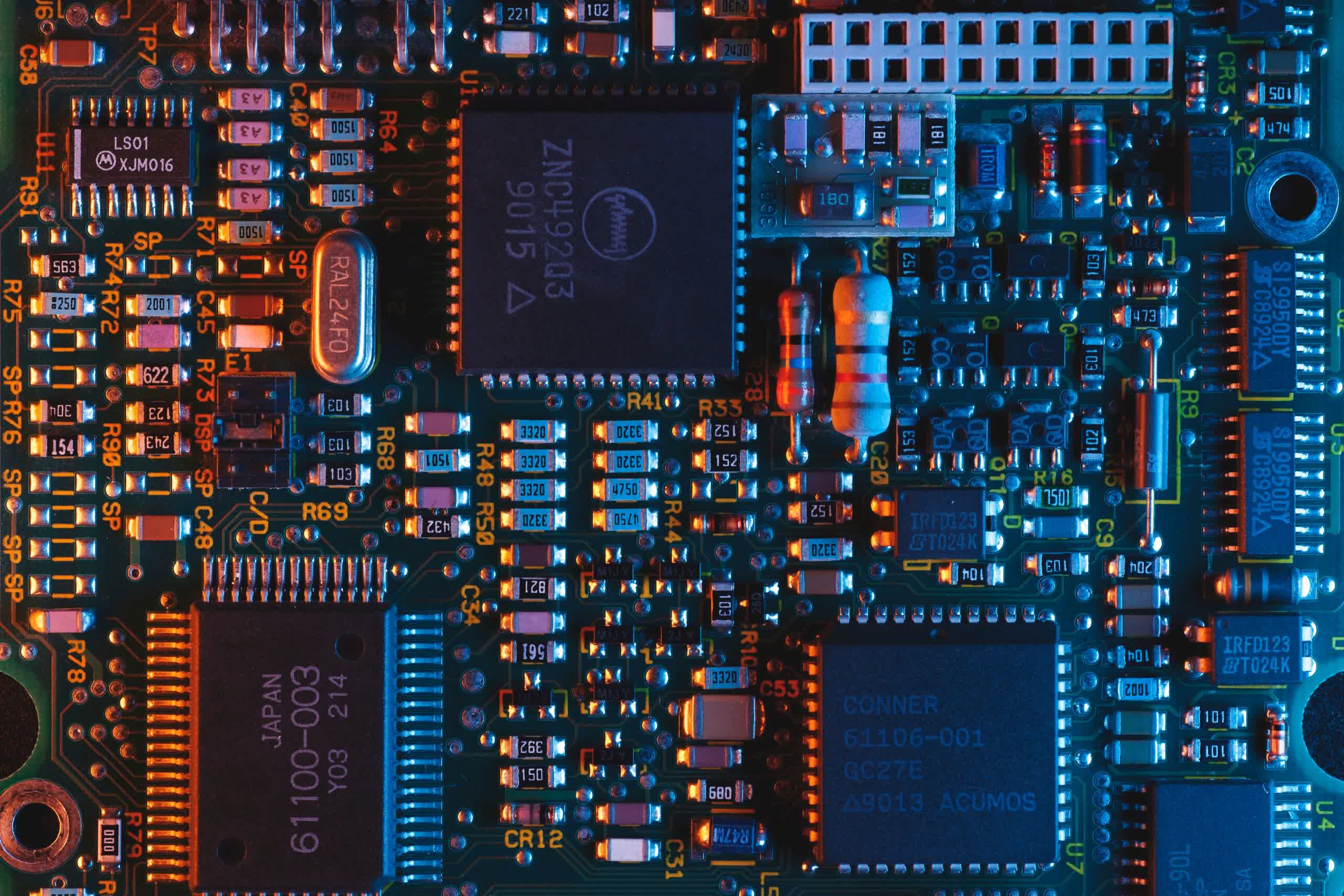

Arm is the largest designer of processors in the world, if the sale of their designs is counted instead of the number of designs they produce: their rather slim Mali GPU series, for example, encompasses just nine models but has been the number one shipping GPU since 2015. If Arm sold just their most popular product, the Cortex-M CPU series, then they'd still be the largest designer of processors in the world. Last quarter, 4.4 billion Cortex-M designs were shipped.

The popularity of Cortex-M designs isn't mysterious and neither is the wider success of Arm. In the IoT realm, the most affordable and efficient option is Cortex-M. Arm's Cortex-A series forms the basis of all smartphone processors, and their Cortex-R series covers critical applications like medical equipment. From the "world's number one supercomputer down to the tiniest ultra-low power devices," Arm's wriggled its way in, says Rene Haas, President of the IP Products Group at Arm. And he's not exaggerating.

But Haas doesn't attribute Arm's recent successes to his own team. Instead, he calls the recent shipments a "testament to the incredible innovation of [Arm's] partners," referring to the 530 licensees that use Arm's designs to produce their own products. Subtract the flattery, though, and he's really crediting Arm's business model.

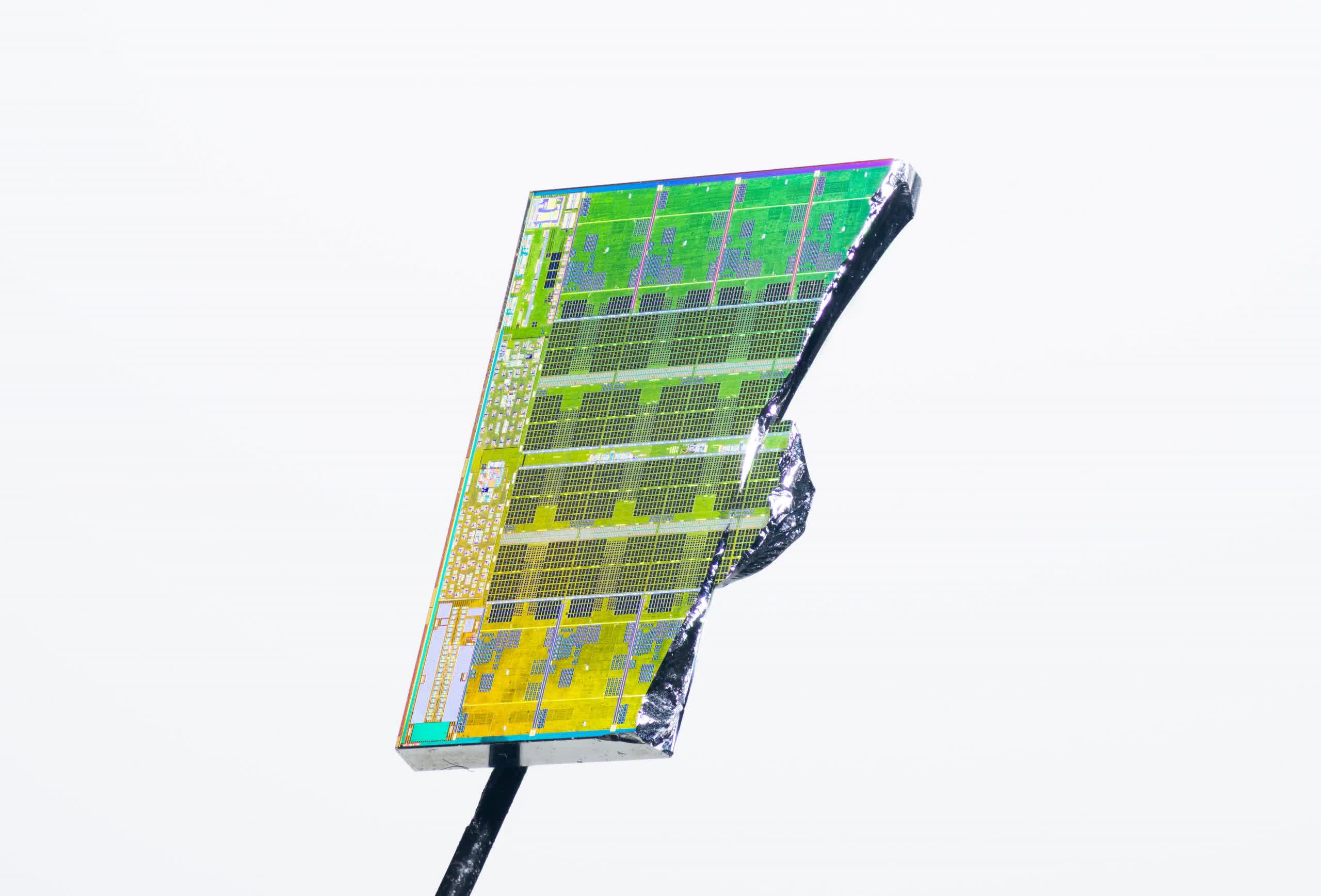

The closest comparison might be a record label. Arm doesn't manufacture products, and nor are their designs immediately manufacturable. They license the most fundamental of processor core designs, along with the accompanying patents and software, to other companies to be integrated into products. Apple, Samsung, and Qualcomm all use the same Arm designs to produce wildly different smartphone processors, for example.

Last year, Arm signed a record 175 new licenses, many to new licensees, which Haas thinks will accelerate the adoption of Arm products in 2021. Arm will probably continue to permeate new markets this year as it did last, when it saw its first mainstream laptop implementation in MacBooks, and a major integration into Amazon servers.

Arm's strong fourth quarter results are good news for the company, but they'll have placed added pressure on the looming acquisition by Nvidia – read more about that here.

Image credit: Fritzchens Fritz, Umberto