Bottom line: Samsung executives addressed investor's questions about the future capabilities of their chip foundries during a recent earnings call. In essence, they're planning a large expansion, but it'll require a correspondingly large investment paid for by their customers. Samsung's present manufacturing capacity was already sold to its partners at standard prices before the chip shortage began, but as hardware designers experience surging demand, they'll pay for Samsung's new capacity at prices reflective of the current market.

Last quarter, Samsung invested KRW 12.5 trillion ($10.9 billion USD) in their foundry division. Ben Suh, a representative of the company, told investors that "foundry investments focused on capacity expansions for advanced processes such as 5-nanometer EUV to respond to customer demand."

Moving forward, Samsung's "foundry will accelerate growth by expanding Pyeongtaek S5 Line capacity and by adjusting pricing to enable future investment cycles." Pyeongtaek is one of Samsung's most modern foundries, and can produce second-generation 5nm and first-generation 4nm products.

"We will maximize our capability to supply chips by strengthening cooperation with major foundry companies and will flexibly adjust our product mix to prioritize high value-added productions," Suh said.

Samsung isn't the first foundry to raise their prices, although they've been the most open about it. TSMC has reportedly stopped giving discounts to their long-term customers, as was customary in the industry. UMC, another foundry, also raised some of their prices last year.

An increase in manufacturing costs can have a knock-on effect on the retail prices of hardware. But in the long run, if profits are reinvested the way Samsung says they will be, then next-generation hardware won't be afflicted by shortages.

In the meantime, though, Samsung doesn't have any quick solutions. In the second half of the year, "we expect overall demand to exceed supply due to rising demand from the accelerating penetration of 5G, the continuation of the work-from-home trend and growing demand for safety stock from customers," Samsung's Shawn Tan said.

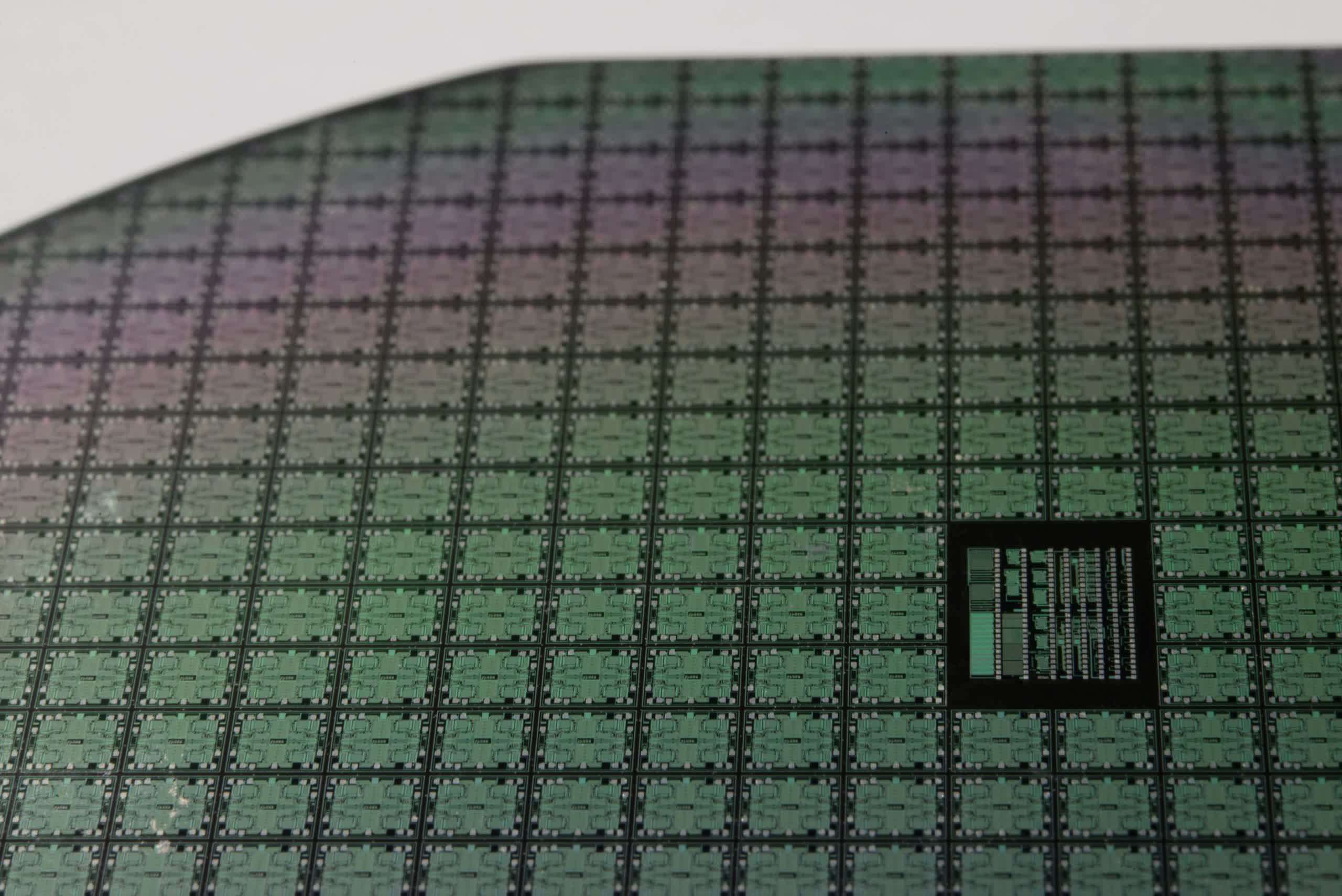

Image Credit: Kote Puerto, Laura Ockel