In context: Lars Wingefors started his business career selling comic books through the mail. Since then, he has amassed a $2.4 billion fortune as the founder, co-owner, and CEO of Embracer Group based in Sweden. The company owns eight major video game publishers, 69 studios, and 240 game franchises. It is now financially bigger than Ubisoft, with a valuation of $13 billion.

The Swedish game developer Embracer Group AB (formerly THQ Nordic AB) may not ring any bells for some people, but it is making big waves in the European mergers and acquisition arena. The company has picked up 27 studios in just the last year and pushed its valuation to $13 billion, surpassing rival developer Ubisoft. It even managed to outpace companies in the business of making deals like Swedish investment firm Lifco, which landed only 16 mergers in the last year.

Founded in 2008 by Lars Wingefors, Embracer shares have skyrocketed 2,900 percent since its initial public offering in 2016. Wingefors has watched his 35-percent stake in the company grow from $1.4 billion last year to $2.4 billion as of the end of March---more than a 71-percent year-over-year increase.

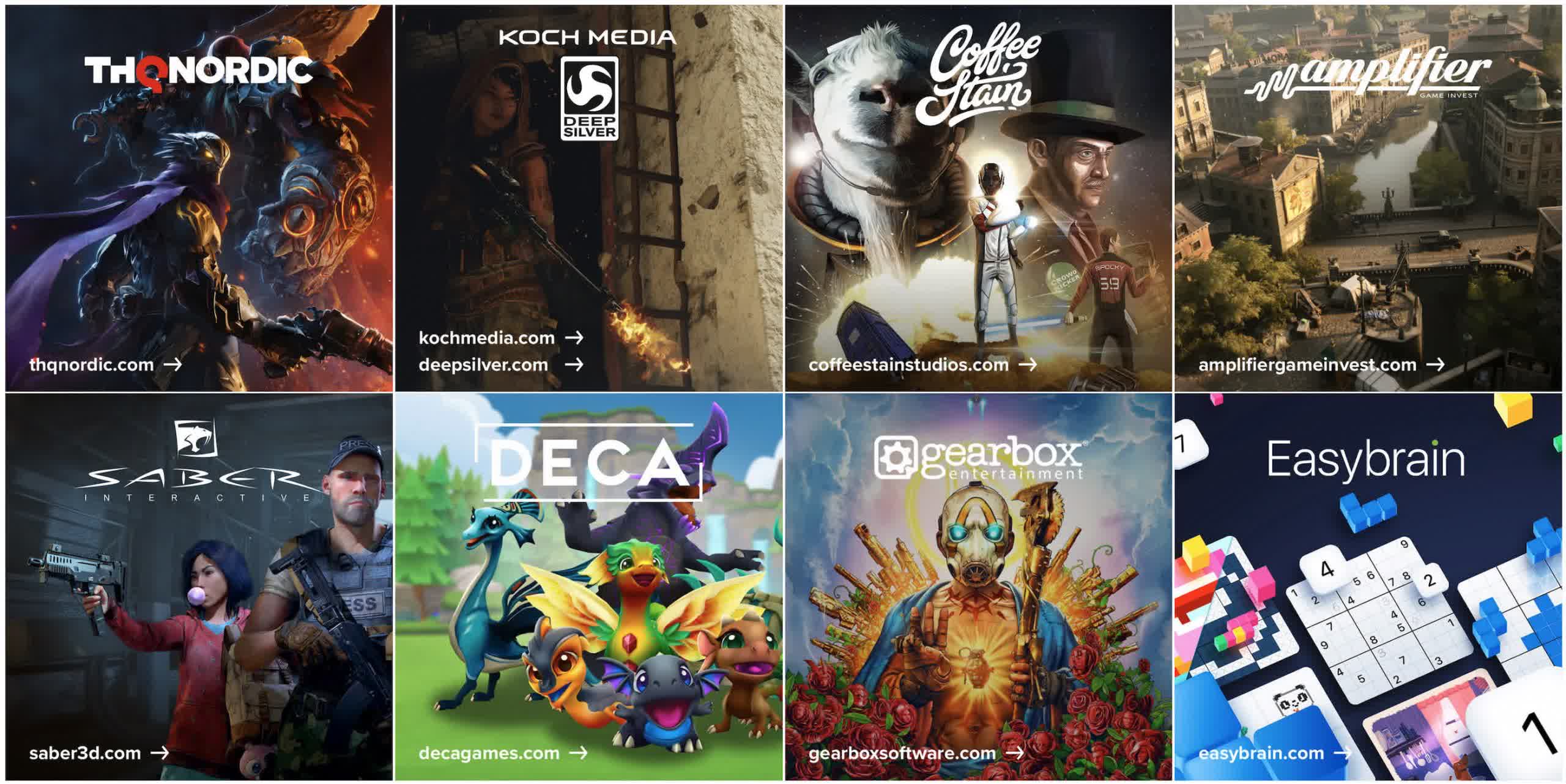

While the Embracer brand might not get much recognition, some of the 69 development studios and publishers under its belt are well-known in the gaming industry, including THQ Nordic, Saber Interactive, Deep Silver, and Volition. It most recently closed two deals in February, picking up Gearbox Entertainment and Aspyr Media. Embracer has more than 7,000 employees in 45 different countries.

While the company's financials have looked outstanding, Bloomberg notes that growth through M&A can be risky. Embracer failed to publish a single triple-A game in 2020 and has mainly relied on popular "second-tier" games to keep the revenue flowing.

"The big risk for inorganic growth stories in the games industry has always been what happens when they run out of targets---can they grow organically?" said Bloomberg Intelligence technology analyst Matthew Kanterman. "I don't think we're at that point yet with Embracer, but it's something to consider down the road."

While it might be hard to see what is "down the road" in Embracer's distant future, its short-term goals are clear. The company is currently looking to list on Nasdaq Stockholm to break out of its domestic market. It is also considering dual listings in other markets, but Embracer did not give specifics. Both moves will provide more capital to fuel future mergers.